Table of Contents

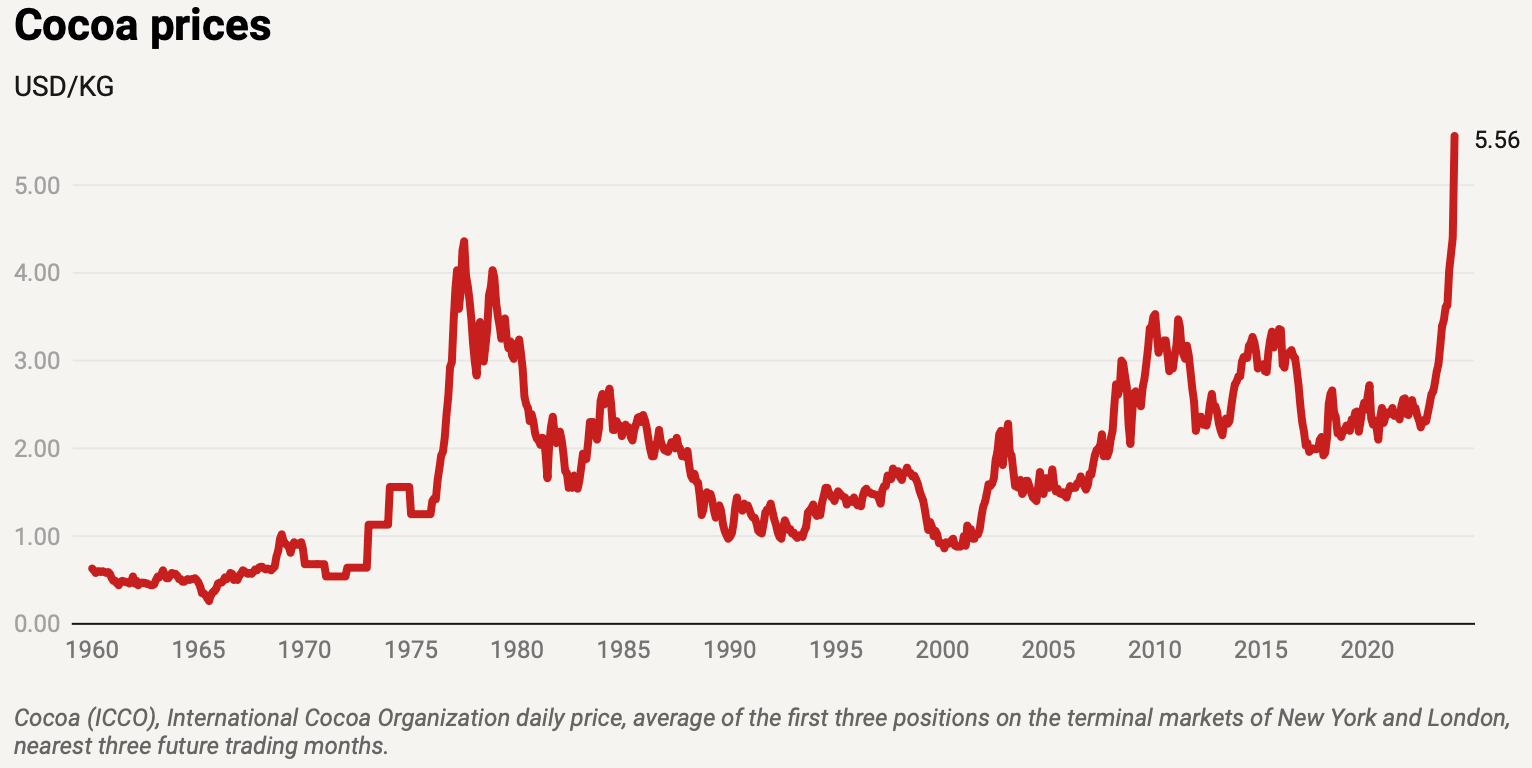

Over the past six months, cocoa bean prices have soared to unprecedented nominal levels, more than doubling since August 2023, This substantial increase can be attributed primarily to weather-related diseases that have significantly impacted cocoa production in key West African countries, which collectively account for nearly three-quarters of global supplies.

