Table of Contents

A de minimis tax loophole refers to a provision in the tax laws the USA that allows businesses to import goods up to a certain minimal or small value into a country without having to pay duties or taxes.

Nearly three million de minimis shipments enter the United States each day, and about half are textile and apparel products.

The de minimis exception provides admission of products free of duty if the fair retail value of the product does not exceed $800.The de minimis threshold was previously $200 but increased in 2016 with the passage of the Trade Facilitation and Trade Enforcement Act (TFTEA).

Chinese-founded companies like Shein and Temu, both budget-friendly retailers, would ship merchandise directly from their overseas warehouses to shoppers’ homes, and few of those packages were worth at least $800. But products made overseas and shipped to U.S. retailers in bulk — then stored in warehouses before being shipped to customers — are less likely to fall under the $800 threshold.

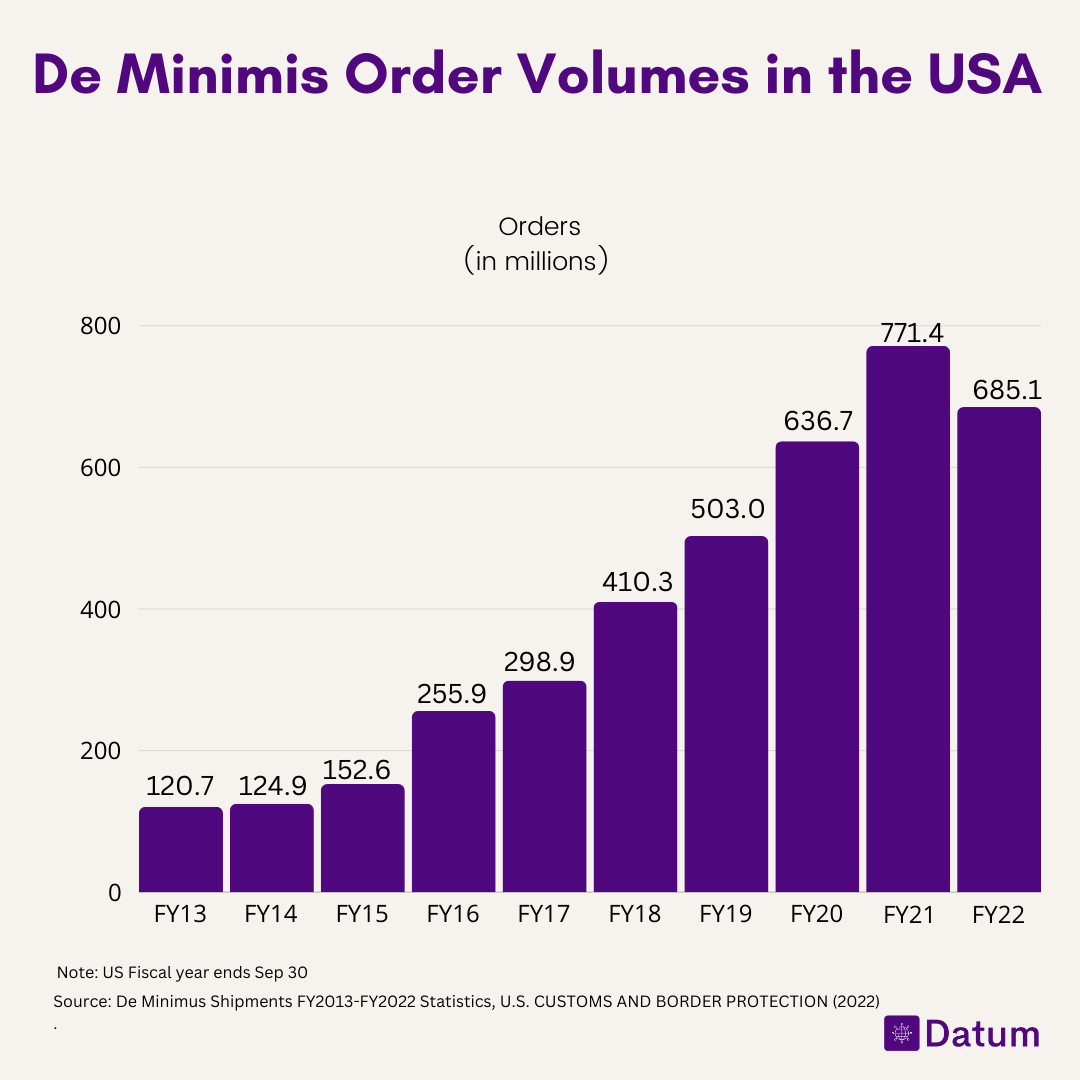

Since the de minimis threshold was increased, the scale of de minimis imports arriving in the United States has expanded from 256 million packages in 2016 to 771 million in 2021.

