Table of Contents

The share prices of online dating giants Match Group and Bumble have experienced significant declines in recent times, raising concerns among investors and analysts. Several factors contribute to these companies' financial woes, including a slowdown in revenue growth, increased competition, and market saturation.

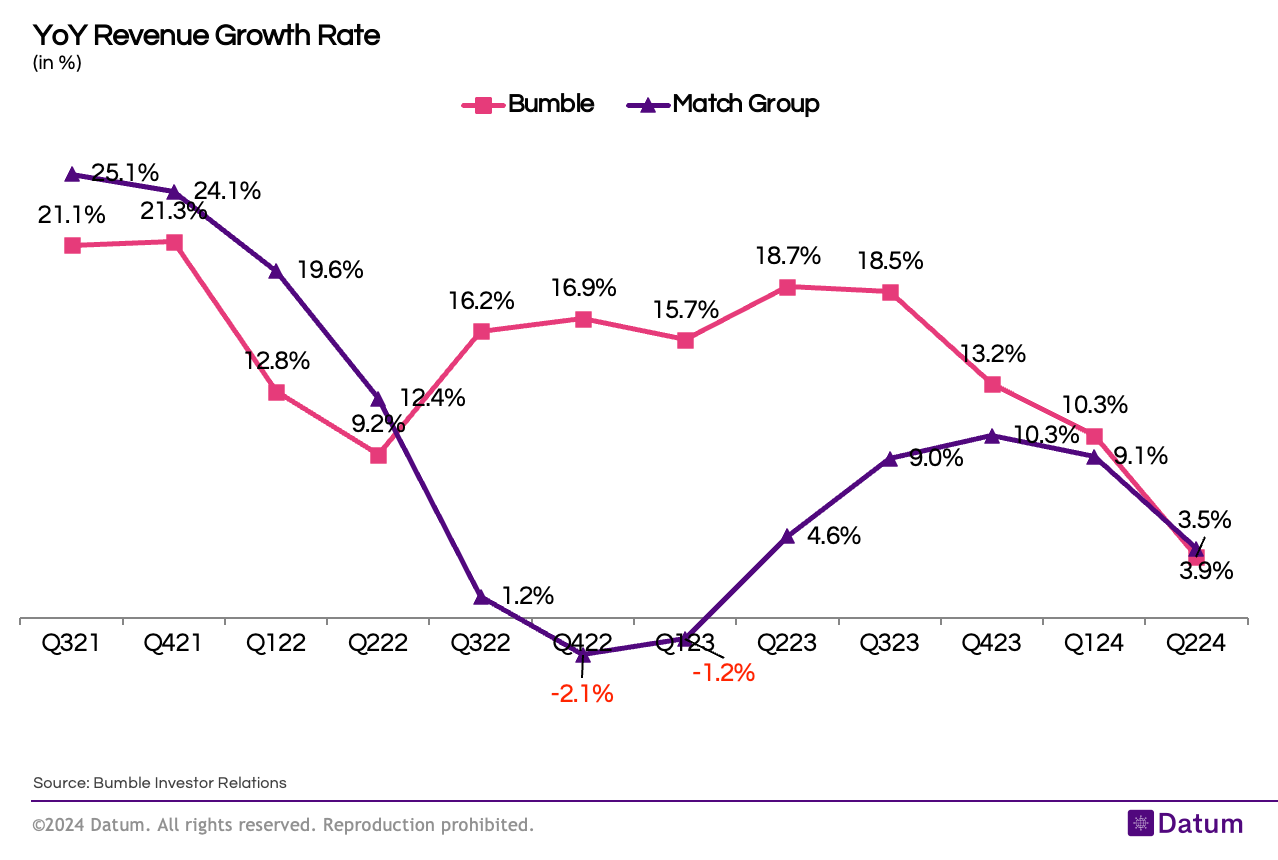

Declining Revenue Growth

Bumble's YoY revenue growth has declined from 21.3% in Q4 2021 to 3.5% in Q2 2024. This suggests that Bumble is struggling to maintain its early growth momentum. Similarly, Match Group’s revenue growth from 2021 to 2023 was 5.2% CAGR. The revenue peaked in Q3 2023 and then declined, highlighting a substantial reduction in growth momentum.

