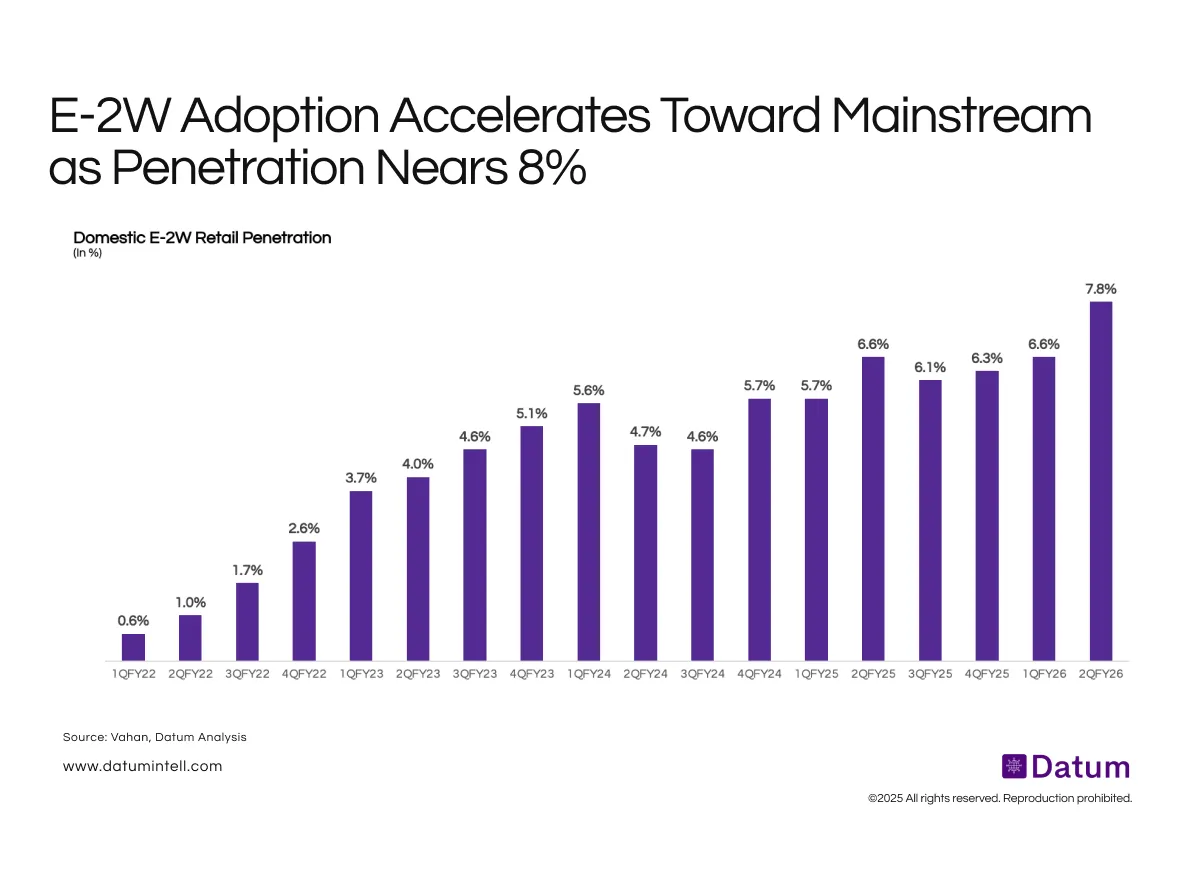

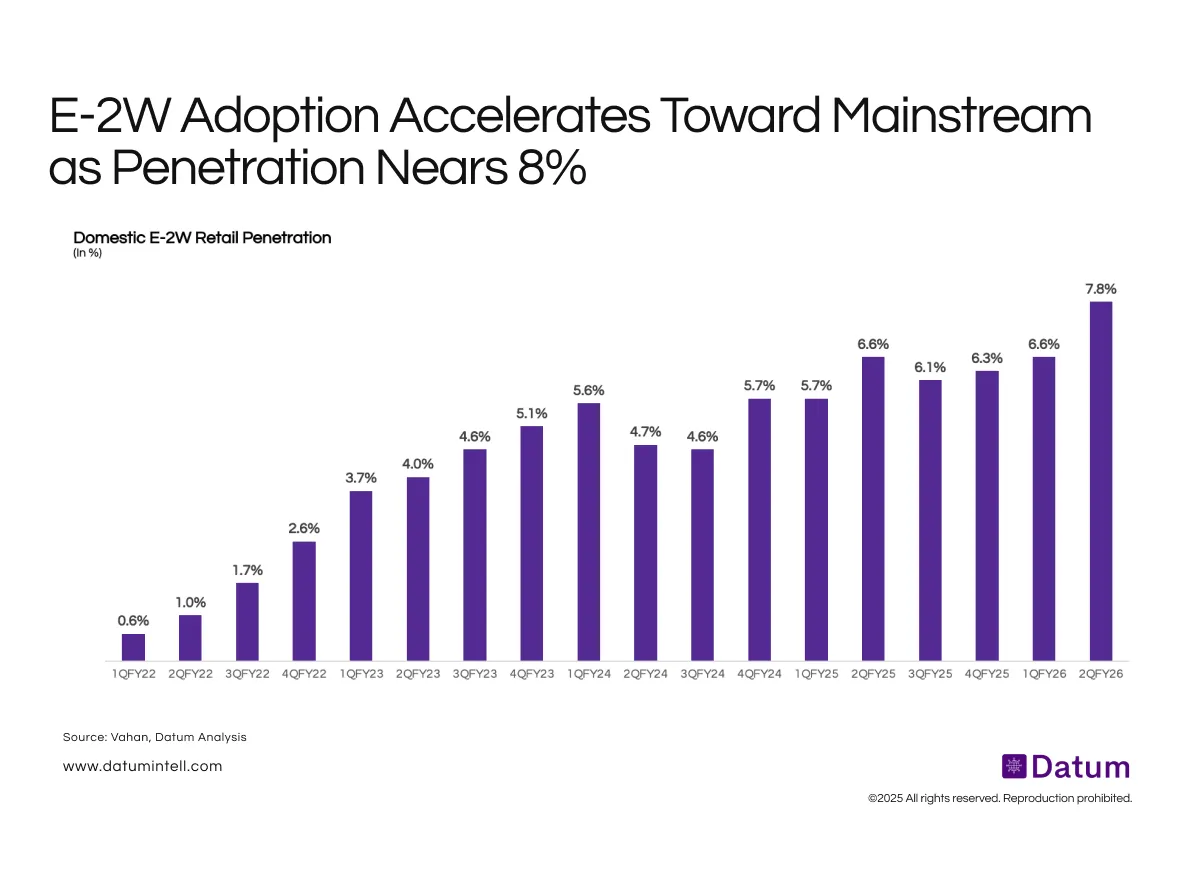

Electric Two-Wheeler Penetration Reaches Record 7.8%, Signaling Broader Market Adoption

E-2W retail penetration has climbed from 0.6% in FY22 to 7.8% in FY26, reflecting accelerating consumer adoption and supportive policy momentum.

E-2W retail penetration has climbed from 0.6% in FY22 to 7.8% in FY26, reflecting accelerating consumer adoption and supportive policy momentum.