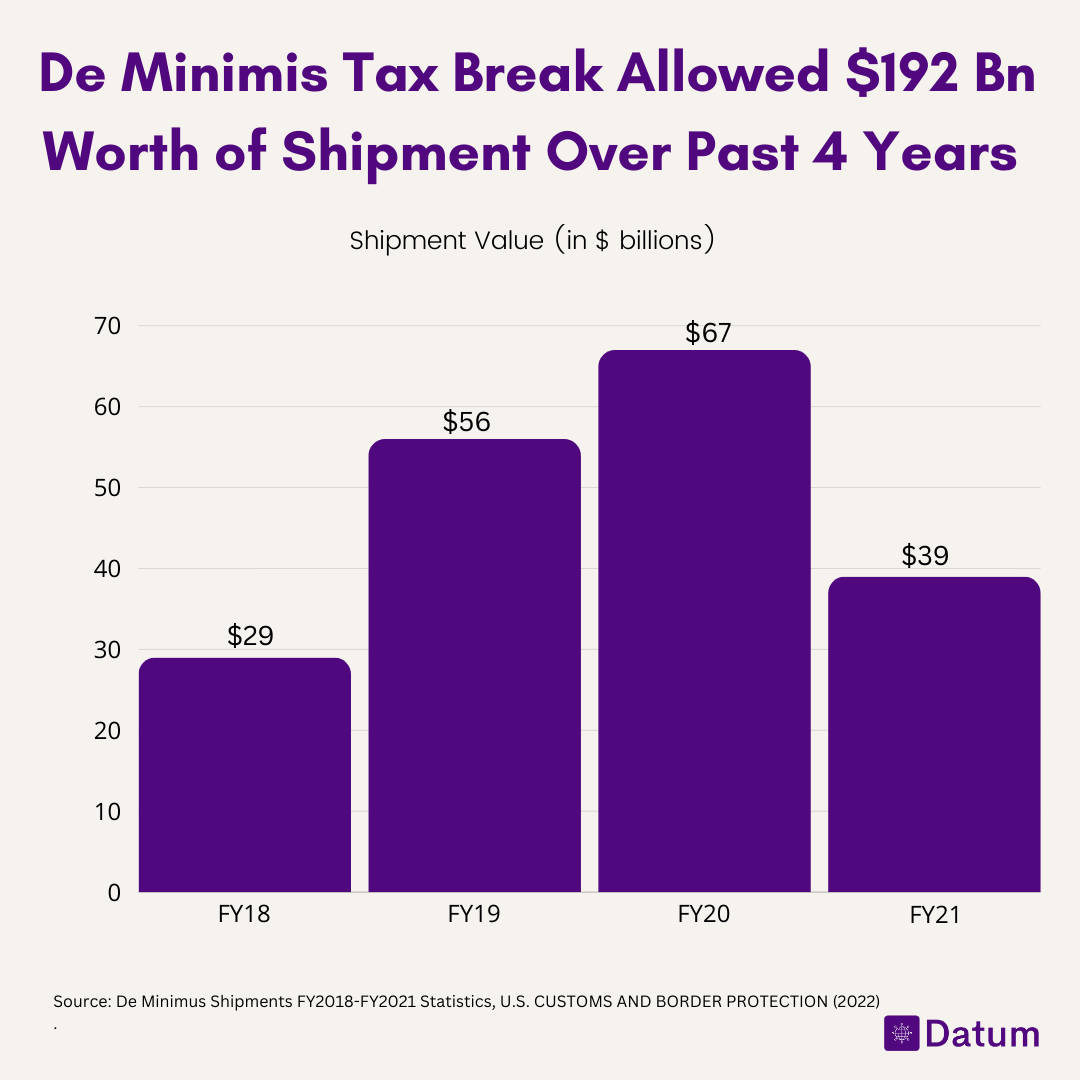

De Minimis Loophole Allowed $192 Billion Worth of Shipments Over Past Four Years

The de minimis tax provision has allowed nearly $200 billion worth of import shipments to enter the United States duty-free over the 4 fiscal years between 2018 to 2021, according to analysis by the Government Accountability Office (GAO). Enabled by federal regulations that permit individual shipments with values under $800 to bypass formal customs declaration and payment of import taxes, the cumulative impact of low-value online shopping orders and consolidated logistics packages qualifying for this exemption has resulted in substantial losses of custom duties that would otherwise be owed to the Treasury.

High De Minimis Threshold in the US

With a lofty $800 no-tax import allowance per shipment, the United State’s de minimis threshold stands in a league of its own - more than twice as high as the next highest exemption limit governed by any other country worldwide. At over 2X the levels in Mexico ($117), or Singapore ($200), the substantial tax break American eCommerce firms enjoy on low-value product imports like electronics, apparel and machined parts has been crucial to fueling shipment volumes from Asia and driving the meteoric rise of platforms like Wish or Shein or Temu.