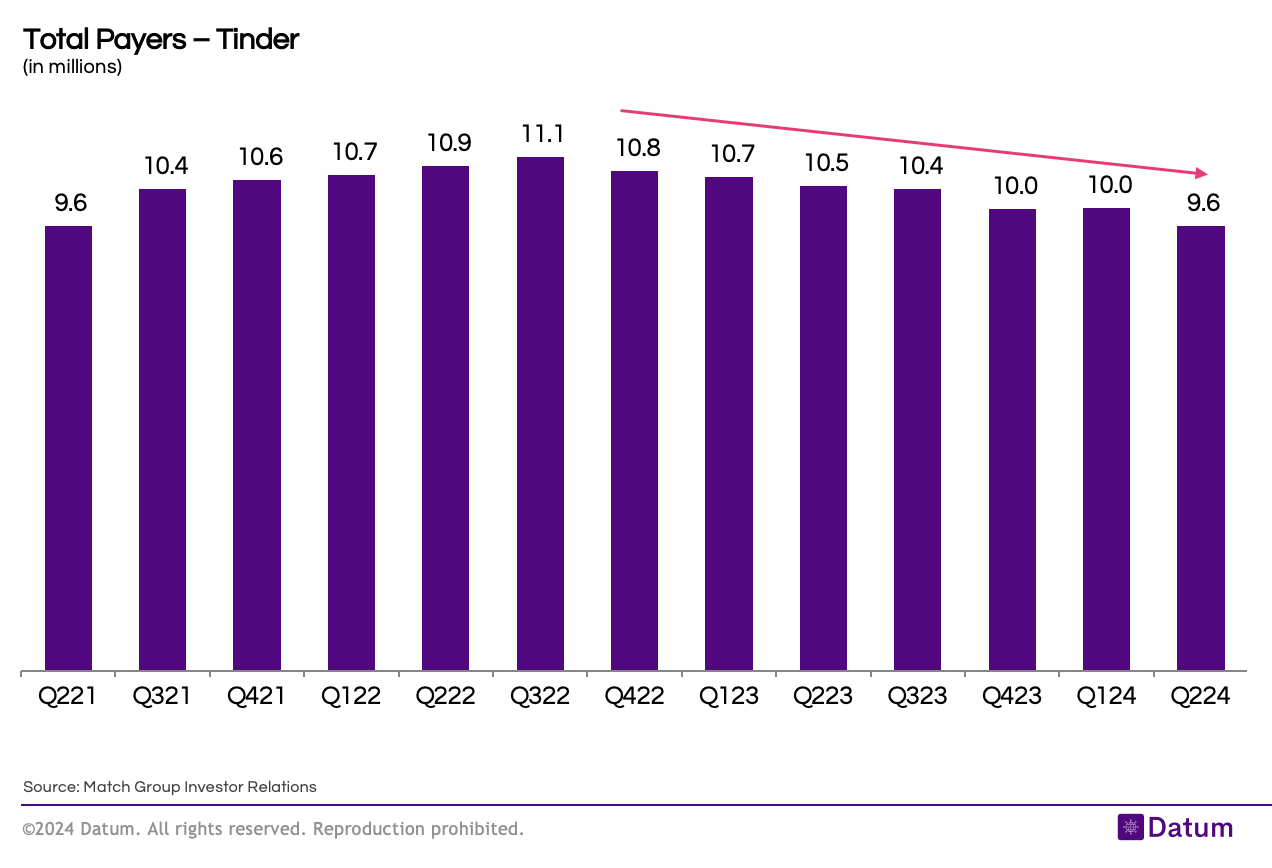

Negative Growth in Paying Users for Tinder

Tinder’s total number of payers peaked at 11.1 million in Q3 2022 but declined to 9.6 million by Q2 2024. Tinder's total payers YoY growth turned negative after Q4 2022 (-0.4%) and has consistently declined, seeing a peak decline of -8.3% in Q2 2024. The total payers for Match Group also show a declining trend, from a peak of 16.5 million in Q3 2022 to 14.8 million in Q2 2024. This suggests that the struggles are not limited to a single app but affect the broader portfolio of dating apps within the Match Group.