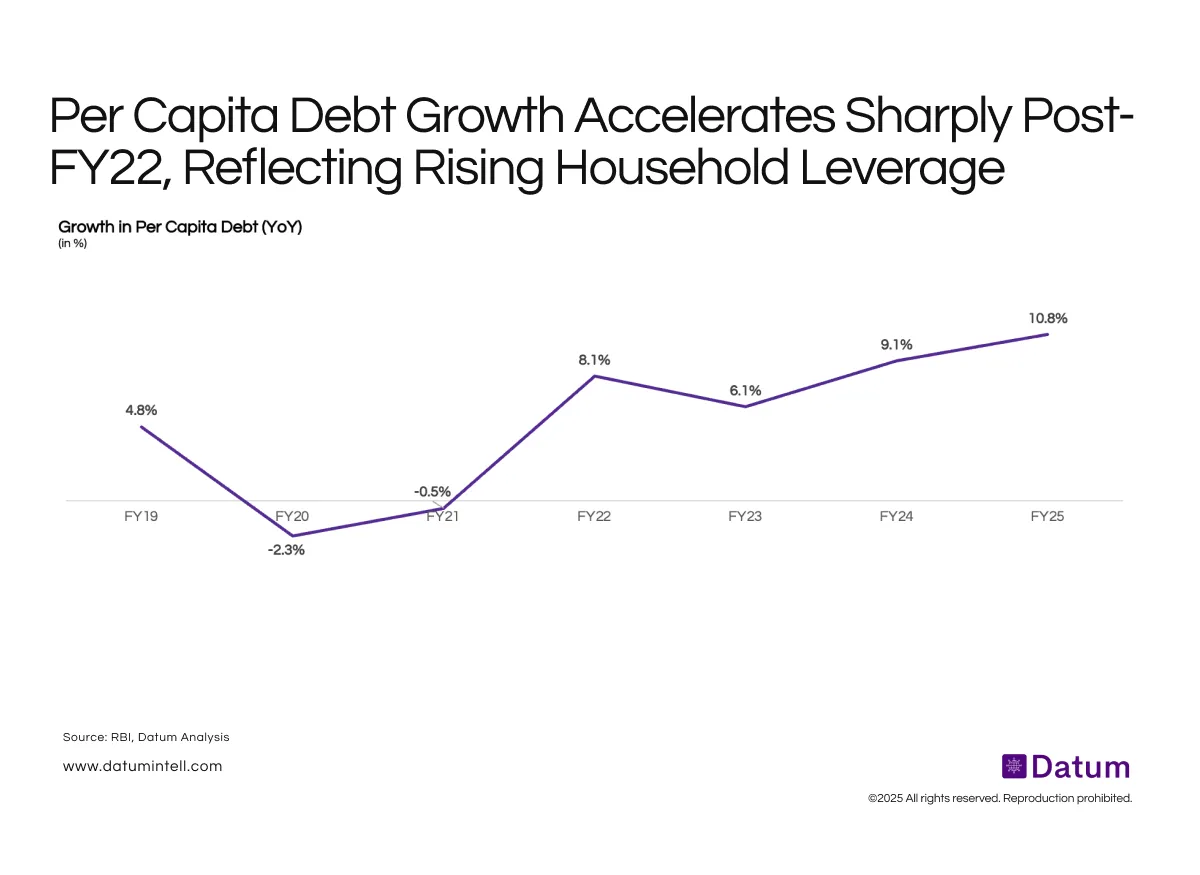

After two years of contraction, India’s per capita debt has risen >8% annually since FY22, reaching 10.8% in FY25. The surge reflects broad-based retail credit growth and rising household leverage-signaling both expanding credit inclusion and higher exposure to consumption-led borrowing.