China's de minimis threshold is $7, for comparison

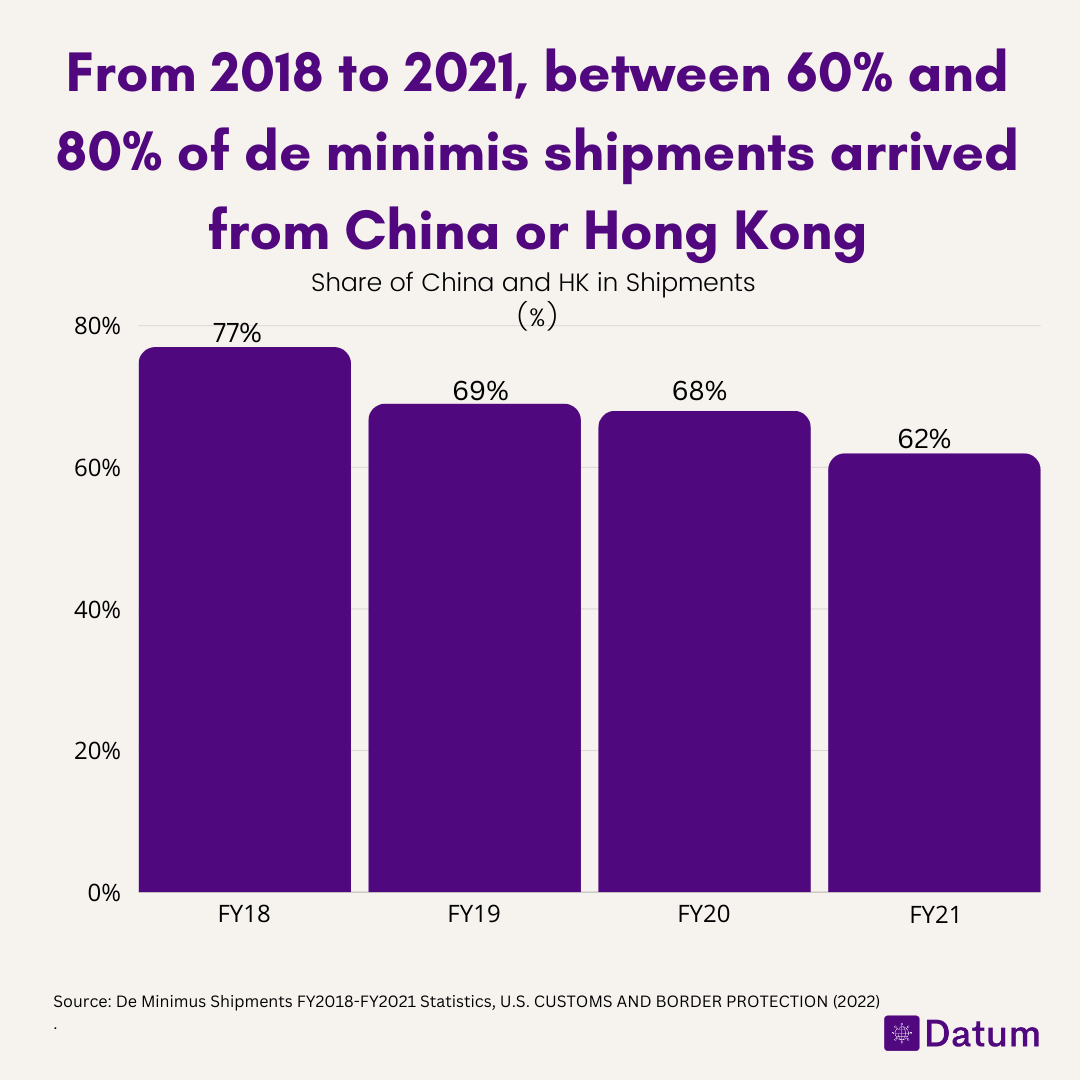

China and Hong Kong Account for 60-80% of $192 Billion De Minimis Imports to United States Since 2018

Of the nearly $200 billion worth of import shipments that entered the United States duty-free under the de minimis tax exemption between fiscal years 2018 to 2021, a disproportionate 60% to 80% originated from China and Hong Kong collectively. This concentration of low-value overseas purchases flooding in from Chinese e-commerce giants like Pinduoduo (PDD) and Shein owes to the nation's dominance in manufacturing and exporting inexpensive consumer goods preferred by Americans.