Why are Cocoa Prices Rising?

According to a report by JP Morgan, the recent surge in cocoa prices can be largely attributed to a global cocoa shortage stemming from climate change-induced drought, which has severely impacted crops in West Africa. As the world's primary cocoa-producing region, West Africa accounts for approximately 80% of global cocoa output. According to the International Cocoa Organization, the 2023/2024 season is projected to see a significant decline of nearly 11% in global cocoa supply.

There are also deep-rooted structural issues at play, including chronic underinvestment in cocoa farms. Today, the crop is still largely cultivated by smallholder farmers, many of whom struggle to make a living income and lack the means to reinvest in their land — which translates to lower yields over time. “Cocoa is a market where the grower produces a very high-value good but receives a very low share of the actual value chain. As a result, replanting rates are very low and cocoa trees are ageing,” said Tracey Allen, an Agricultural Commodities Strategist at J.P. Morgan.

Cocoa Market Structure

Cocoa, a crop native to the Amazon basin, is cultivated in various tropical and subtropical regions worldwide. Introduced to West Africa as a commercial crop in the late 19th century, the region has since become the primary source of global cocoa production.

Ghana, once the world's largest cocoa producer throughout most of the 20th century, was eventually surpassed by neighboring Côte d'Ivoire in the late 1970s.

In 2022, Côte d'Ivoire's cocoa production reached over 2.2 million metric tons, solidifying its position as the world's top cocoa producer.

Despite this dominance, cocoa farmers in the region continue to face significant challenges, including low prices and the impact of climate change on crop yields.

In 2023, cocoa beans and products accounted for almost 70% of Côte d'Ivoire's total agricultural export earnings, almost 60% of Ghana's agricultural export earnings, and almost 80% of Cameroon's agricultural export earnings. Over half of Nigeria's agricultural exports were cocoa related, mostly in the form of cocoa beans.

What’s the Impact on Chocolate Makers?