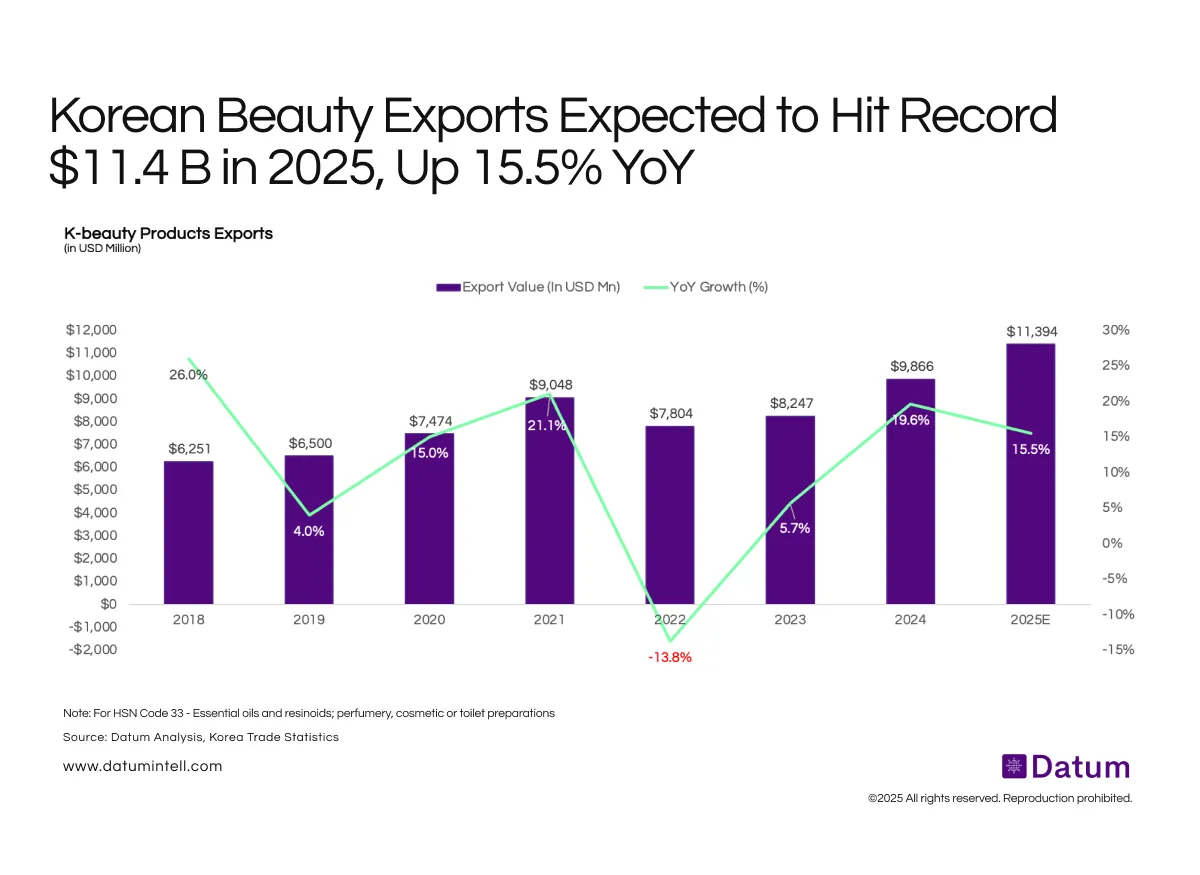

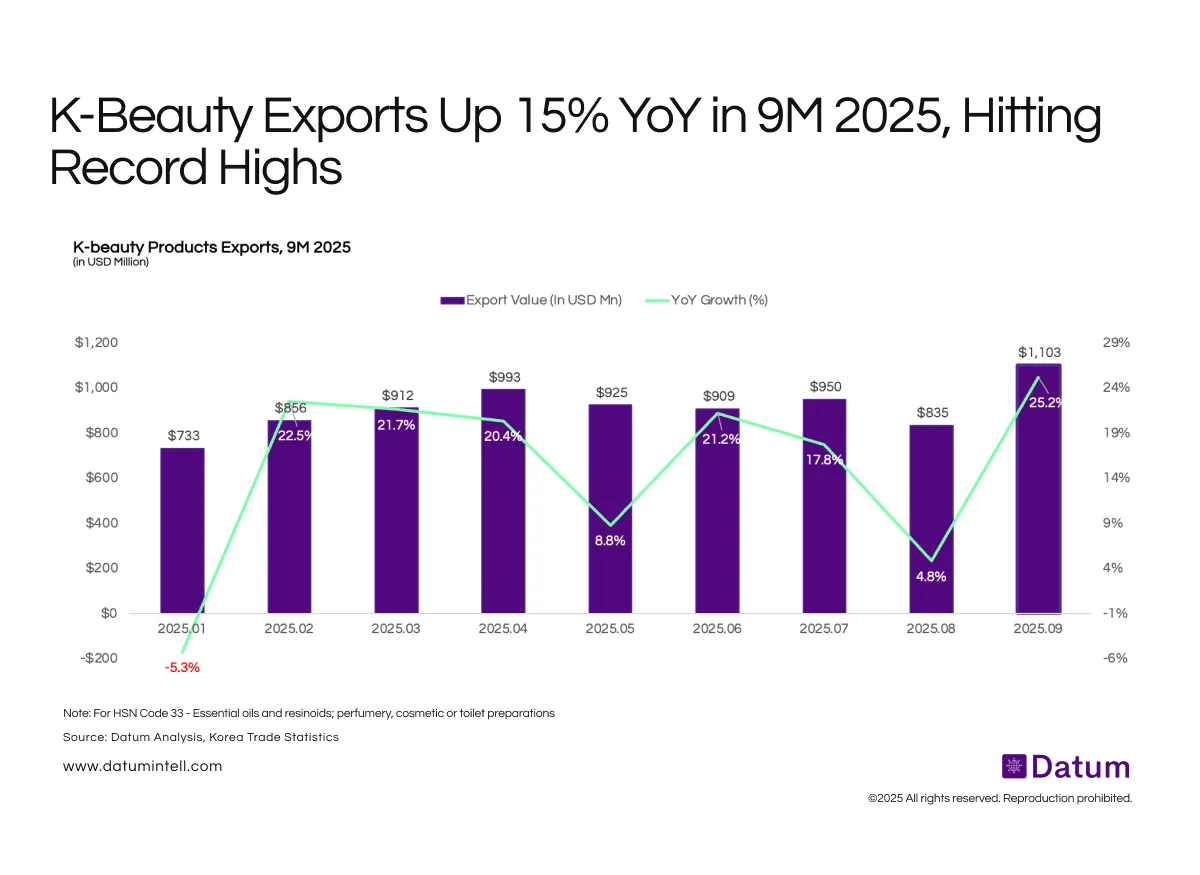

K-Beauty exports are on track to hit $11.4 B in 2025, up 15.5% YoY - the highest ever. After a brief 2022 dip, Korean cosmetics have bounced back stronger, powered by skincare innovation, premium repositioning, and global consumer trust.

K-Beauty exports hit a record $8.52 B in 9M 2025, up 15% YoY - led by skincare and rising US demand. With September alone crossing $1.1 B, Korea’s beauty engine shows sustained global strength and category resilience.

Intune has scaled from 3 to 75 stores, achieving ₹68 crore in quarterly revenue with a 5,000 sq. ft. store format and ₹1,600 average basket value - proof that affordable fashion and profitability can grow together.

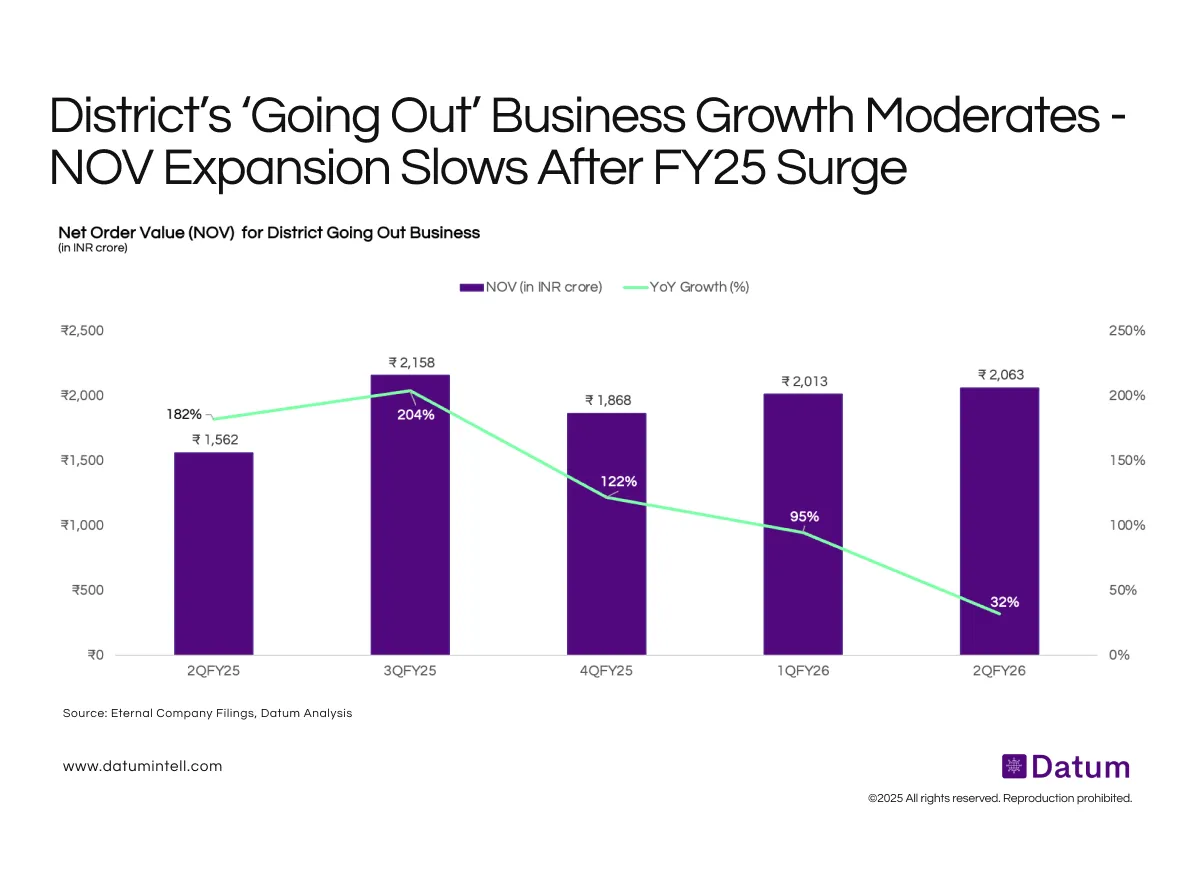

District’s ‘Going Out’ business has grown 32% YoY to ₹2,063 crore in 2QFY26 -down from 204% a year ago. After a breakout FY25, growth is stabilizing as the segment matures-signaling a shift from expansion to sustained engagement and loyalty-building.

