Table of Contents

Goldman Sachs Research expects several tailwinds to global growth in 2024, including strong real household income growth.

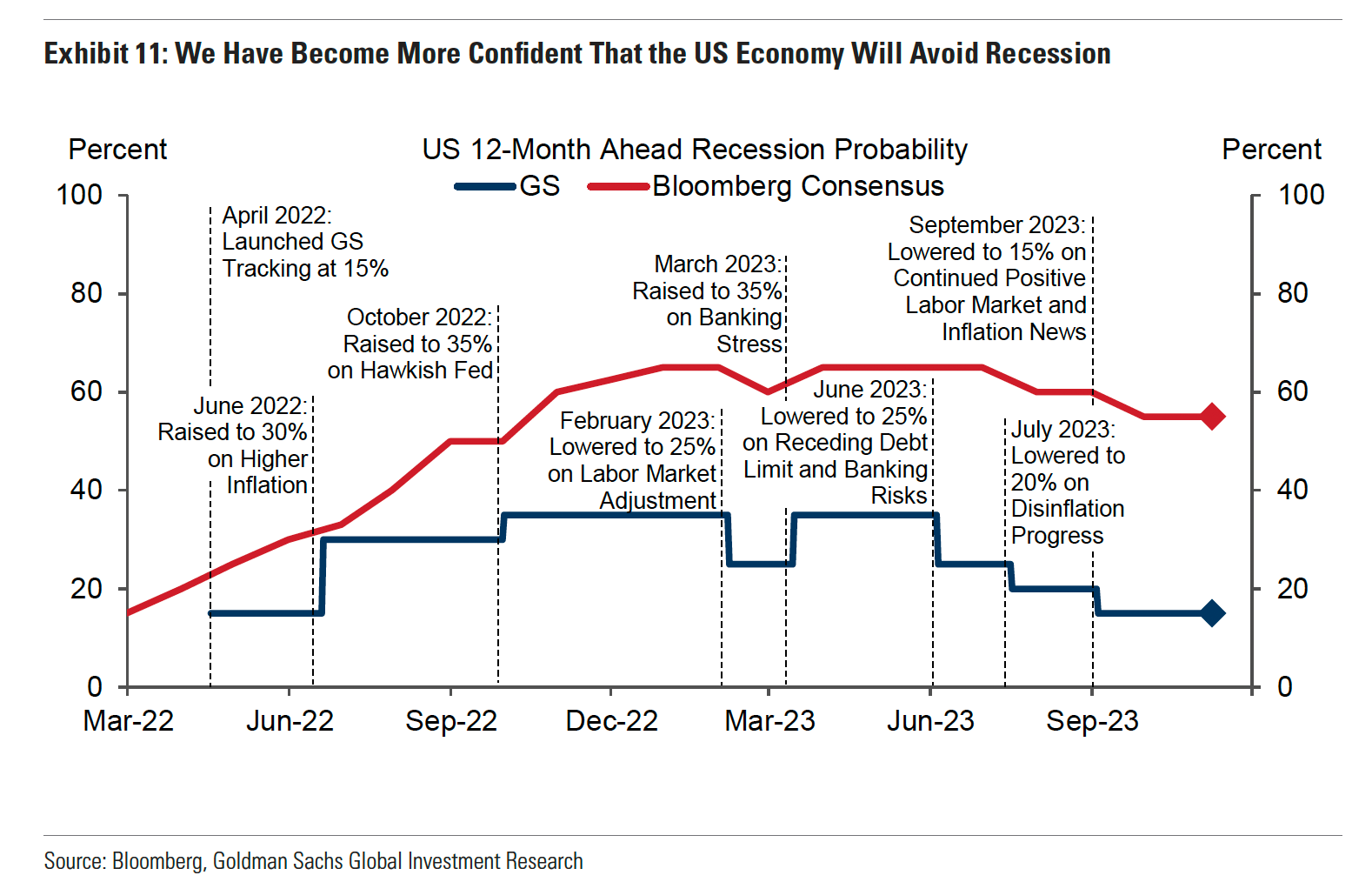

US will Avoid Recession in 2024

While the US economy has shown impressive growth in the past year, the specter of recession looms large. The median forecaster predicts a 50% chance of a recession starting within the next 12 months. This represents a modest decline from the 65% probability predicted in late 2022, but it remains significantly higher than Goldman Sach's forecast of 15%.

