Table of Contents

The Indian Consumerware Market is broadly divided into two categories, Consumer Houseware and Consumer Glassware. The Consumer Houseware and Consumer Glassware markets are further segmented into various subcategories like:

Consumer Houseware: Hydration, Cookware, Insulated Ware, Lunchboxes, Storage Containers, Melamine, Small Kitchen Appliances and Cleaning Products.

Consumer Glassware: Opalware, Glassware and Porcelain

The consumerware market in India has showcased steady growth in recent years, driven by the rise of organized retail and e-commerce.

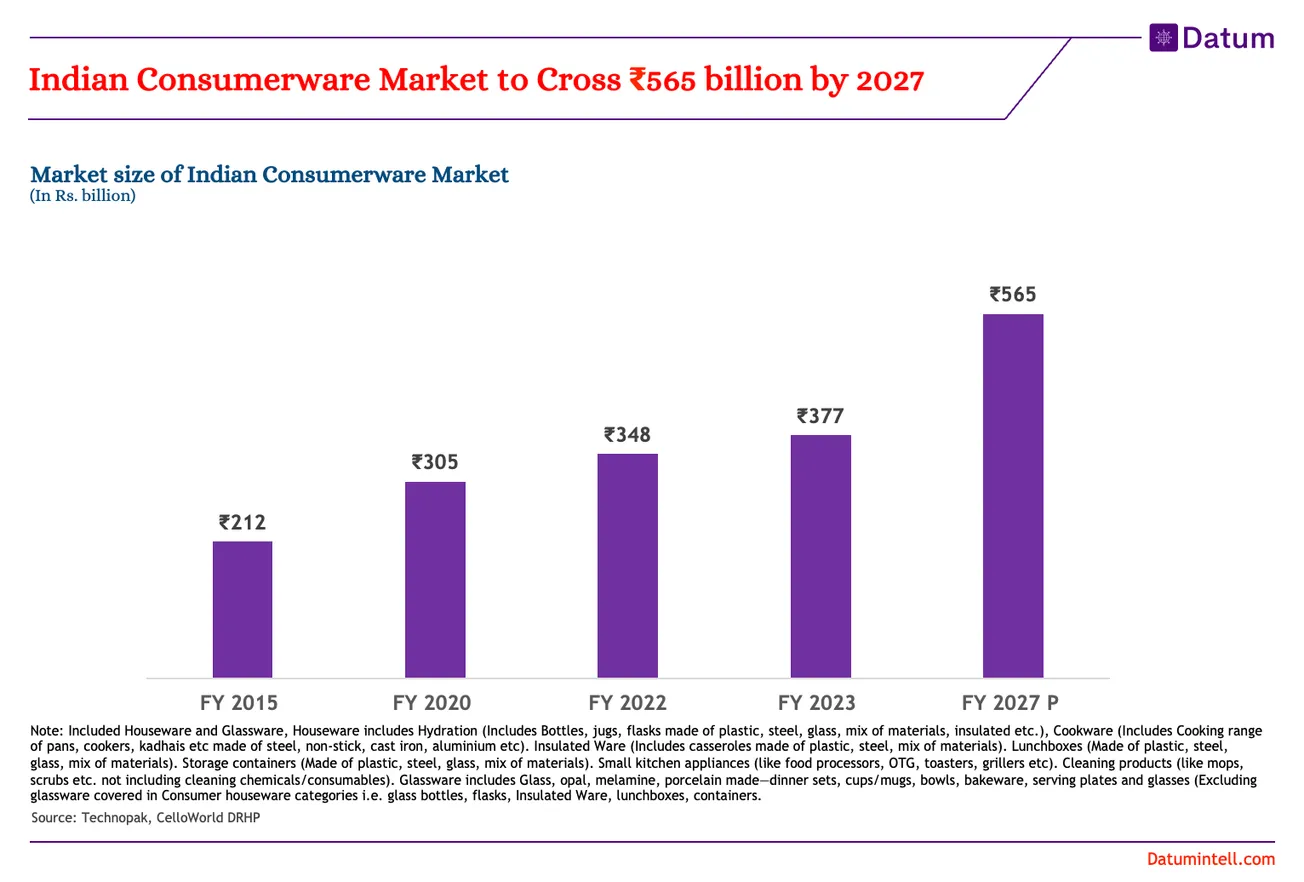

In financial year 2022, the total market size reached INR 348 billion, up from INR 305 billion in FY 2020. This represents a compound annual growth rate (CAGR) of 6.9% over the past two years.

The positive momentum is expected to continue, with the market projected to reach INR 565 billion by FY 2027. The CAGR for the period FY 2022-2027 is forecast at 10.2%.

Driving this growth are factors like growing disposable incomes, increasing nuclearization of households, and high demand for well-designed and functional kitchens. Consumers are willing to spend more on modern houseware and appliances that offer convenience and ease of use.

As urbanization rises, Indian households are evolving towards more organized and hygienic kitchens. The market for solutions that save time and effort is expanding rapidly. Brands are responding to this demand with user-centric product design and competitive pricing.

With incomes and living standards set to improve further, the Indian consumerware industry is headed for robust growth ahead. The shift towards organized retail makes it ripe for market players to tap into rising consumer aspirations.