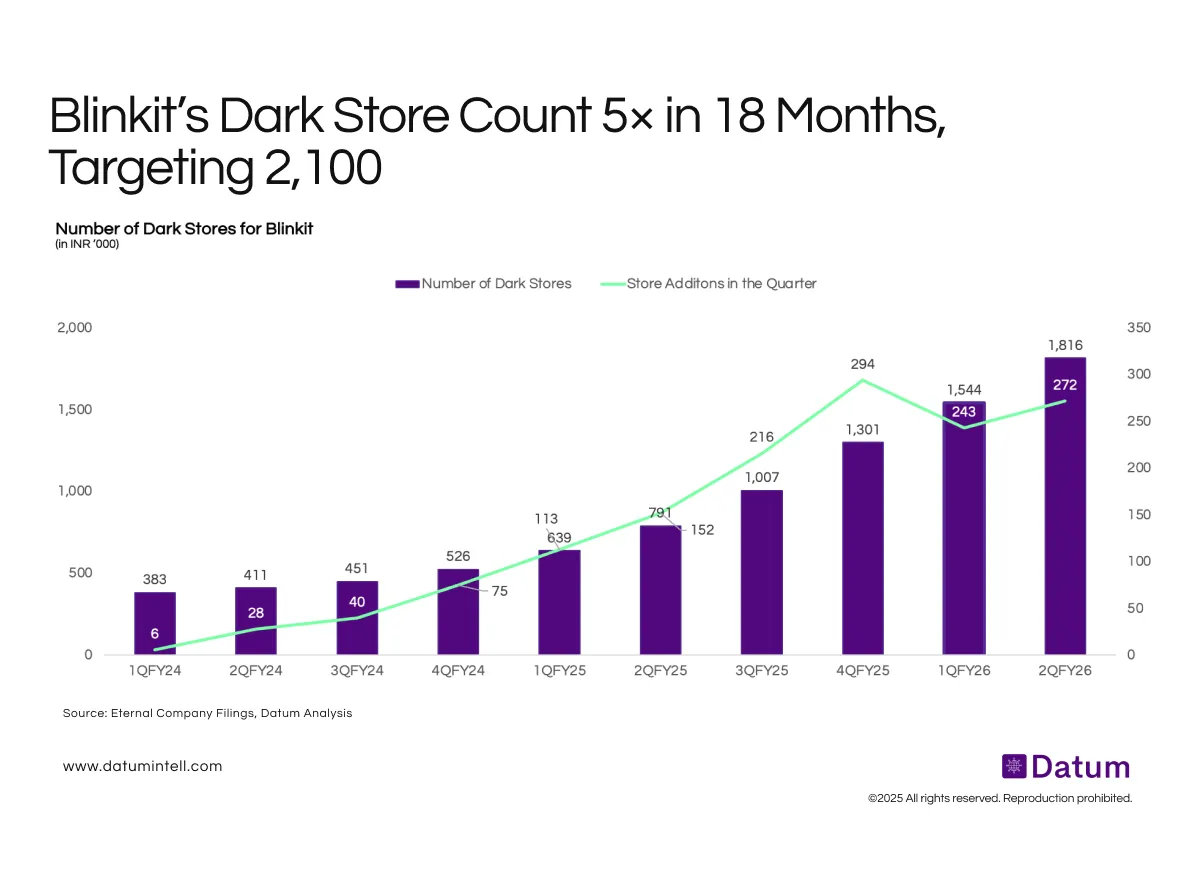

Blinkit’s dark store network has expanded nearly 5× in 18 months — from 383 in 1QFY24 to 1,816 in 2QFY26. The surge in store additions reflects Blinkit’s push to deepen quick-commerce penetration across India, with growth now shifting from expansion to efficiency and category depth.

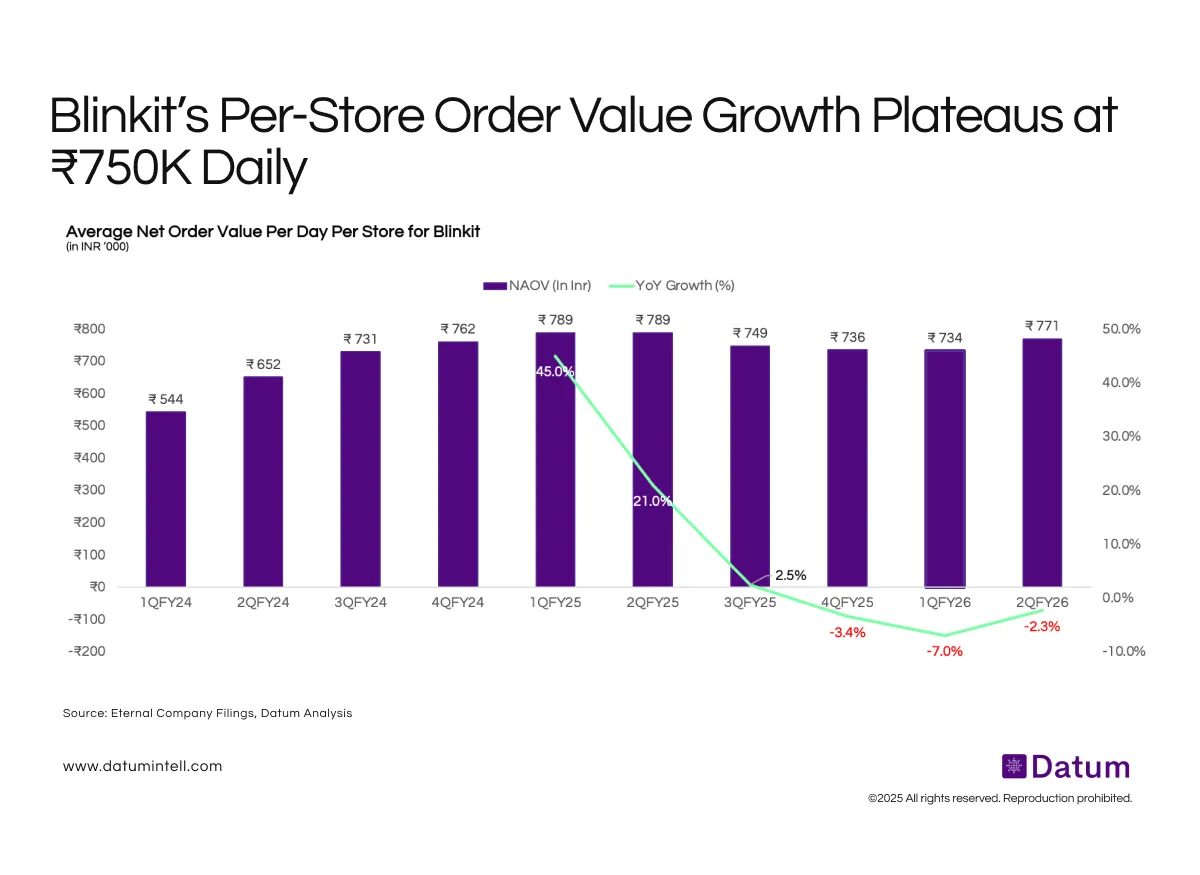

Blinkit’s Average Net Order Value per store surged 45% YoY in FY25, but growth has since plateaued around ₹750K per day.

