Table of Contents

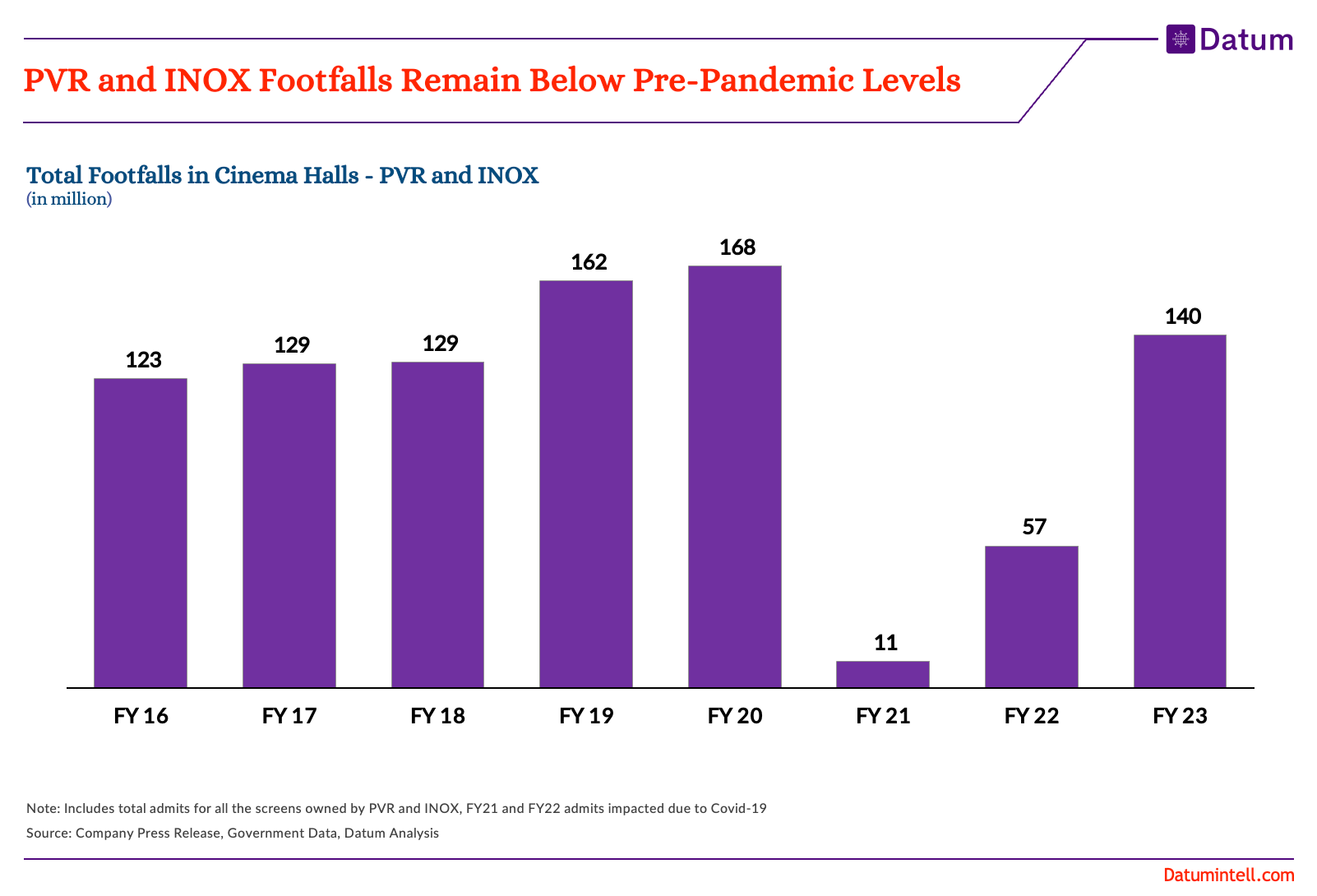

After the merger in 2023 PVR and INOX, continue to face challenges in recovering footfalls to pre-Covid levels despite the resumption of operations post lockdowns.

The uneven nature of film releases, growing threat from OTT platforms, inflationary pressures on discretionary spending, and repeated pandemic waves have all contributed to the slower-than-expected recovery in plex footfalls.

PVR and INOX reported total footfalls of 140 million for FY23, representing an occupancy rate of 26.4%. This occupancy rate was lower than the 34.9% achieved in FY20 prior to the pandemic.

The recently launched PVR INOX Passport aims to boost weekday footfalls and increase occupancy rates, which have been ranging around 16-17% on weekdays.

Apart from this, the consolidation with the PVR-INOX merger proposal provides an opportunity to regain scale, optimize utilization, and drive growth in the long-term. Investments in premium formats like IMAX and 4DX can also boost footfalls. But plex operators need to undertake targeted strategies to rebuild movie-going habits among lapsed consumers in a rapidly evolving entertainment landscape.

Note: Data before FY 23 is the combined sum of reporting by PVR and INOX.