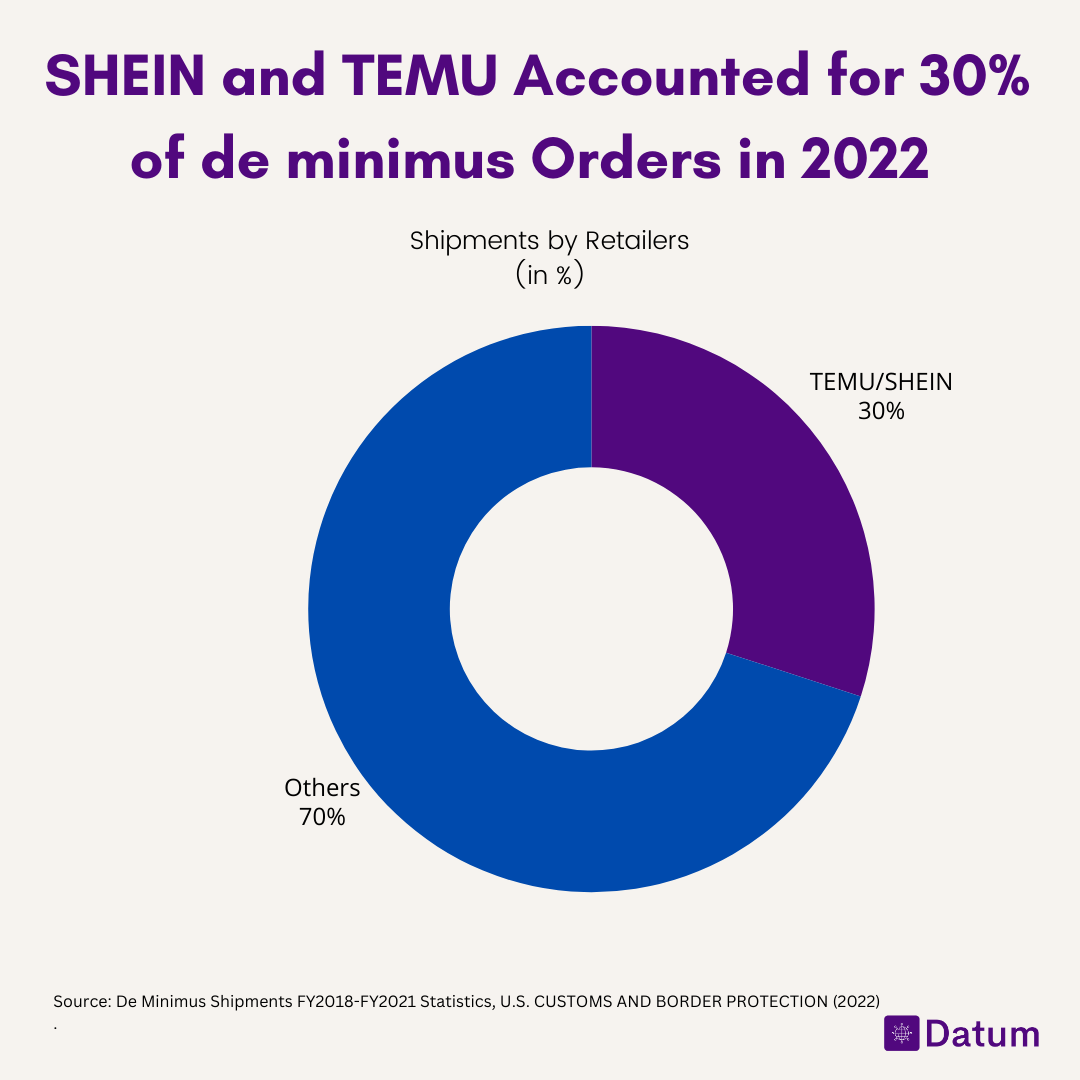

Shipments from Temu and Shein alone may account for nearly half of all de minimis shipments from China in 2022

Billions of Dollars Loss in Tariffs

In 2021, the Federal Reserve Bank of New York estimated that the U.S. Department of the Treasury loses as much as $10 billion a year in tariffs through tariff strategies like de minimis.