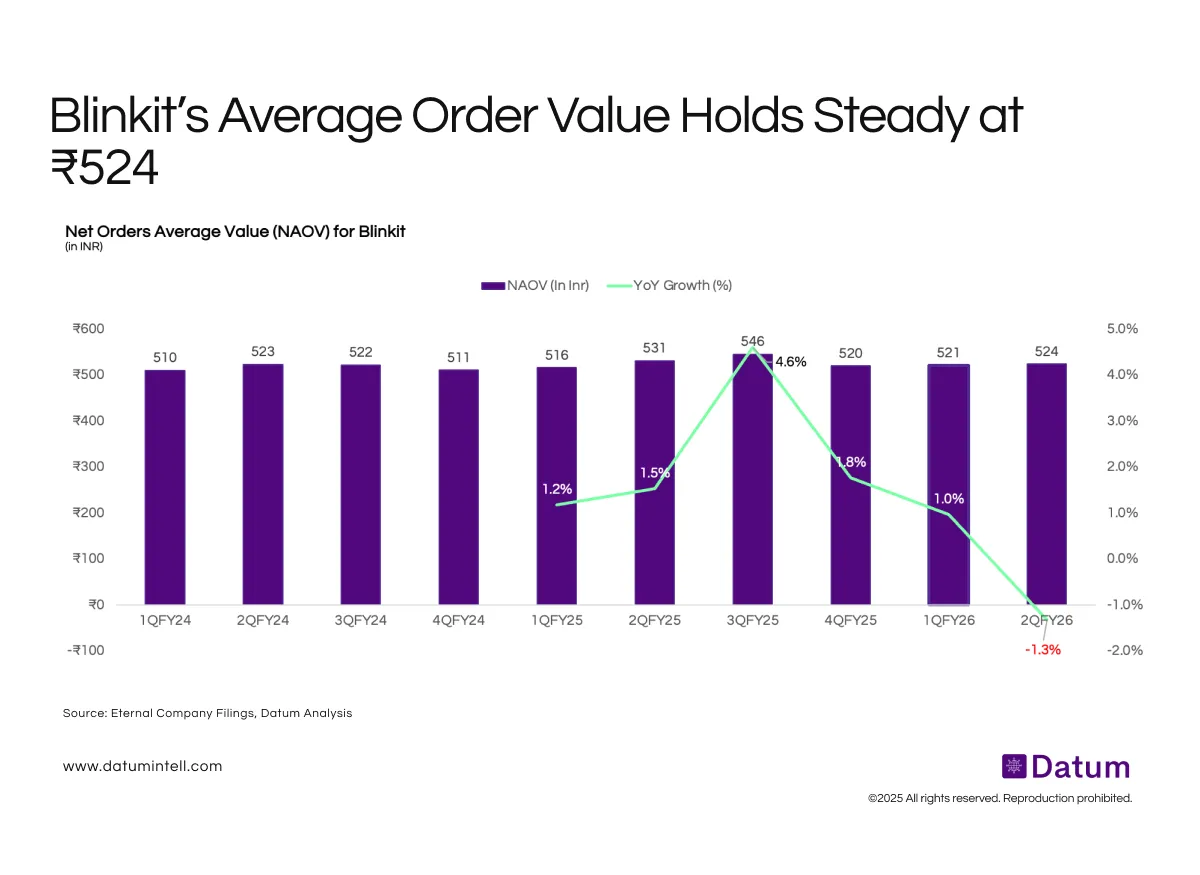

Blinkit’s average order value held steady at ₹524 in Q2 FY26, marking a 1% YoY decline even as volumes surged. With frequency and category depth driving growth, Blinkit’s order value stability signals a shift from impulse to habitual, everyday use — a key indicator of platform maturity.

