Table of Contents

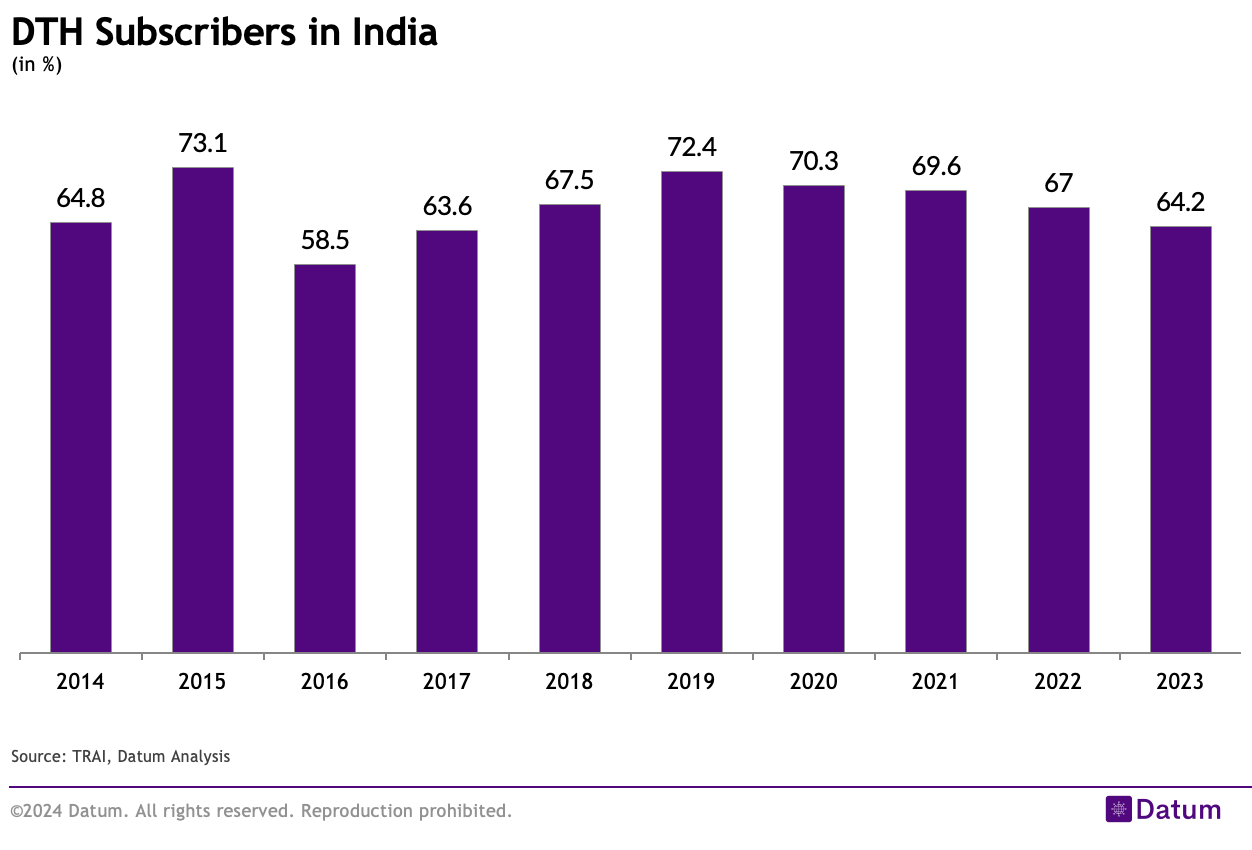

Since its introduction in the year 2003, Indian DTH services have displayed a phenomenal growth. But the subscriber base peaked in 2015 with 73.1 million DTH subscribers in India.

According to the Telecom Regulatory Authority of India (TRAI), the number of pay direct-to-home (DTH) subscribers in India has been declining. In the quarter ended September 2023, the subscriber base decreased by 4.2%, falling from 67 million to 64.18 million.

Impact on Revenue

In the fiscal year 2022-2023, the combined revenue of four private direct-to-home (DTH) companies—Tata Play, Bharti Telemedia (owned by Bharti Airtel), Dish TV, and Sun Direct—dropped by nearly 10% to Rs 11,072 crore compared to Rs 12,284 crore the previous year.

Together, these operators faced a net loss of Rs 2,143 crore, with Dish TV recording the largest loss of Rs 1,684 crore.

The industry is grappling with challenges such as a shrinking subscriber base and declining average revenue per user (ARPU), resulting in over four million customers lost in fiscal years 2022 and 2023.

Reasons for Decline

This decline is mainly attributed to subscribers migrating to alternatives like DD Free Dish and Over-The-Top (OTT) platforms. Despite the obstacles, Bharti Airtel’s DTH business has shown positive growth, gaining market share through strategic acquisitions and simplified pricing strategies.

To combat competition, the industry is introducing hybrid set-top boxes and OTT aggregation services. Dish TV, now free of net debt, intends to use its cash flow to attract new customers through capital investments. Despite facing losses, the DTH sector remains hopeful about capitalising on digital opportunities, adapting to changing viewer preferences, and boosting OTT subscriptions in fiscal year 2024.2

In response to industry challenges, DishTV is making moves into the digital realm by exploring opportunities in the OTT sphere. This strategy is estimated to increase the subscriber base throughout FY24 as the companies adapt to changing consumer preferences and evolving media spaces.