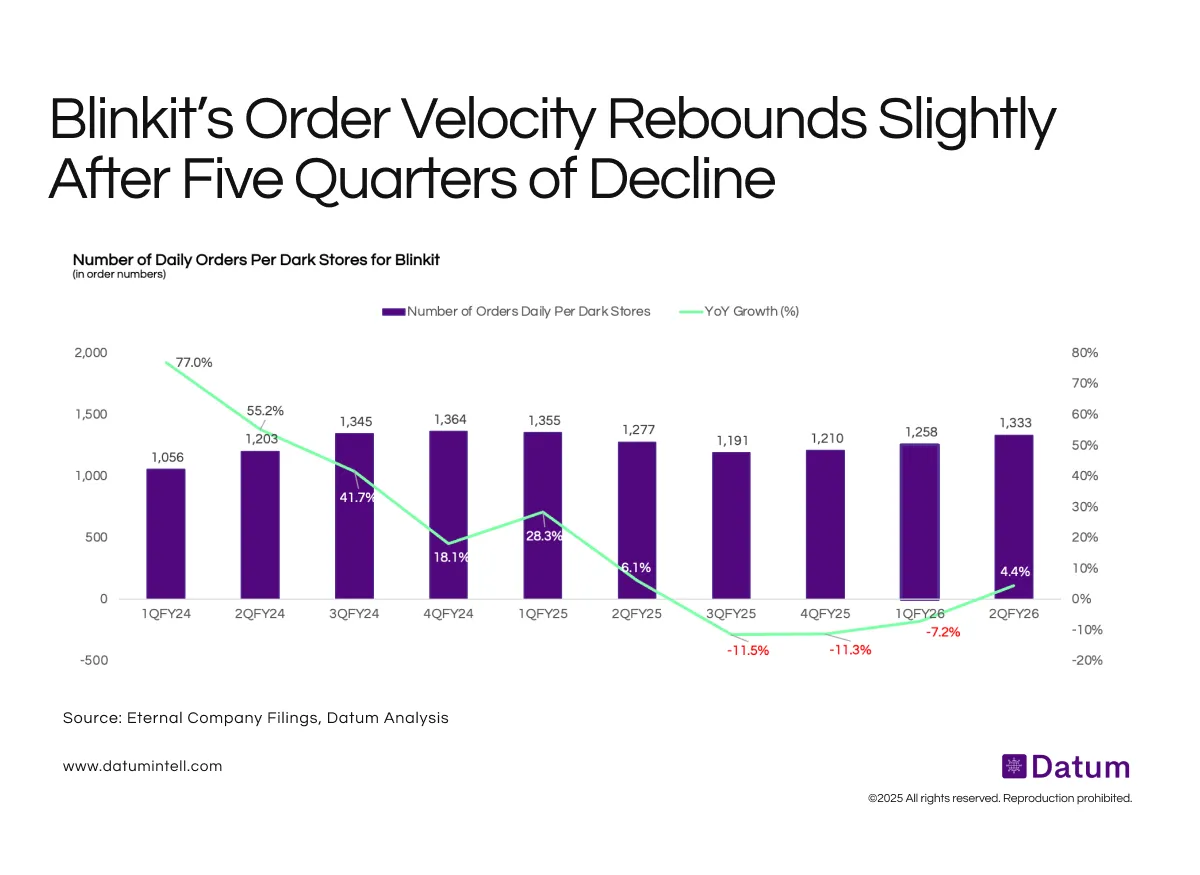

Blinkit’s Per-Store Orders Rebound, Marking the End of a Five-Quarter Dip

Blinkit’s per-store order volumes are showing early signs of recovery after five quarters of contraction- daily orders per dark store rose 4% YoY in Q2 FY26, pointing toward stabilization in operational efficiency.