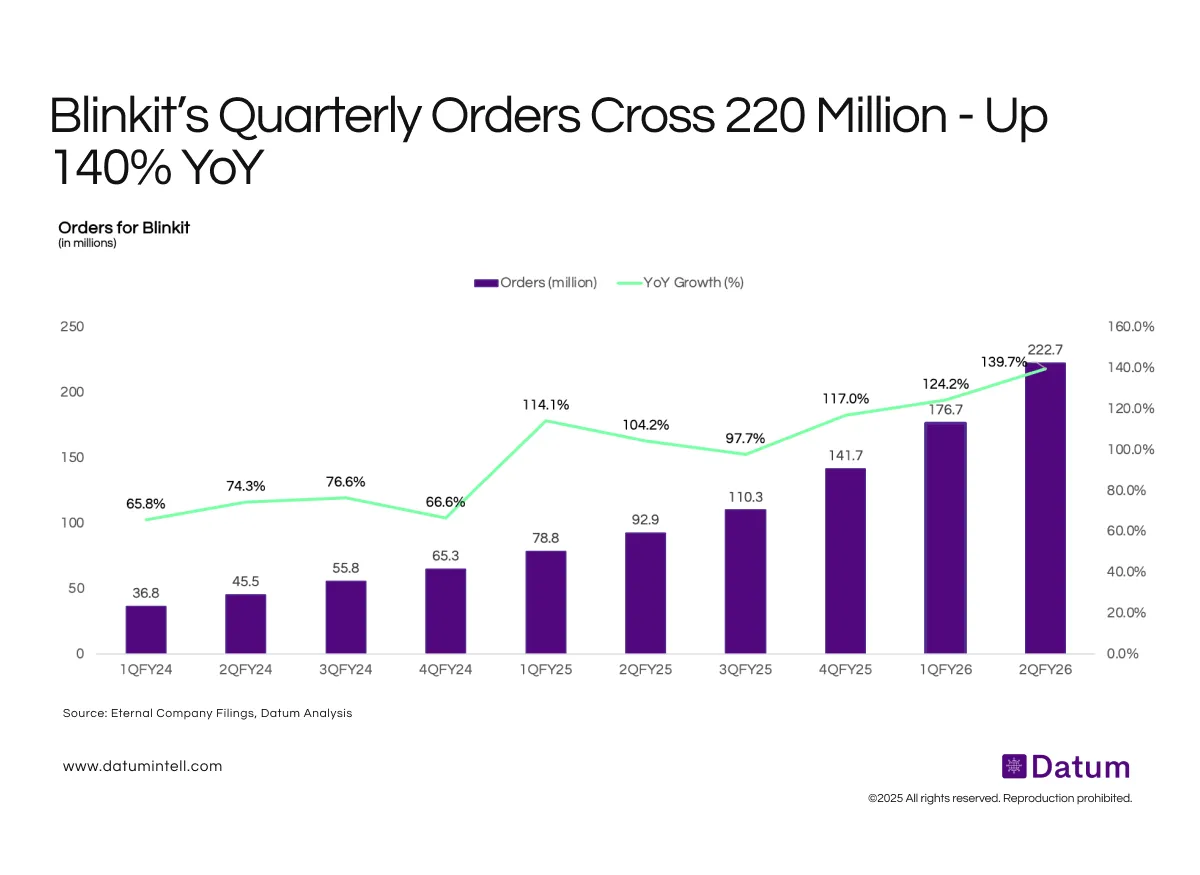

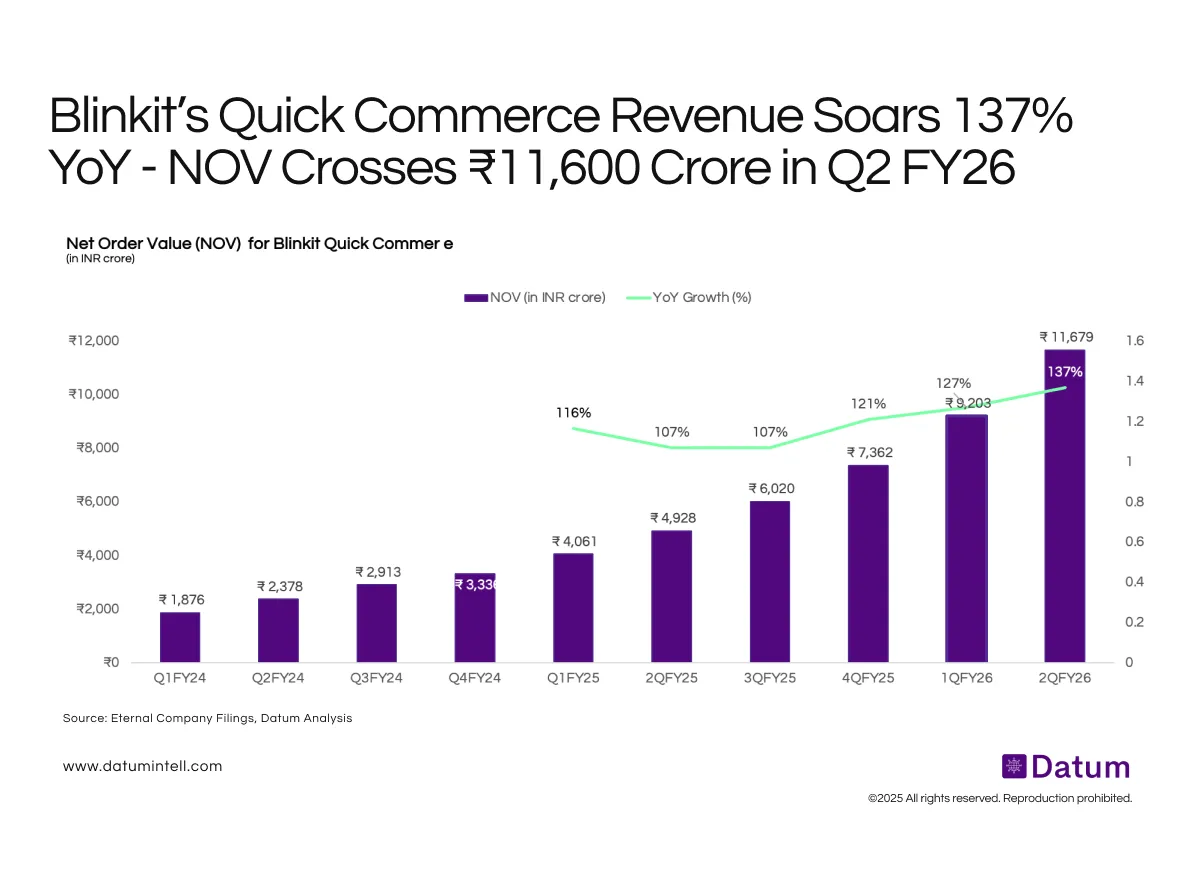

Fueled by rapid store expansion and category diversification beyond essentials, Blinkit is fast emerging as Zomato’s fastest-growing vertical, redefining everyday retail through convenience and habit-driven commerce.

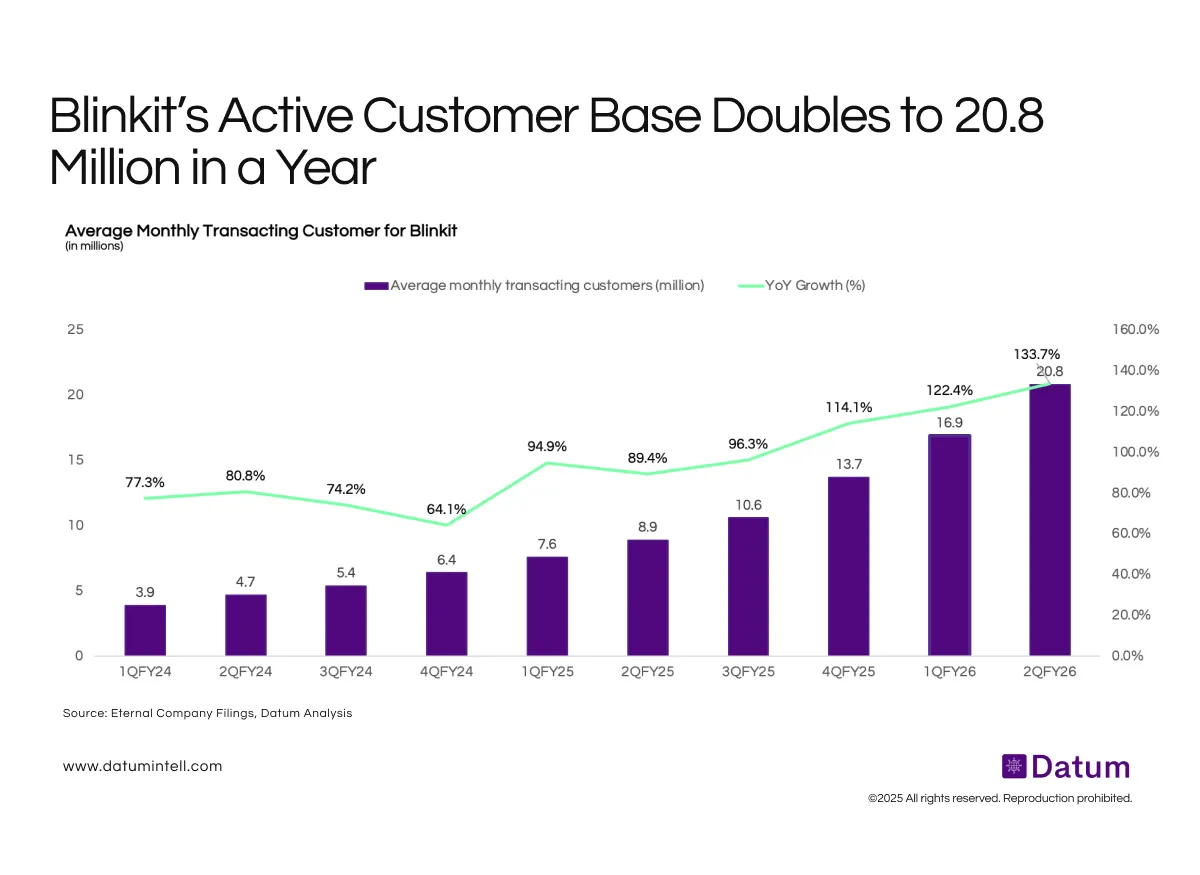

Blinkit’s monthly active customer base hit 20.8 million in Q2 FY26, up 134% YoY -reflecting strong adoption across metros and Tier-2 cities. With daily needs, gifting, and non-grocery categories gaining traction, Blinkit is becoming an everyday commerce destination within Zomato’s ecosystem.

