Table of Contents

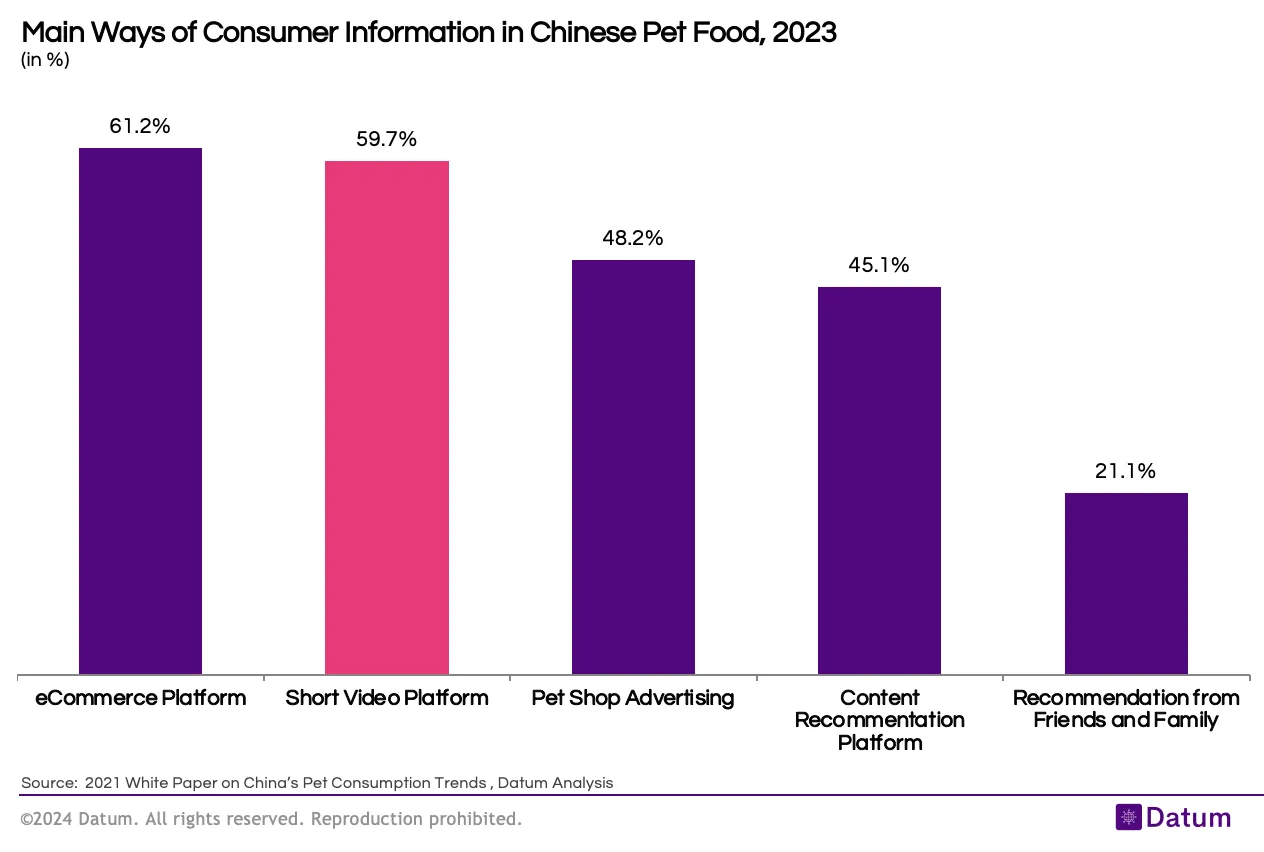

The landscape of consumer information for pet food in China is rapidly evolving, with digital platforms taking center stage in 2023. Based on the white paper on China's Pet Consumption Trends, short video platforms have emerged as a dominant force, rivaling traditional e-commerce in influencing consumer choices.

- E-commerce platforms remain the primary source of information, with 61.2% of consumers relying on them for pet food details.

- Short video platforms, including TikTok, are a close second at 59.7%, showcasing their growing influence.

- Pet shop advertising at 48.2% and content recommendation platforms with 45.1% still play significant roles.

- Surprisingly, recommendations from friends and family at 21.1% have less impact than digital sources.

The rise of short-form video platforms, particularly TikTok, is reshaping the online shopping experience for pet owners. These platforms are not just entertainment hubs but have become essential tools for brands to engage consumers and drive purchasing decisions in the digital retail space.