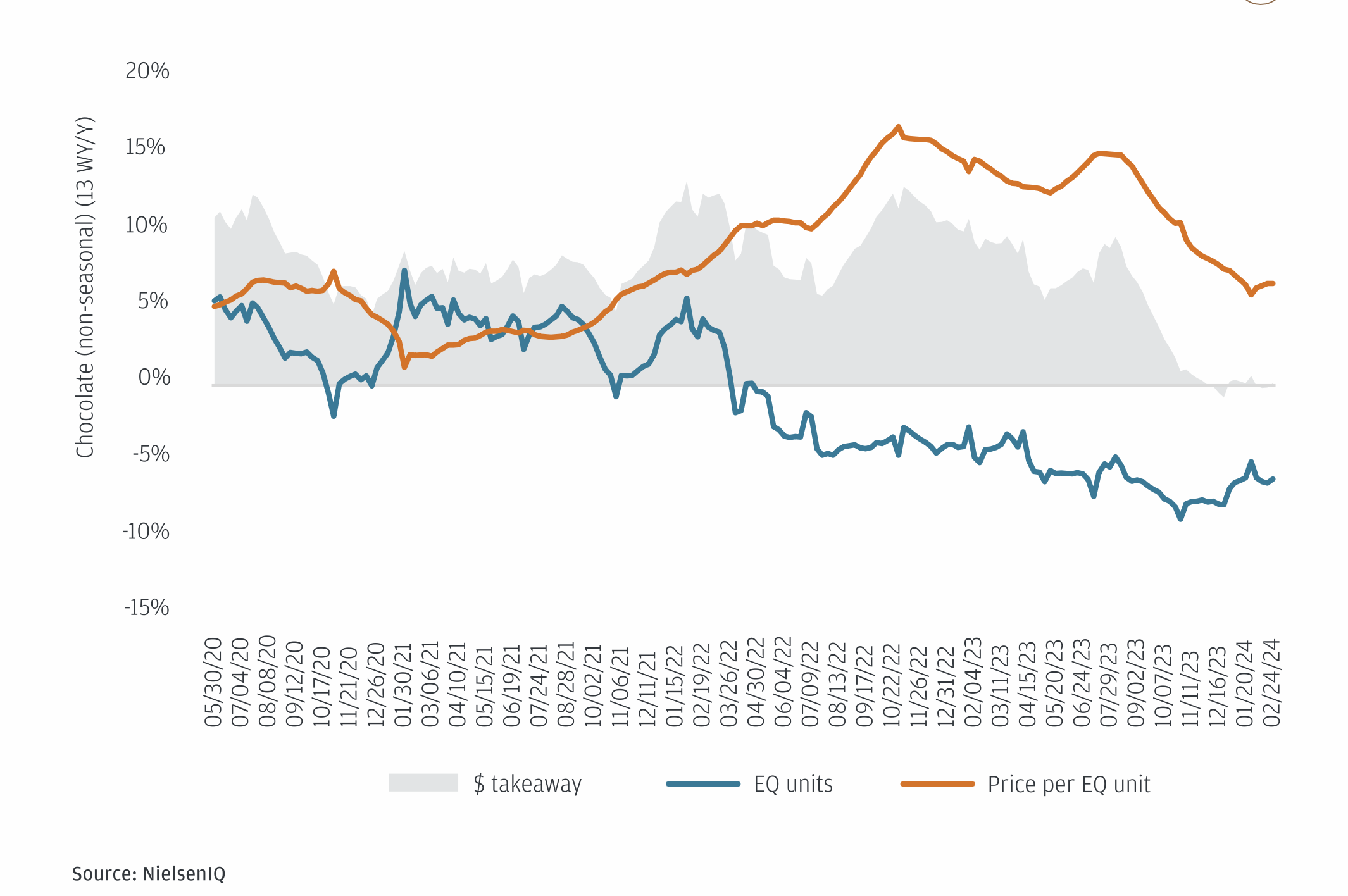

Chocolate brands are grappling with the impact of higher cocoa costs, and many are passing on the burden to consumers in the form of price hikes.

“We have seen some shifting away from chocolate to other products, whether that’s cookies or salty snacks. We think chocolate’s losing a bit of share, so consumers are certainly reacting to higher prices.” - Ken Goldman, Lead Equity Research Analyst for U.S. Food Producers and Food Retailers, J.P. Morgan

Passing on the cost to Consumer. Over the next year or two, it is likely that chocolate manufacturers will increasingly pass on the rising costs of cocoa to consumers, resulting in higher retail prices for chocolate products. As the industry continues to navigate the challenges posed by a global cocoa shortage and other factors, companies may have no choice but to adjust their pricing strategies to maintain profitability.

Alternatives and Shrinkflation. In response to rising cocoa prices and the need to maintain market share, chocolate manufacturers are employing various strategies to adapt. Some companies are experimenting with recipes that require less cocoa, such as producing chocolate bars with a higher proportion of fruits and nuts. Others are opting for "shrinkflation," a practice that involves reducing the size of their products while maintaining the same price.

How Long will High Prices Last?

Cocoa prices are projected to remain elevated through much of 2024 due to ongoing supply shortages and other market factors.

However, if weather patterns and crop yields return to normal levels, a moderation in prices can be anticipated with the arrival of the new crop harvest during the final quarter of 2024. This outlook is corroborated by the cocoa futures contracts forward curve, which indicates declining prices over the next 24 months, suggesting that the market expects a gradual recovery as production and stock levels increase.

One potential concern is the impact of harvest losses and crop diseases on the number of cocoa trees, which could exacerbate the supply shortfall and create a more persistent structural issue.

In such a scenario, high costs would likely persist, presenting a significant challenge for the industry.Furthermore, rising production costs stemming from sustainability concerns could impede supply adjustments, potentially prolonging the recovery process.

As the global cocoa market navigates these complex dynamics, the coming months will be crucial in determining the trajectory of prices and the overall health of the industry.