Growth was driven by 272 new dark stores and category expansion beyond essentials into beauty, electronics, and gifting. Blinkit is fast emerging as Zomato’s core growth engine, powering scale, loyalty, and everyday convenience across India.

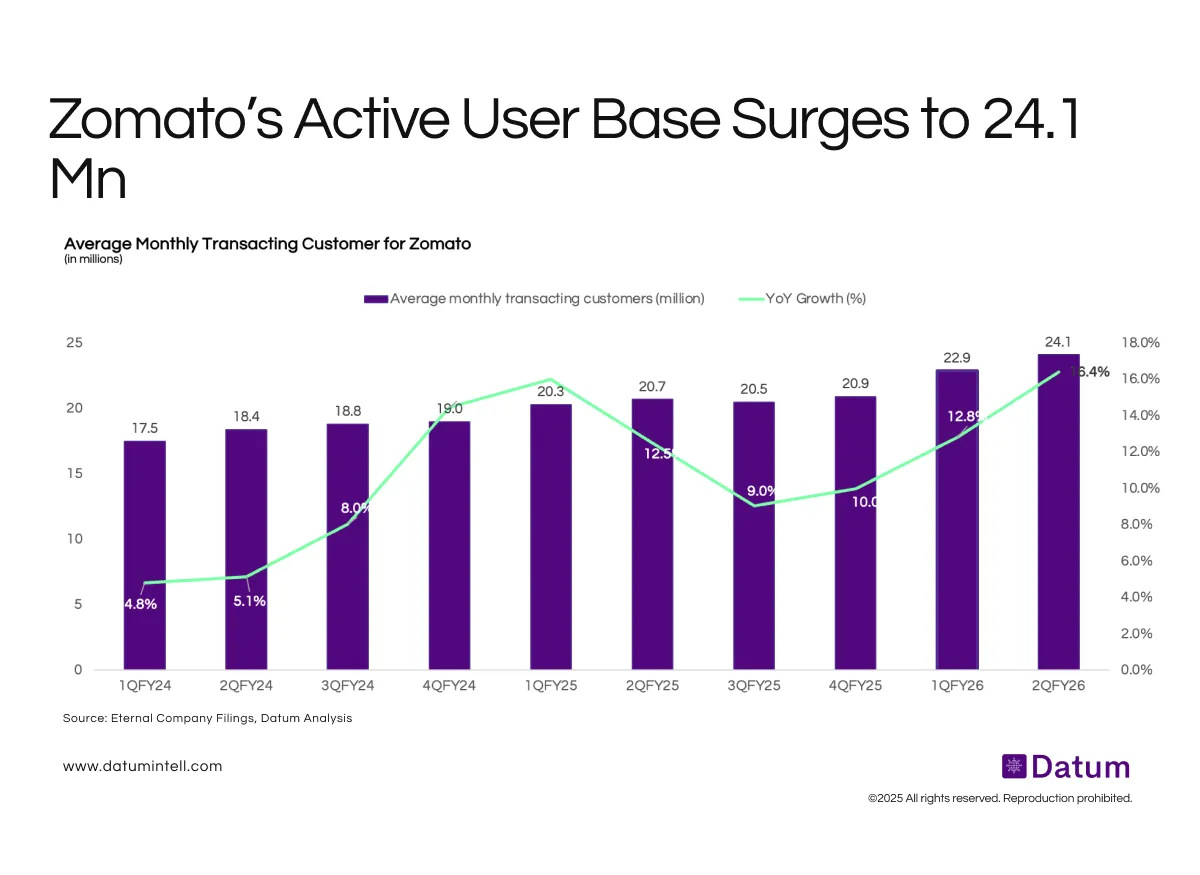

Zomato’s active monthly user base hit a record 24.1 million in Q2 FY26, up 16% YoY, driven by Gold loyalty and repeat orders. Growth now stems from frequency and retention, marking a shift from scale to depth in India’s food delivery market.

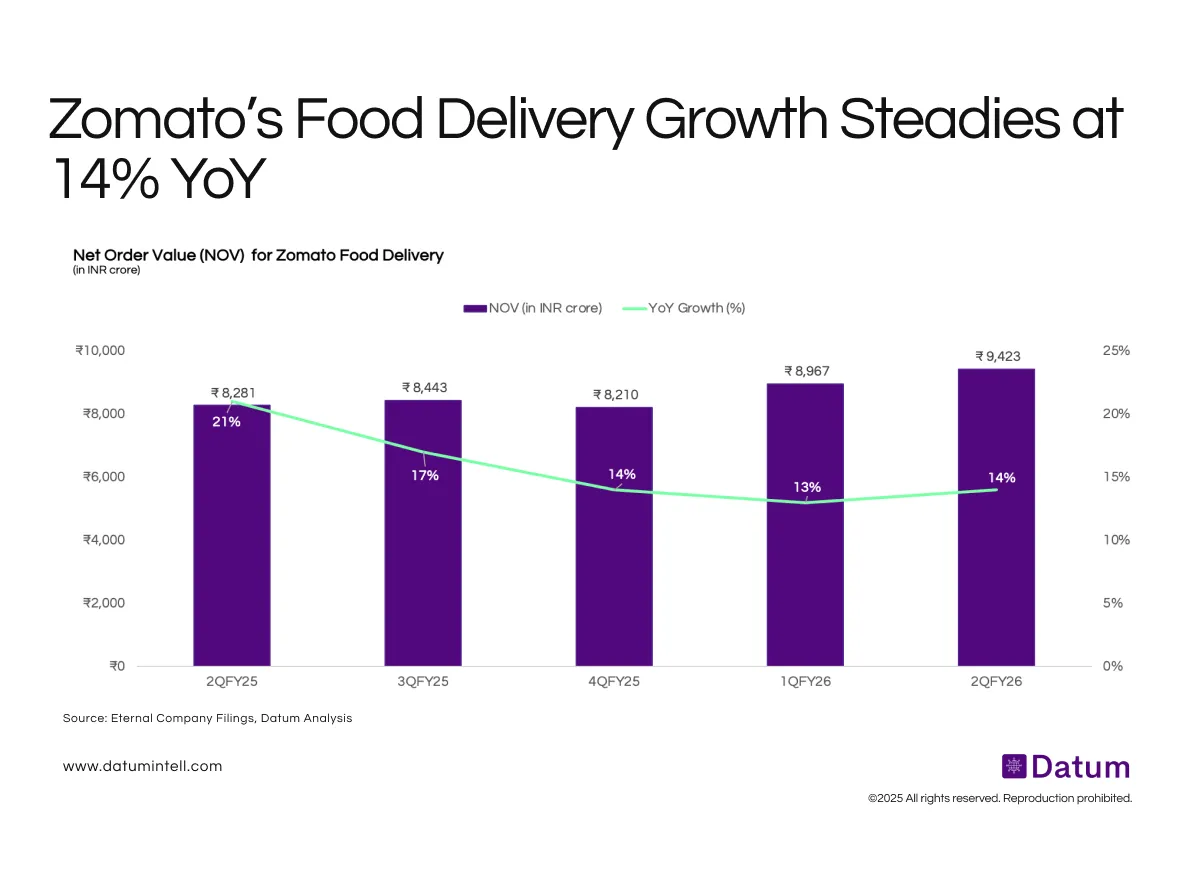

Zomato’s food delivery NOV grew 5% QoQ to ₹9,423 crore in Q2 FY26, marking steady 14% YoY growth.