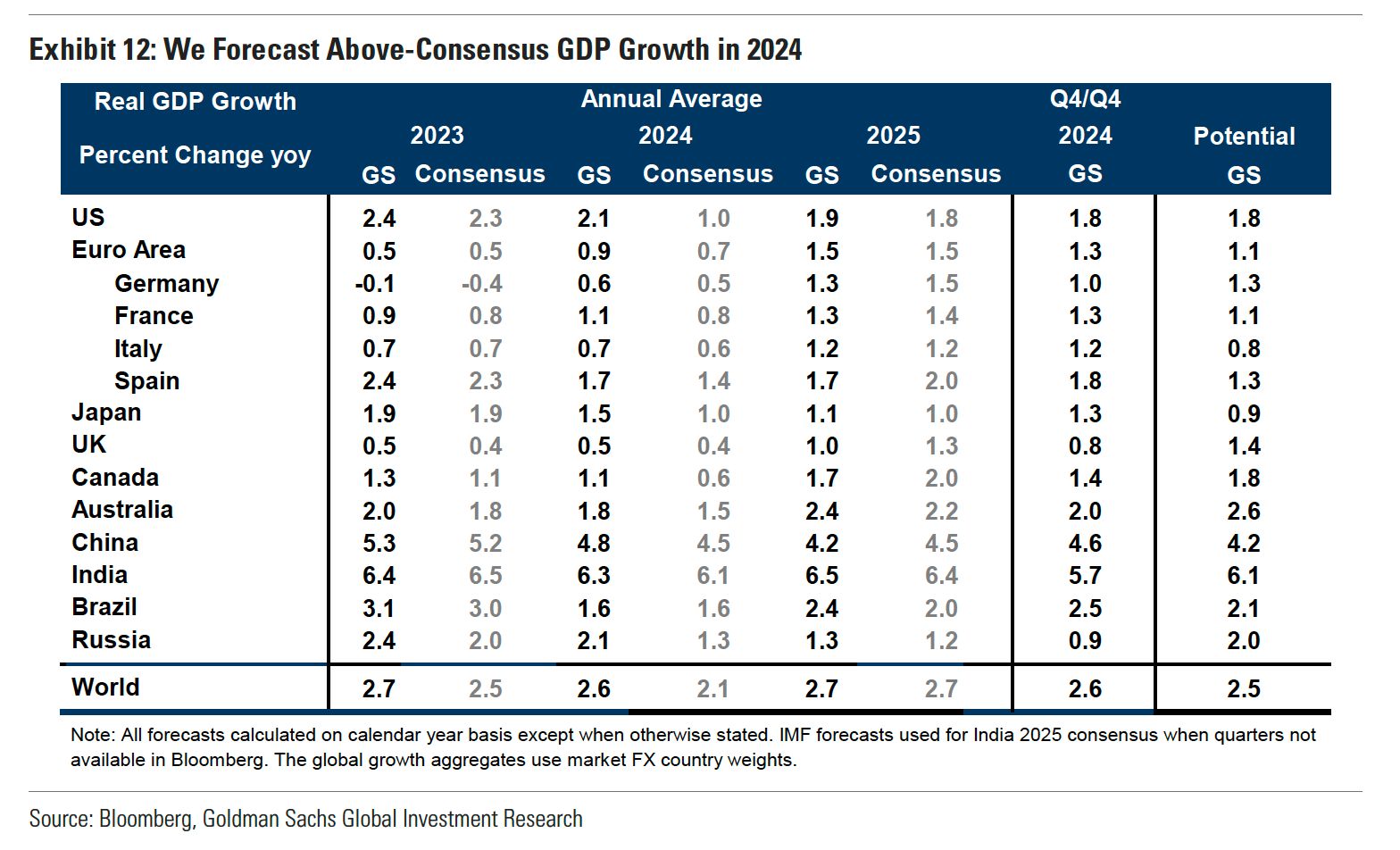

Goldman forecast 2.6% global growth in 2024 on an annual average basis

Goldman Sach's forecasts call for US growth to again outpace its DM peers, with country-level forecasts implying 1.1pp outperformance (vs. consensus) in the US, 0.5pp in Japan, 0.5pp in Canada, 0.3pp in China, 0.3pp in Australia, and 0.2pp in the Euro area.

