Table of Contents

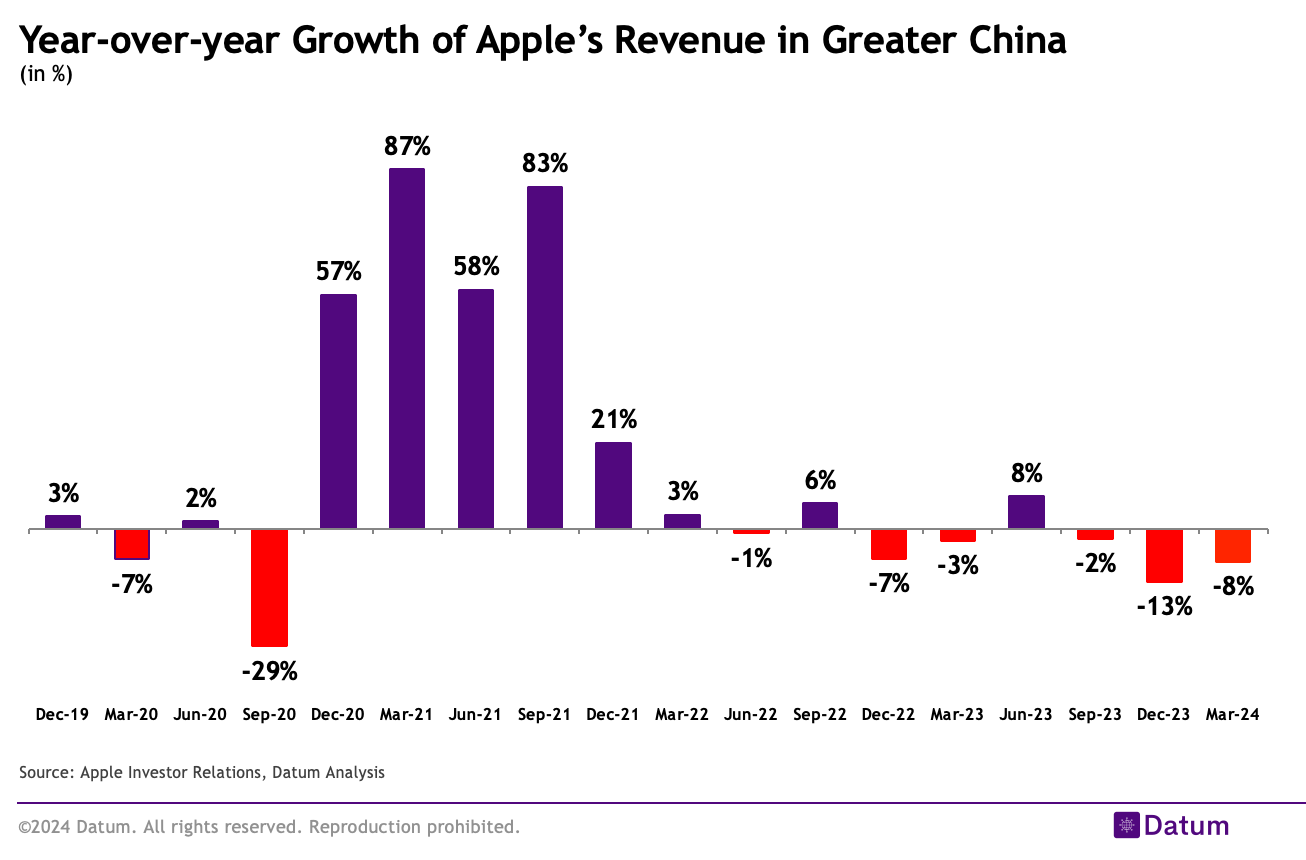

In the quarter ending in Mar-24, Apple's sales in China declined by 8% to $16.37 billion.

Sales in Greater China, Apple’s third largest region, were off 8% to $16.37 billion in revenue, which was significantly better than the $15.25 billion in sales expected by FactSet analysts, potentially quelling investor worries the iPhone maker may have been losing market share to local competitors such as Huawei. - CNBC

Here’s how Apple did versus LSEG consensus estimates in the quarter ended March 30:

- EPS: $1.53 vs. $1.50 estimated

- Revenue: $90.75 billion vs. $90.01 billion estimated

- iPhone revenue: $45.96 billion vs. $46.00 billion estimated

- Mac revenue: $7.5 billion vs. $6.86 billion estimated

- iPad revenue: $5.6 billion vs. $5.91billion estimated

- Other Products revenue: $7.9 billion vs. $8.08 billion estimated

- Services revenue: $23.9 billion vs. $23.27 billion estimated

- Gross margin: 46.6% vs. 46.6% estimated

- Apple's declining revenue in China can be attributed to intensifying competition from domestic rivals and more cautious consumer spending habits during the economic slowdown.

- Apple faced similar situation in 2016, 2019 and 2020 but recovered in 2018, 2021, 2022

- This time recovery is looking difficult due to emergence of local players and the ongoing challenges of US-China relations

As local Chinese brands continue to improve their offerings and gain traction with consumers, Apple's once-dominant position in the market appears to be waning. The company will need to adapt its strategies and offerings to regain ground in this increasingly competitive landscape.