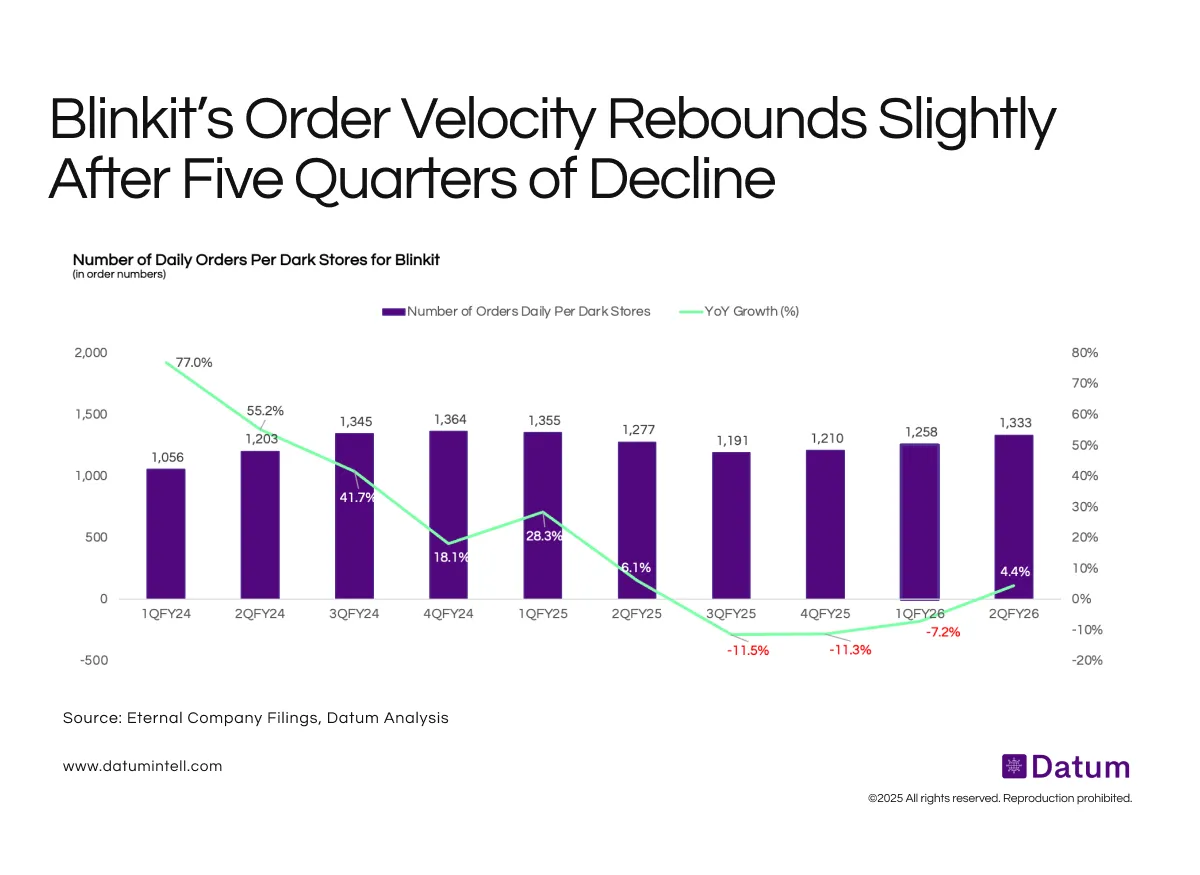

Blinkit’s per-store order volumes are showing early signs of recovery after five quarters of contraction- daily orders per dark store rose 4% YoY in Q2 FY26, pointing toward stabilization in operational efficiency.

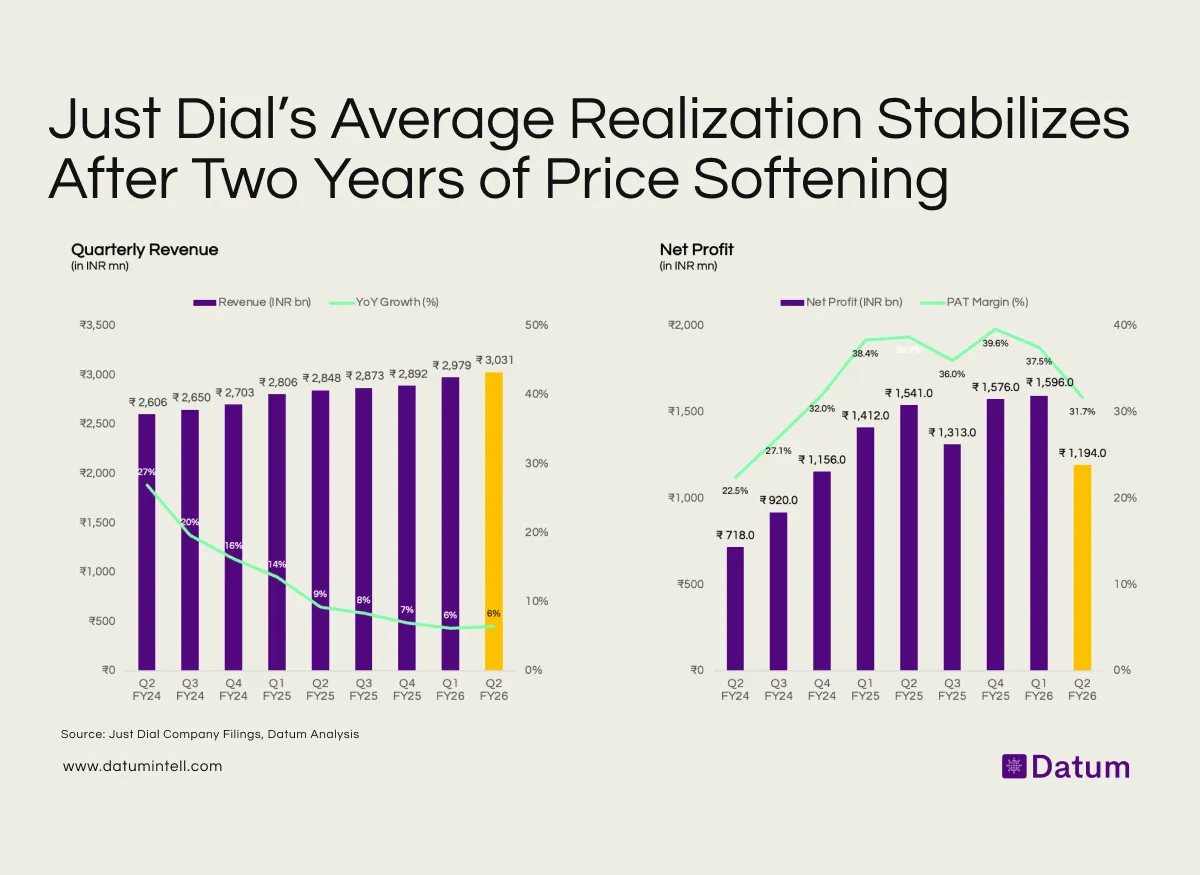

Just Dial’s growth cooled to 6% YoY in Q2 FY26, marking a steady-state phase for the platform. While margins have softened from last year’s peak, the business remains highly profitable with PAT above 30% - signaling resilience even as growth normalizes.