Reasons for Optimism on Growth

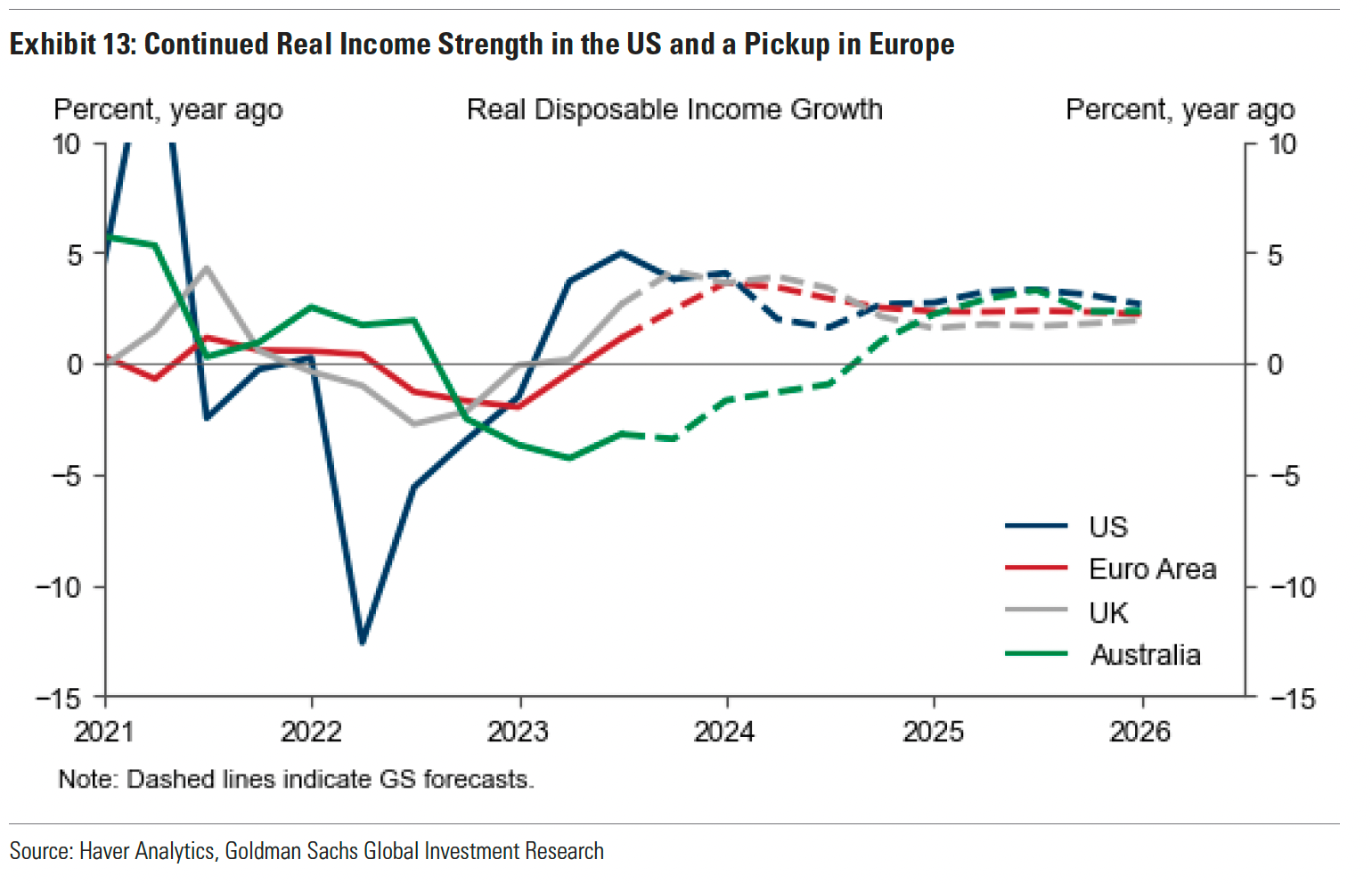

Growth in Real Disposable Income

While the exceptional 4% US real income growth experienced in 2023 is expected to slow to 2¾% in 2024, this remains sufficient to underpin consumption and GDP growth at or exceeding 2%. Meanwhile, the Eurozone and UK are projected to see a significant acceleration in real income growth, reaching around 2% by year-end 2024. This positive development is attributed to the gradual fading of the Russian gas shock that had previously impacted these economies.

