Table of Contents

Nykaa reported Q2 FY24 Results yesterday.

- Nykaa reported a 50% year-on-year increase in net profit to Rs 7.8 crore for the second quarter of FY23, largely attributed to robust demand growth in its fashion segment

- Its revenue from operations rose 22% to Rs 1,507 crore compared to the year-ago period.

Despite robust fashion sales growth, Nykaa's spending to boost its fashion presence and assortment has been a key factor dragging on overall profitability.

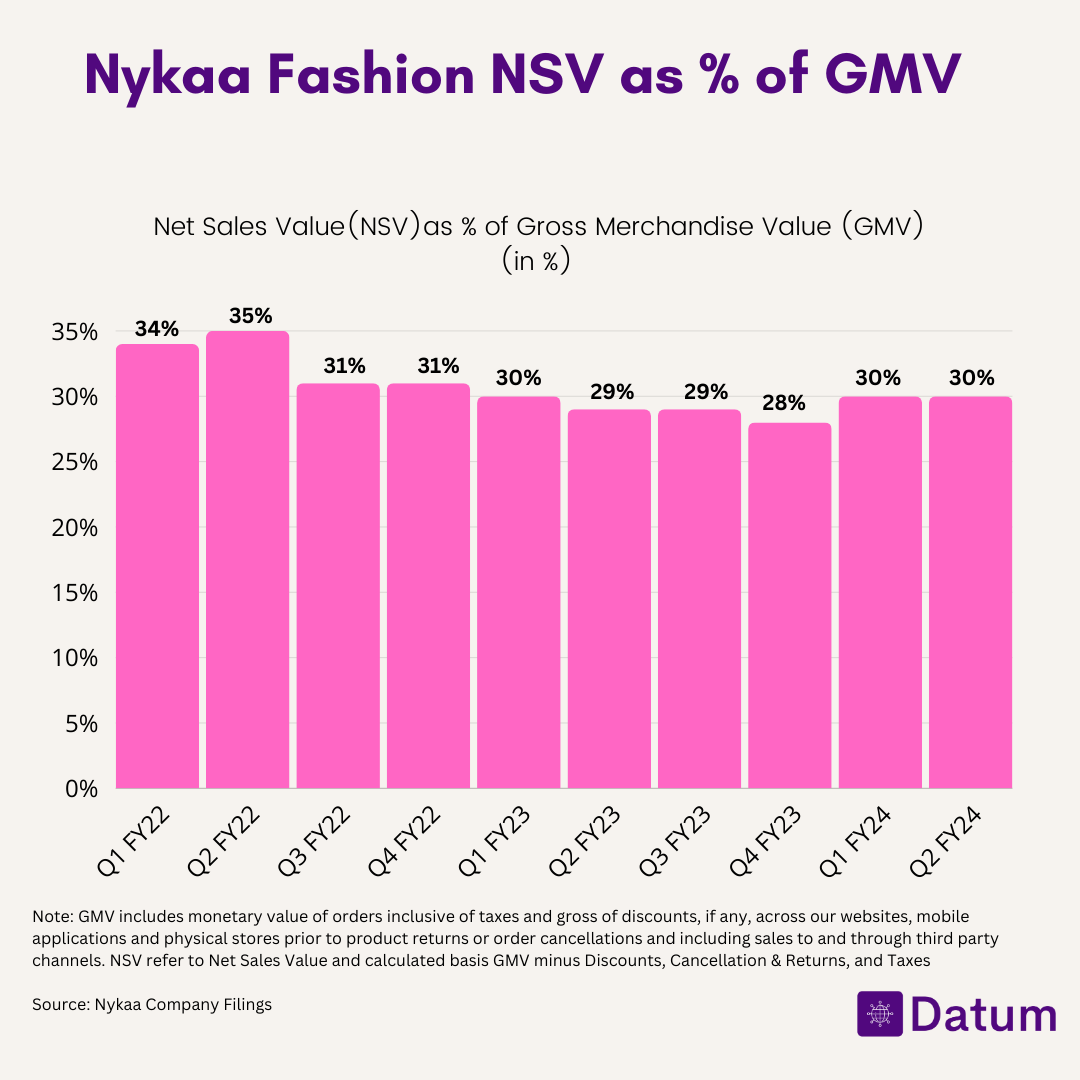

Net sales value which is defined as Net Sales Value calculated basis GMV minus discounts, cancellations, returns and taxes is the number which you have to look while digging deep into Nykaa Fashion numbers.

Nykaa Fashion has consistently trailed the company's Beauty and Personal Care business in profitability over the past two years. Across the last 10 quarters, Nykaa Fashion's NSV as a percentage of GMV has remained range-bound around 30%. In contrast, the NSV percentage for Nykaa's Beauty and Personal Care segment has been significantly higher at approximately 58% over the same period. The nearly 30 percentage point gap highlights that profit margins for Nykaa's fashion vertical have plateaued at less than half that of beauty over more than two years. With fashion NSV stuck at 30% of GMV, it continues to face profitability challenges compared to Nykaa's more established beauty category.

