Table of Contents

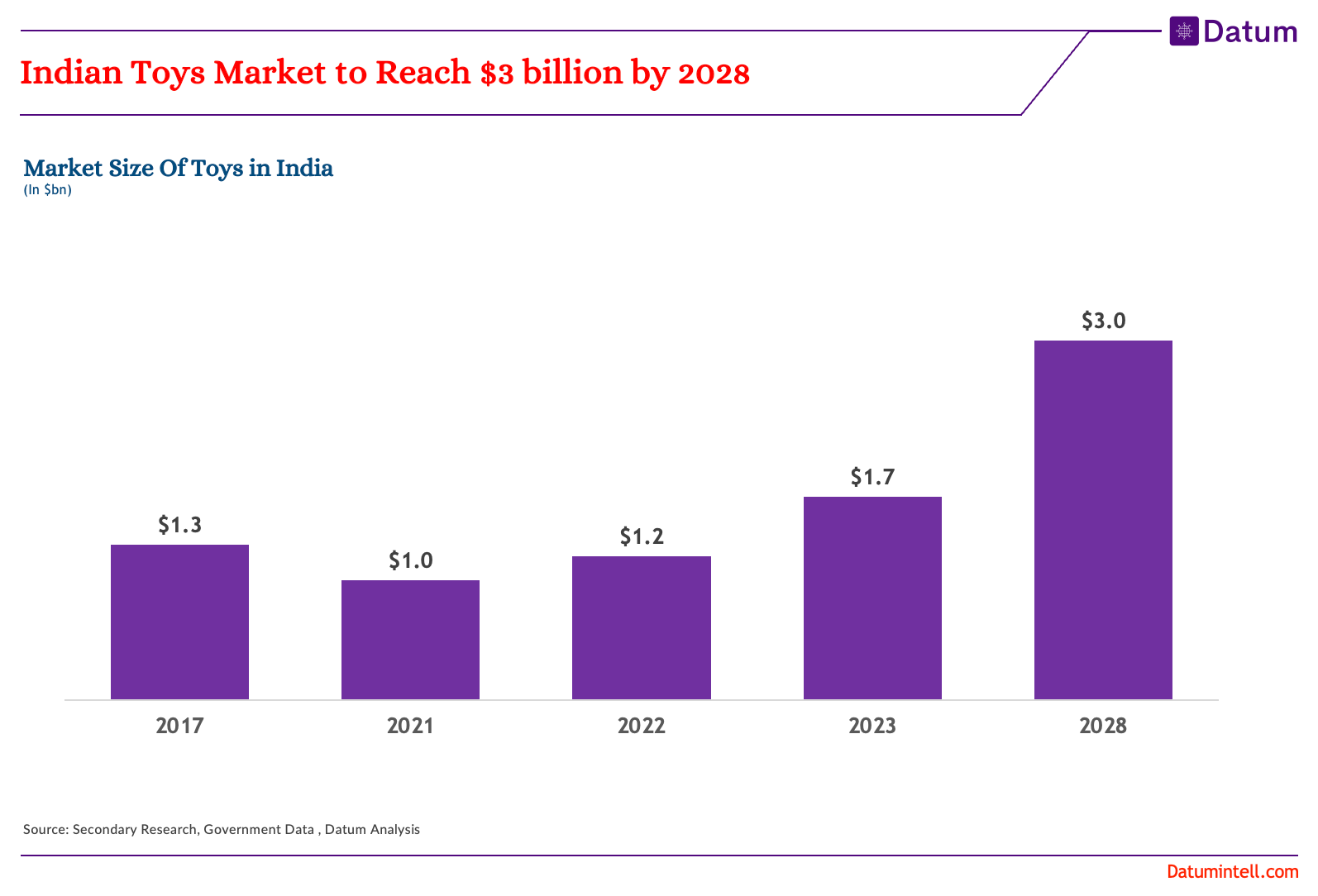

The Indian toy industry is poised for robust growth in the coming years, with the domestic market expected to reach an estimated value of $3 billion by 2028. As one of the fastest growing toy markets globally, India is projected to expand at over 15% CAGR fueled by improving economic conditions, favorable demographics, and government initiatives supporting domestic manufacturing.

India has one of the lowest per capita spends on toys and games globally, with estimates pegging the average annual spend at just $3 per child on toys.

This compares unfavorably to over $100 spend per child in developed markets like the US and UK annually. The low toy spend is attributed to factors like lower disposable incomes and traditional toys still dominating playtime for most Indian children. Accessibility is also a constraint as organized retail reaches only a fraction of the vast population. However, India's per child toy expenditure is projected to rise steadily with a growing middle class and youth demographics.

India's large youth population and increasing disposable incomes in urban and rural areas alike are key drivers spurring toy demand. The market is also shifting towards more educational and tech-based toys from traditional products. Backed by policies like the National Toy Action Plan, indigenous toy brands see strong upside potential despite stiff competition from established multinationals.