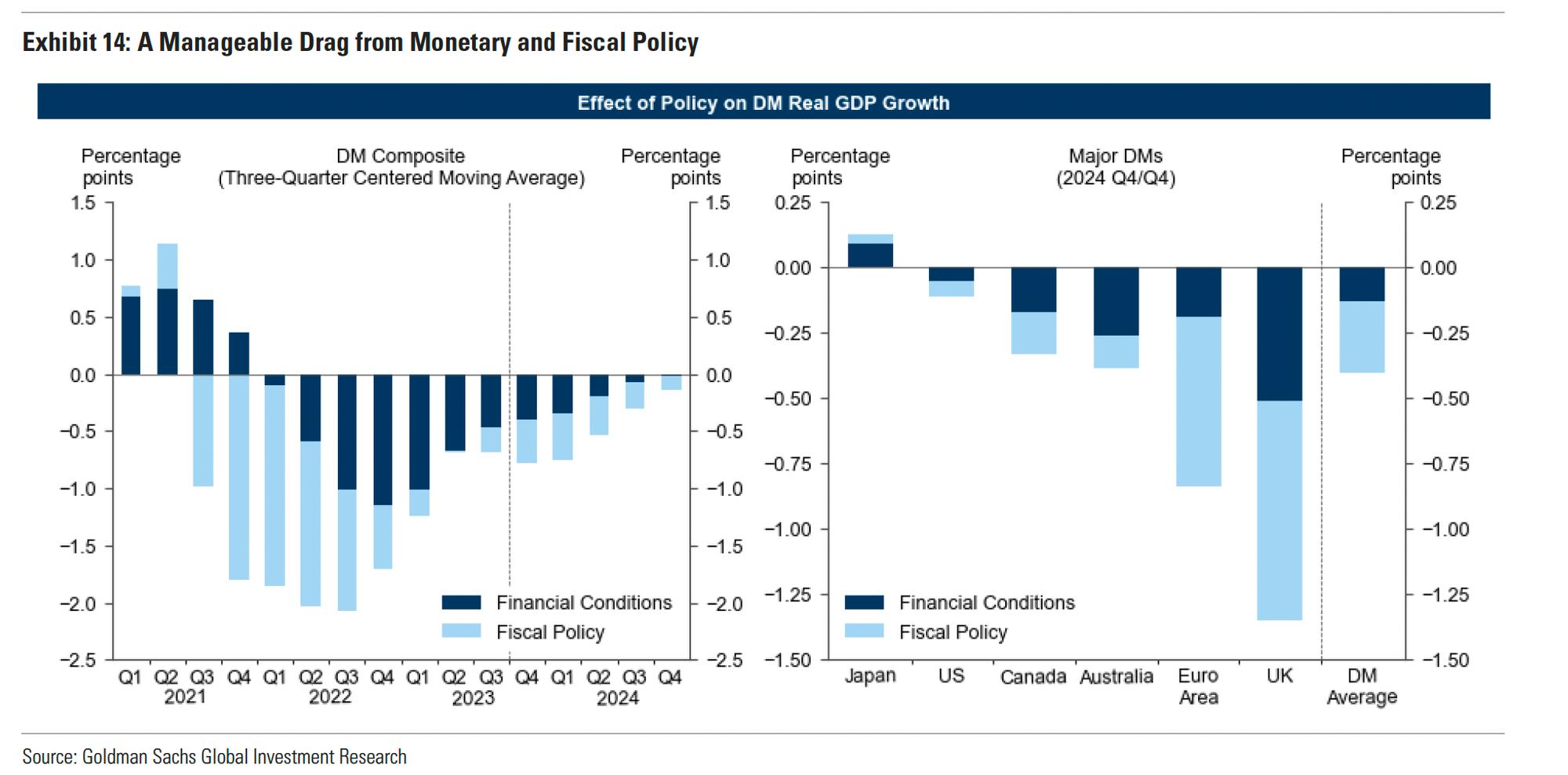

Smaller Drag from Tighter Financial Conditions in 2024

Goldman Sach's estimate that fiscal policy will subtract 0.2pp from global growth in 2024, with only a slightly larger 0.3pp drag in DMs. The drag is likely to be small in the US because most pandemic-related stimulus has already ended and fiscal consolidation is unlikely to start in a presidential election year. It should be larger in the UK (where an election also looms but the energy crisis support will nevertheless roll off) and in Southern Europe (which will likely see the end of energy-related payments and a pullback in EU Recovery Fund spending).