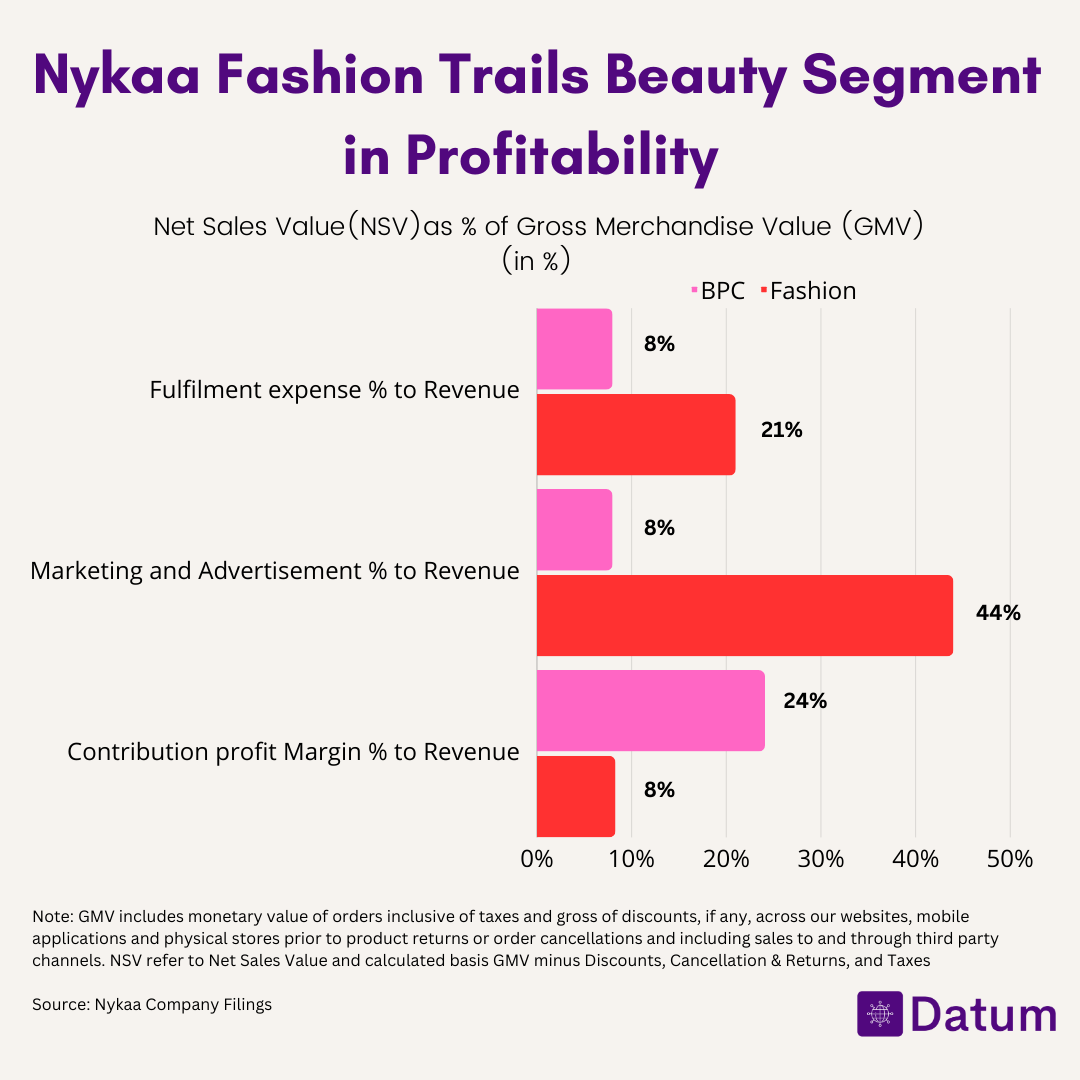

When we compare NSV as % of revenue for Fashion and beauty and personal care for Nykaa the difference is clearly visible in terms of the profitability.

What is the impact of 30% NSV as % of GMV

- High rate of return. Return rates in fashion are around 40% but for Nykaa looks like it is more than 40% which will keep profitability under consistent pressure

- High cost of Fulfilment Expenses. Nykaa Fashion shoulders markedly higher fulfillment expenses compared to the company's Beauty segment. Nykaa Fashion has a fulfillment cost to revenue ratio of 21%, over twice as high as the 8% ratio for Beauty. The higher costs for Nykaa Fashion stem from customers ordering more fashion products, leading to increased shipping, returns, and packaging expenses. Additionally, the wear and tear of fashion merchandise during shipping and try-ons further drives up fulfillment spends. As Nykaa Fashion customers purchase more items and return a higher proportion, it weighs on profitability due to elevated logistics and reverse logistics cost

- Low Contribution to Contribution Margin. Nykaa fashion has a low contribution margin % at 8% as compare to 24% for beauty.

- The Growth is on Fashion is Not coming Cheap. Nykaa Fashion allocates a significantly higher 44% of revenue towards marketing and advertising compared to just 8% for Nykaa Beauty. This disproportionately large marketing spend is problematic as the fashion category's growth seems contingent on excessive promotions. Additionally, a large portion of the revenue is later expended on fulfillment costs and returns due to low retention of fashion buyers. With fulfillment and returns eating into a major share of earnings, the high marketing costs appear inefficient.

With the growth in beauty and personal care segment slowing down the consistent failure of Nykaa fashion to increase profitability is a key cause of concern for Nykaa.