With only 2% of India's population currently using branded, high-quality toys, substantial room remains for market penetration and revenue growth.

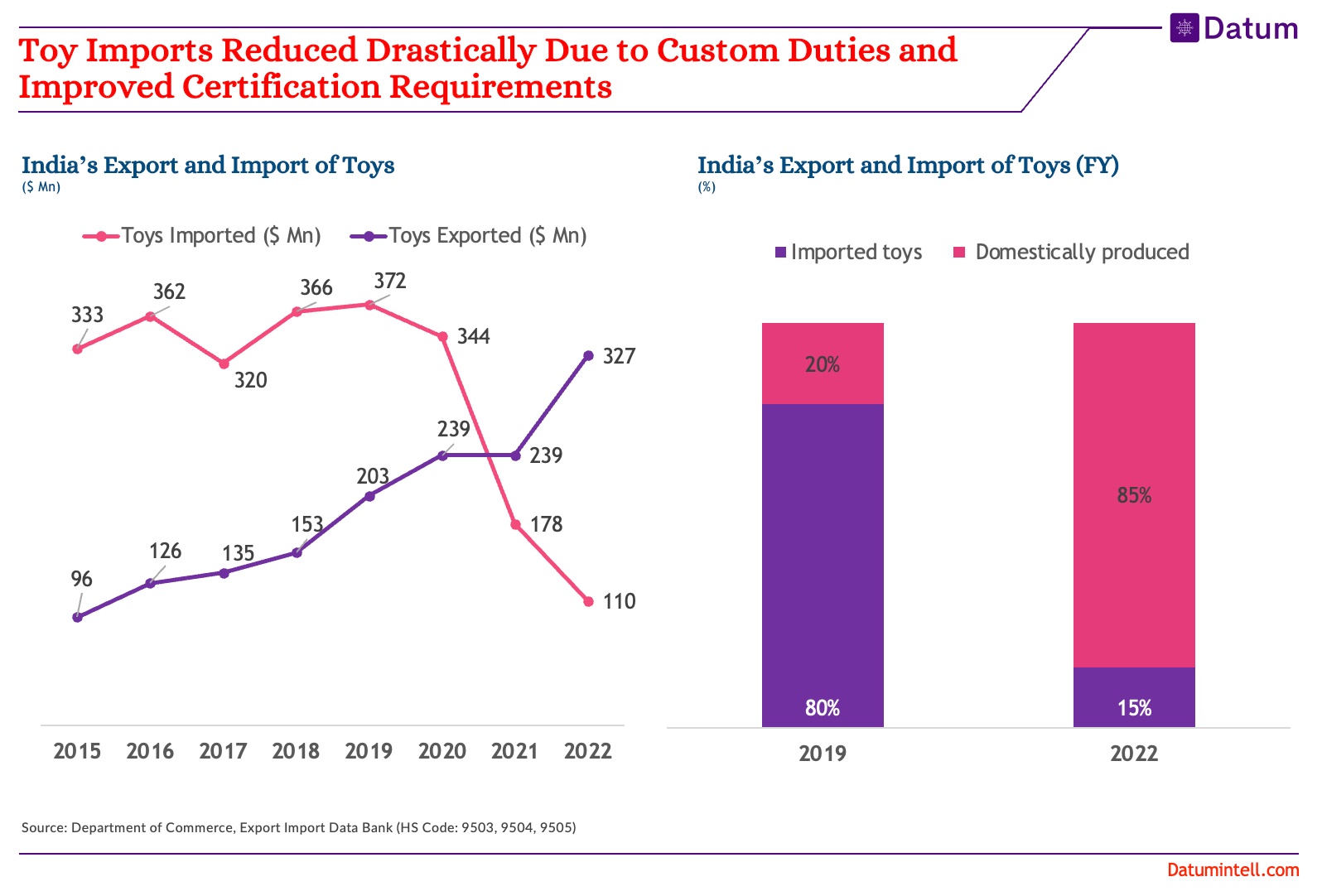

Stricter Regulations Sharply Curtail Toy Import

measures like increased custom duties and more stringent safety certification norms. In 2020, toy imports dropped by 70% driven largely by hikes in import duties on toys from 20% to 60% as part of Prime Minister Modi's vocal for local initiative. Tighter quality control and testing requirements for chemical safety have also deterred imports, especially from major supplying countries like China. The Indian government recently mandated additional safety checks and quality certificates including ISO certification for imported toys.

The government has approved eight toy manufacturing clusters at a cost of INR 2,300 crores to boost India’s traditional toy industry. Three out of the eight clusters are in Madhya Pradesh, two in Rajasthan and one each in Karnataka, Uttar Pradesh and Tamil Nadu.