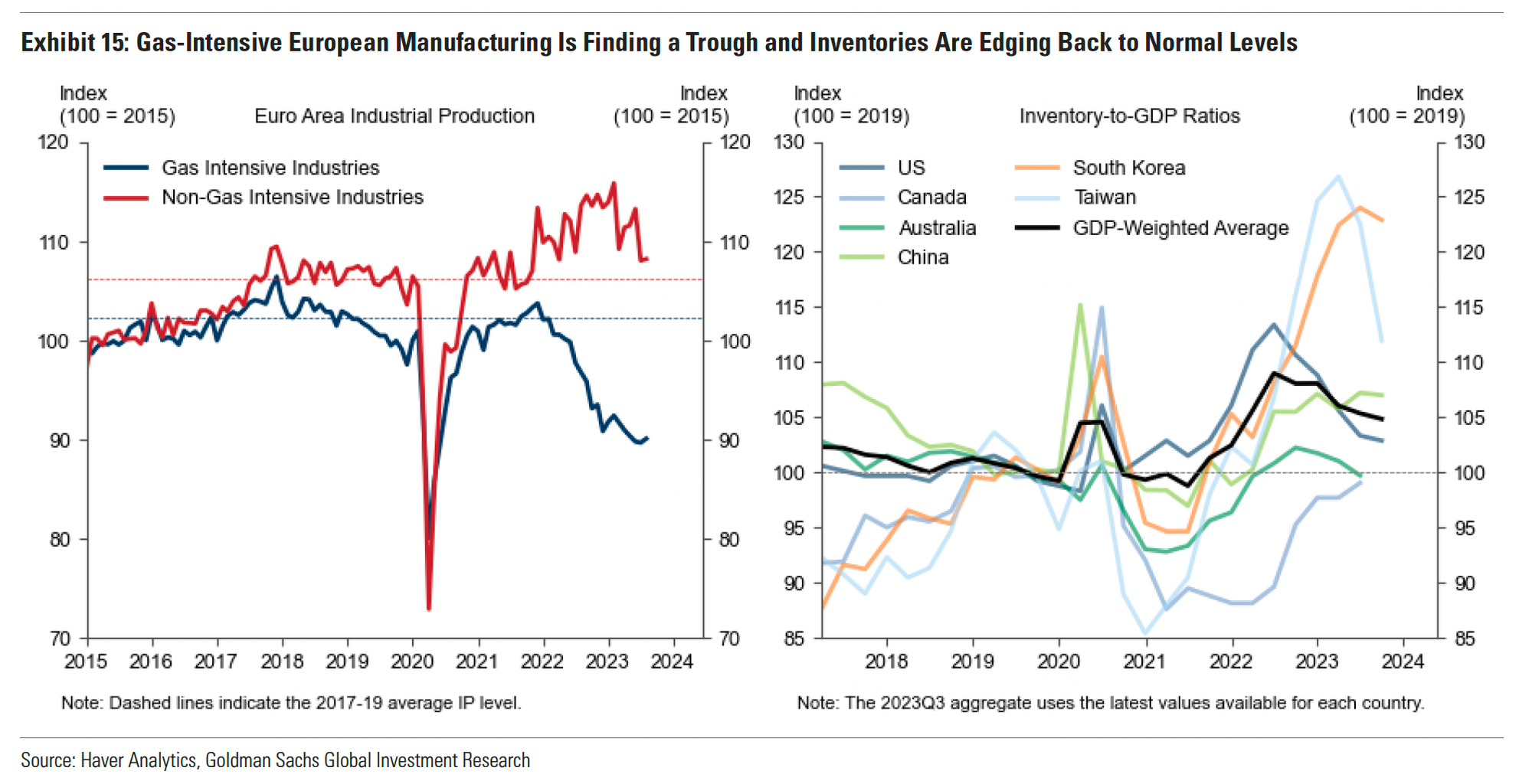

Recovery of Manufacturing in 2024

he sluggish industrial activity witnessed this year was a result of a confluence of unique challenges:

- Shifting Spending: Consumers prioritized services over goods, rebalancing their spending patterns.

- European Energy Crisis: Energy disruptions in Europe impacted production activity.

- Inventory Correction: Businesses underwent an inventory destocking cycle, adjusting for an overbuild in 2022.

- China's Manufacturing Stumble: China's manufacturing sector experienced a weaker-than-expected rebound.

However, the outlook for 2024 is more optimistic as these headwinds are expected to gradually dissipate:

- Spending Normalization: Consumer spending patterns are expected to stabilize, with a more balanced allocation between goods and services.

- European Production Trough: Gas-intensive European production is anticipated to reach a nadir, paving the way for recovery.

- Inventory Stabilization: Inventories are projected to stabilize relative to GDP, prompting a return to normal manufacturing activity.

These positive factors are poised to fuel a robust recovery in the industrial sector, propelling it back toward its pre-headwind trend.