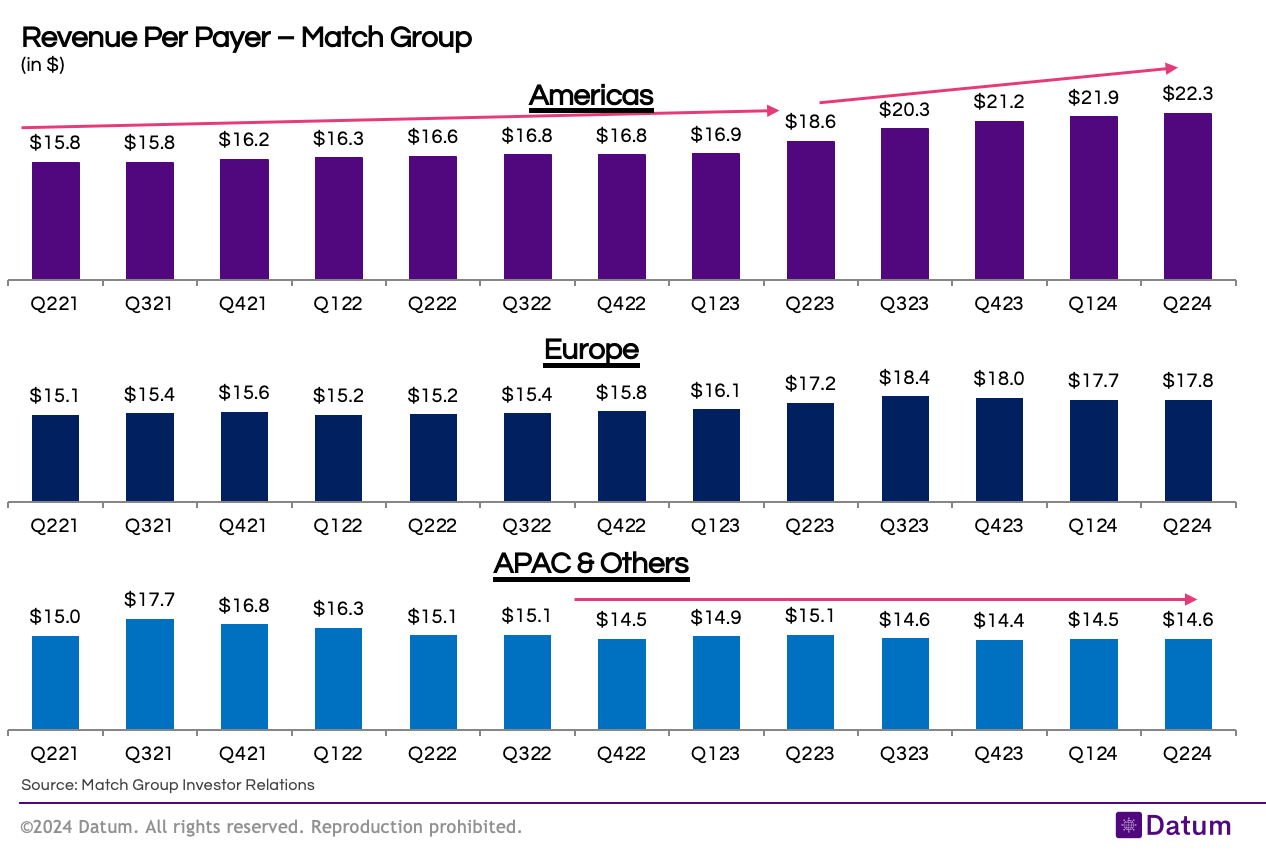

Revenue Per Payer Trends

The revenue per payer for Match Group shows regional disparities. While the Americas region saw an increase to $22.3 in Q2 2024, growing consistently, although slowly, Europe and APAC & other regions had lower revenues per player, peaking at $18.4 and $17.7, respectively. This indicates potential challenges in monetising users outside the Americas.