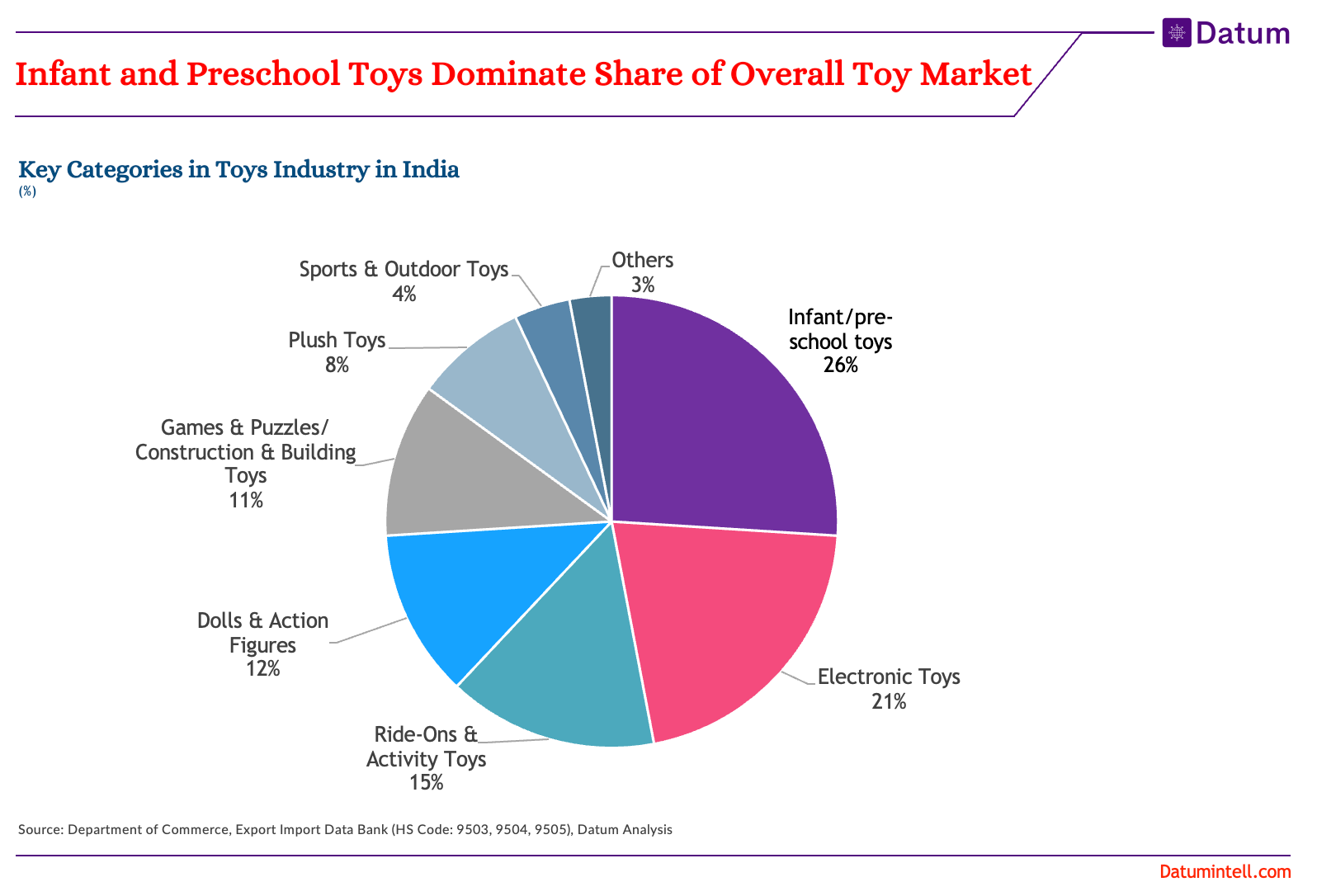

Toys for Babies and Young Kids Account for Largest Segment of Toy Industry

The infant and preschool segment, covering toys for children under the age of 5, accounts for the largest portion of overall toy industry revenues in India.

Infant/pre schools toys accounts for 26% of the toys in India.

Key products driving this dominant category include activity toys, plush animals, vehicles, dolls, and infant development toys. The outsized contribution of infant/preschool toys reflects the importance of playtime for early development and high demand for toys facilitating learning and motor skills. Parents are also more willing to spend heavily on young children’s toys. . Toy companies continue emphasizing infant/preschool given the segment’s scale and loyal consumer base. Domestic brands also see major room to expand share in this critical toy category, especially educational toys.

With over 40% of India's population under age 20, the long-term potential for toy companies is substantial. But affordability remains a key consideration as parents have many competing priorities. Capturing wider market share will depend on increasing toy awareness and availability while tailoring price-points and payment options for the mass market. If rising toy spend can match India's demographic upside, the industry sees immense room for growth.