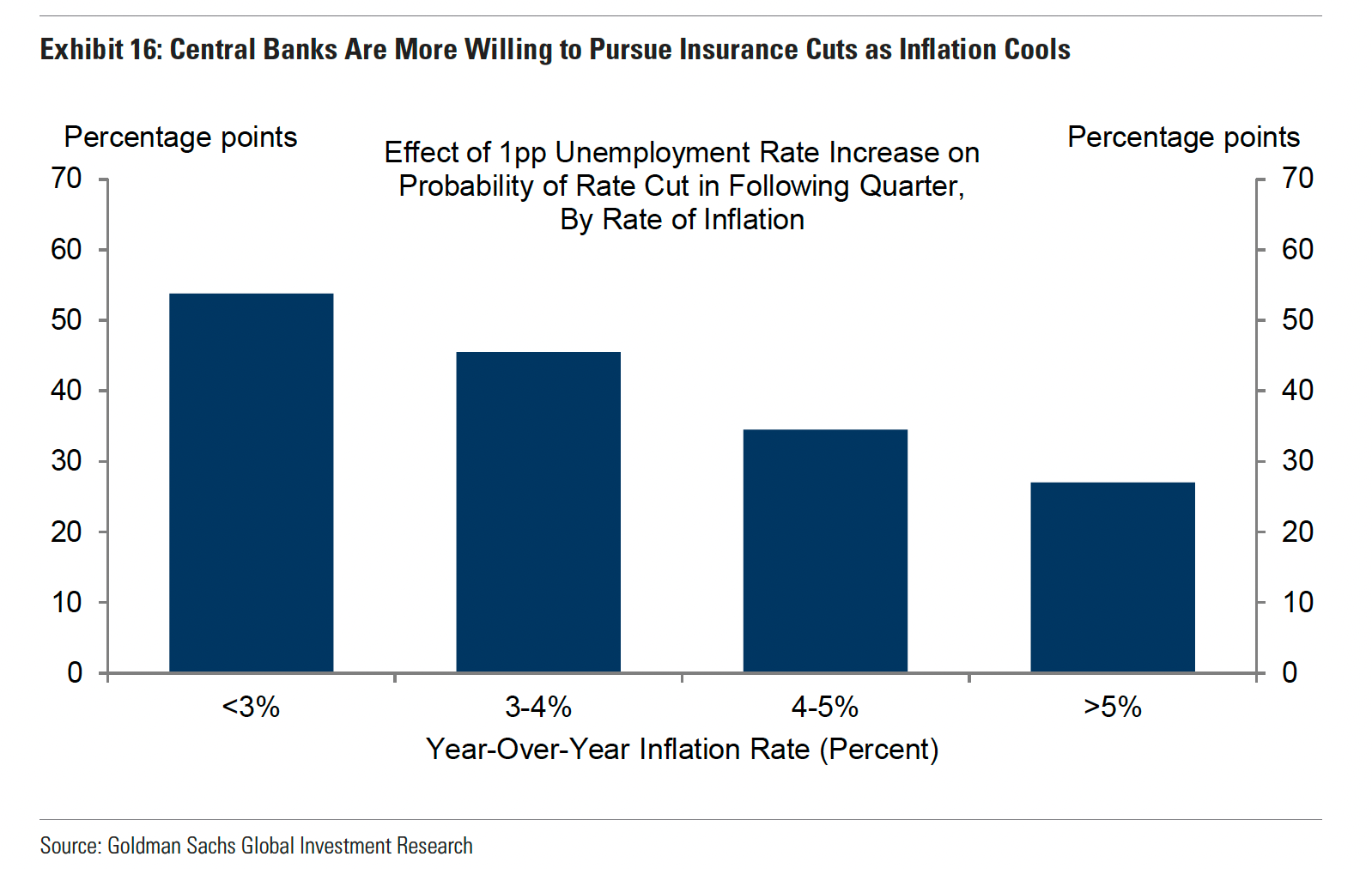

Central Banks Are More Willing to Cut Rates to Avoid Recession

Central banks are not willing to cause a recession just to bring down inflation. This is good news for the economy because it means they will try to keep things moving forward. Several emerging markets, like Brazil and Poland, have already started lowering their interest rates. This is because their inflation rates are coming down and they want to help their economies grow.

Developed markets might not lower their interest rates as quickly, but they will likely do so if the economy starts to slow down. This is because they want to avoid a recession. The fact that central banks are now more focused on avoiding recessions is a good sign for the economy. It means they are willing to do what it takes to keep things going strong.

Growth Coming Back to China

China's economic recovery in 2023 fell short of expectations, despite exceeding forecasts made last fall. The ongoing slowdown in the housing market continues to weigh heavily on growth. However, recent months have seen a modest improvement, and further government stimulus is expected in the near future.