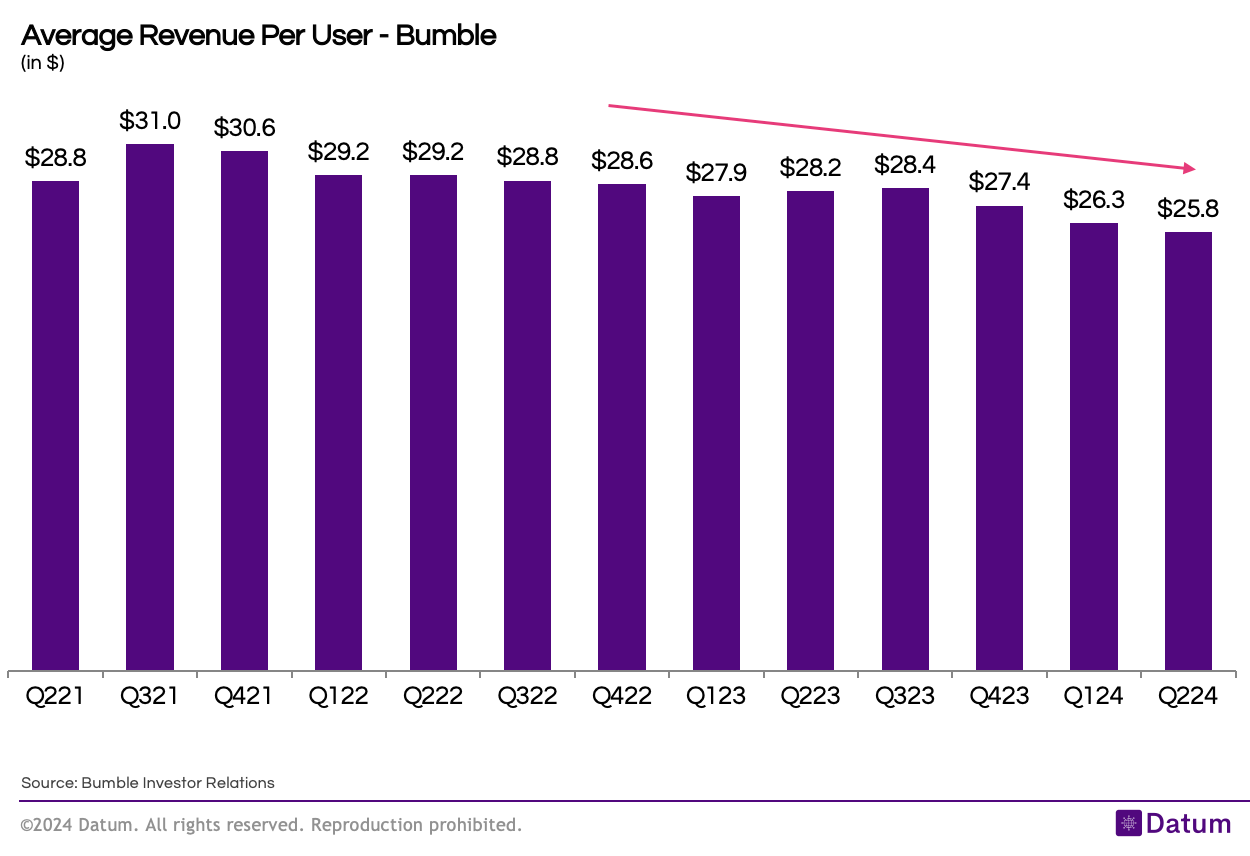

For bumble the total paying users are growing but the average revenue per user (ARPU) is dealing. The company's ARPU dropped to $25.8 in Q2 24 compared to $31.0 in Q3 21, indicating a reduction in monetization efficiency.

From the above points, we can see the key reasons dating apps are struggling. The declining growth rates, decreasing number of payers, regional revenue disparities, and market saturation are significant factors contributing to the challenges faced by these apps.