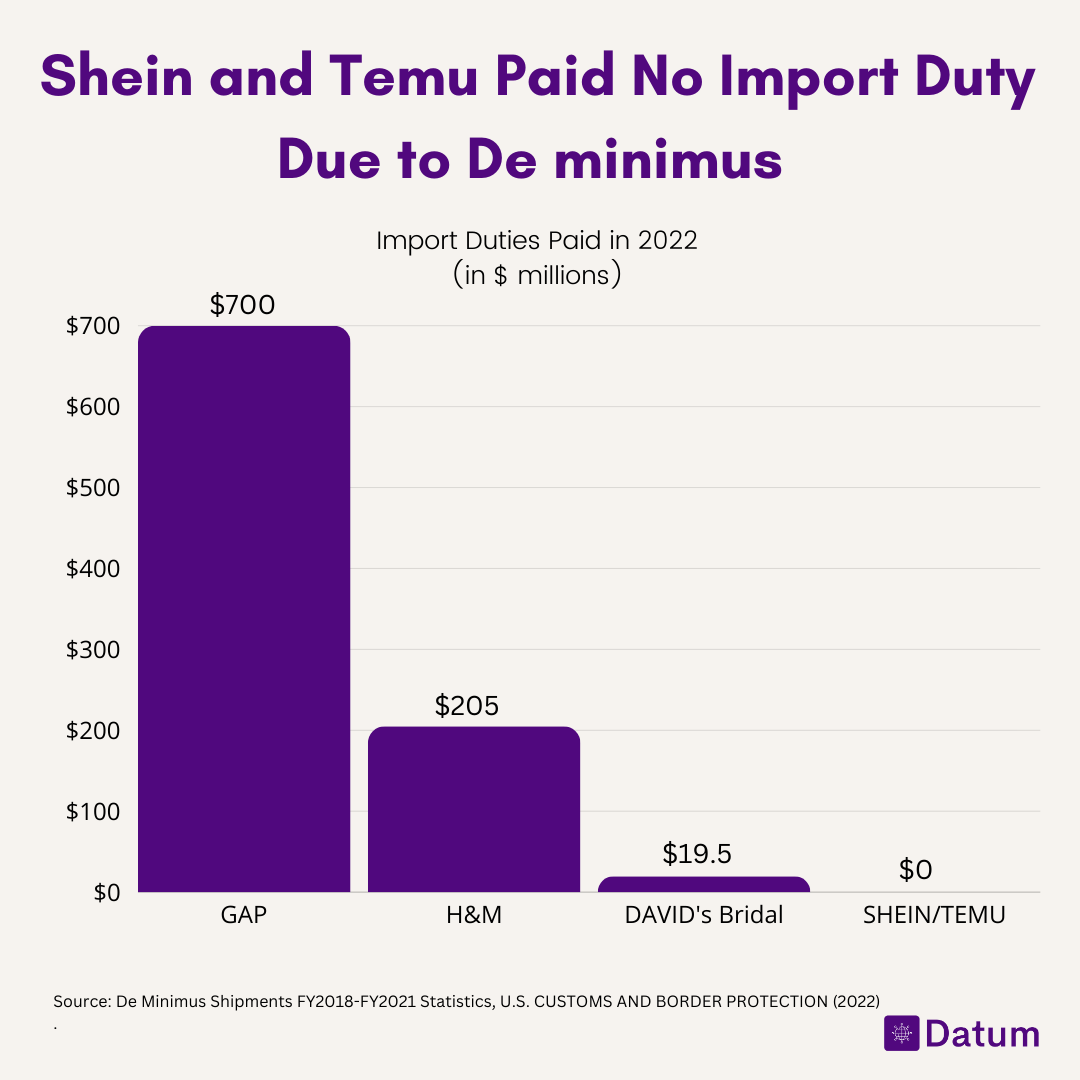

The millions of packages that Temu and Shein ship every year duty free to the United States, without providing CBP with sufficient data regarding the contents of the packages, stand in stark contrast to the millions of dollars in import duties paid by retail companies. For instance, in 2022, Gap, H&M, and David’s Bridal respectively paid $700 million, $205 million, and $19.5 million in import duties. Moreover, these and similar companies’ imports were accompanied by better data, allowing CBP to more effectively enforce the law.

US Retailers Want This Law Changed

According to a report tin NY Times U.S. retailers want the rule changed. If it isn’t, they argue, companies may move their warehouses, and the jobs that come with them, outside the United States.

Both TEMU and SHEIN denied that this is essential for their business models.

A Shein spokeswoman said that the retailer “continues to make import compliance a priority” and that “the de minimis provision is not critical to the success of our business.”

A Temu spokeswoman echoed Shein, saying that Temu’s “growth isn’t dependent on the de minimis policy” and that it was “supportive of any policy adjustments made by legislators that align with consumer interests.”

American Apparel & Footwear Association, a trade organization that represents more than 300 U.S. companies, is collecting input from its members for a policy recommendation it plans to publish in the next couple of weeks.

De minimis is written into law—Section 321 of the Tariff Act of 1930—so Congress would have to act to restrict, change or enforce the rules. This would inevitably affect millions of shipments that have absolutely nothing to do with Xinjiang cotton. But there is bipartisan sentiment that the law isn’t working as intended.