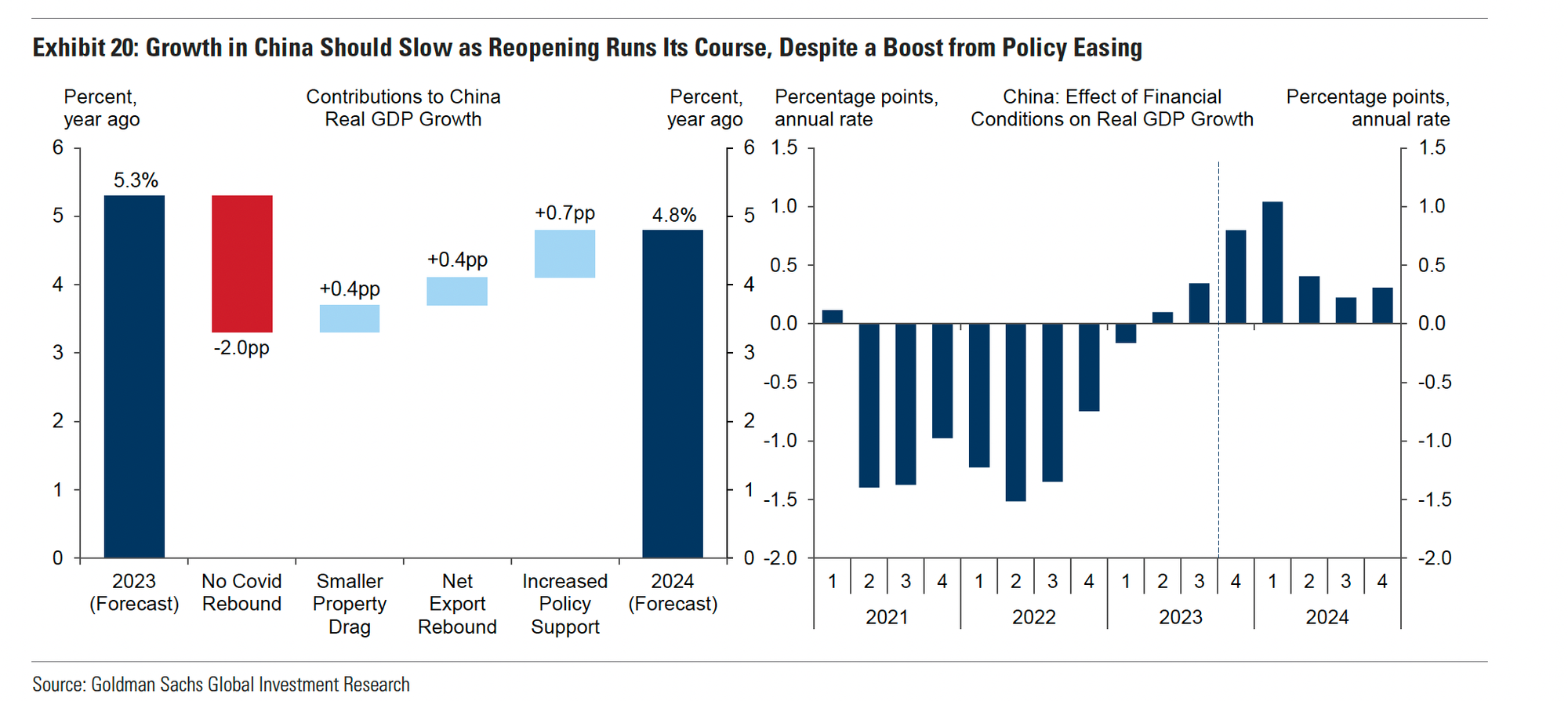

Looking ahead to 2024, China's GDP growth is expected to slow to 4.8%. This is due to two main factors:

- Fading Reopening Benefits: The initial boost provided by China's reopening is expected to diminish in 2024.

- Housing Market Drag: While slightly less severe than in 2023, the housing market slowdown is still expected to dampen overall growth.

However, several positive factors will help mitigate the slowdown:

- Modest Trade Rebound: Global trade, which has been sluggish in recent months, is expected to experience a moderate rebound in 2024.

- Additional Policy Support: The Chinese government is expected to implement further economic stimulus measures, particularly in the first half of the year.

Overall, while China's economic recovery faces challenges in 2024, the expected decline in growth is likely to be modest thanks to supportive measures from the government and a rebound in global trade.

While Goldman's 2024 growth forecast is slightly above the consensus, they see a more difficult long-term picture for the Chinese economy due to several factors:

1. Lingering Property Downturn: The ongoing slowdown in the property market is likely to persist, potentially leading to self-fulfilling negativity and further dampening economic activity.

2. Demographic Headwinds: China's shrinking working-age population presents a significant challenge, requiring a fundamental shift in its economic model for long-term sustainability.

3. Diversification of Global Value Chains: The trend of global value chains diversifying away from China and towards other countries is likely to continue, limiting export-driven growth.

These factors are expected to contribute to a gradual decline in China's trend rate of growth, reaching just 3% within a decade – less than half the pre-COVID norm.