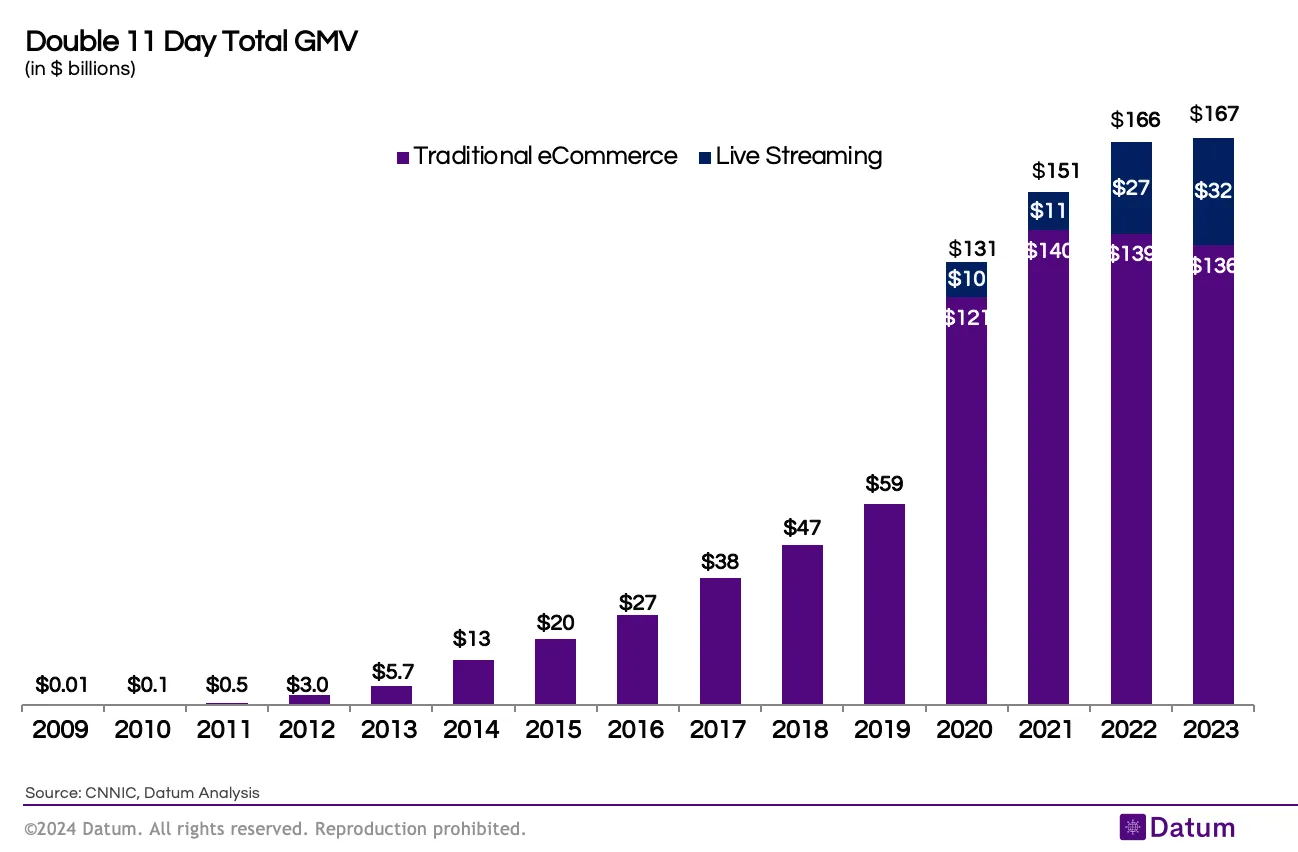

This trend aligns with the broader shifts seen in China's e-commerce landscape, exemplified by the Double 11 Day (Singles' Day) shopping festival.

In 2023, while traditional e-commerce maintained a dominant 81% share of the $167 billion in sales, there was a notable 2.5% decline. Concurrently, live streaming e-commerce, though experiencing slower growth compared to 2022, still increased by 17.8% to reach $32 billion.

The pet food market's reliance on digital platforms reflects a larger demographic trend in China's pet ownership. According to a consumption white paper, pet keeping is predominantly driven by young, educated consumers. Almost 90% of pet owners hold a university degree, despite only 23.61% of the overall population having higher education.

This shift towards digital platforms for pet-related information and purchases is part of a broader trend in Chinese consumer behaviour. During the 2023 Double 11 Day, shoppers demonstrated a polarization in spending, focusing on essential products like pet food while reducing expenditures on discretionary items.

As the pet food market in China continues to grow, brands must adapt to these new digital realities. Integrating short videos and live streaming into marketing strategies is no longer optional but essential for capturing the attention of the modern Chinese pet owner. This digital transformation in consumer information sources will likely have lasting effects on how pet food brands engage with their audience and drive sales in the world's largest e-commerce market."