Table of Contents

The largest segment of India's $800 billion retail business is food. Online retailers have previously experimented with a variety of business models to enter this market, including, among others, scheduled delivery, 30-minute delivery, dark stores, collaborations with kirana stores, and the sale of private label products. The most recent model in the post-COVID era is quick commerce or 10-minute delivery. Zepto was the first in this market to offer speedy delivery, and others that followed it included Swiggy through Swiggy Instamart, Zoamto through the acquisition of Grofers and rebranding it as Blinkit, and Big Basket with the launch of BB Now.

Zepto raised $200 million in fresh funding at a valuation of $1.4 billion, making it the first startup in the country to cross the billion-dollar valuation mark in nearly a year. Here are some statistics pertaining to Quick Commerce in India in Q2 2023.

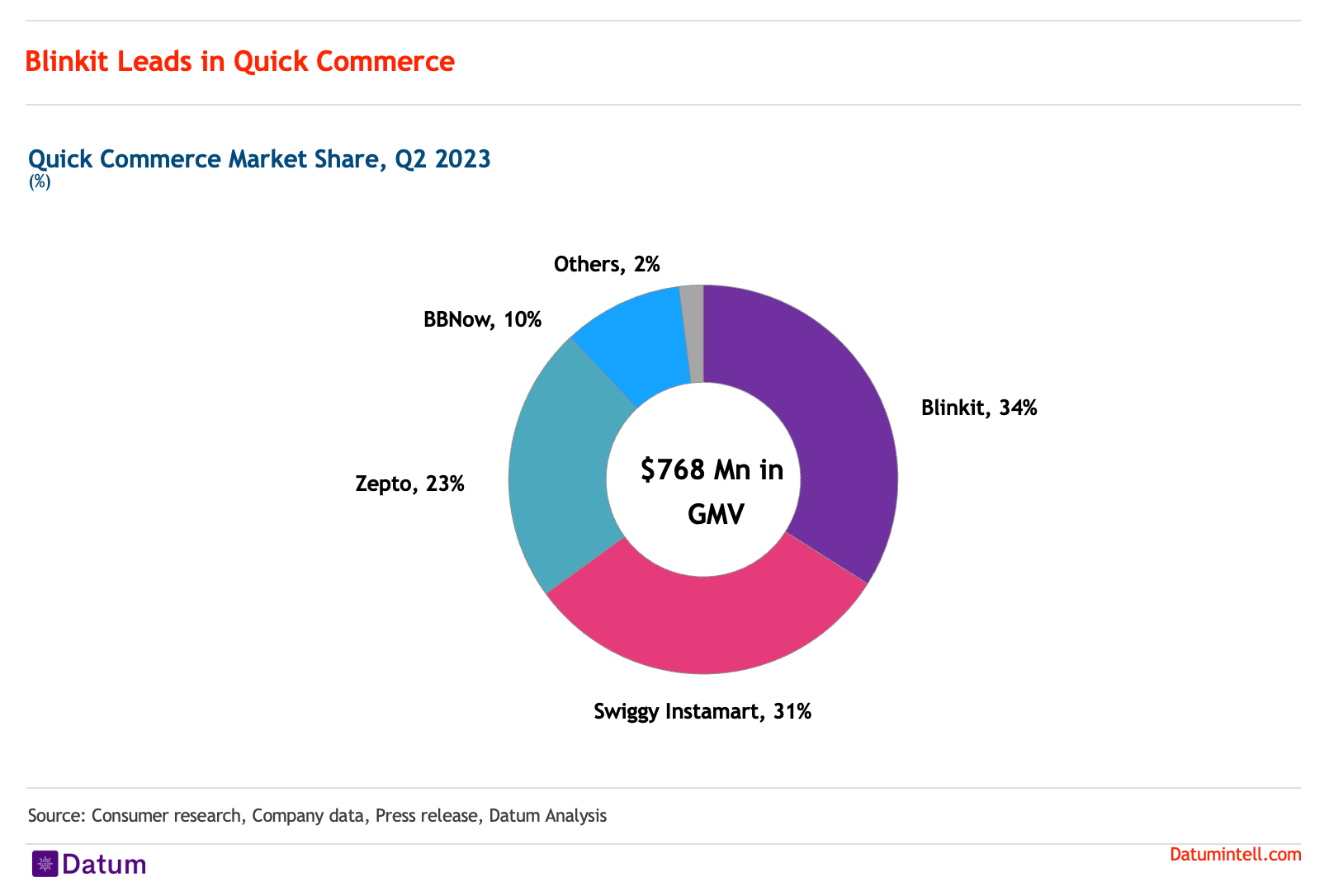

Blinkit Leads in Quick Commerce in Q2, 2023

Quick commerce players delivered goods worth $768 Mn in Q2 2023 lead by Blinkit which accounted for 34% of the market share. With a 31% market share, Swiggy Instamart comes in second to Blinkit. The advantages of being present in more cities and having an established user base for food delivery on these apps are shared by Blinkit and Swiggy Instamart. Third-placed Zepto has a 23% market share and is anticipated to grow it thanks to a recent funding round that will be used for growth.

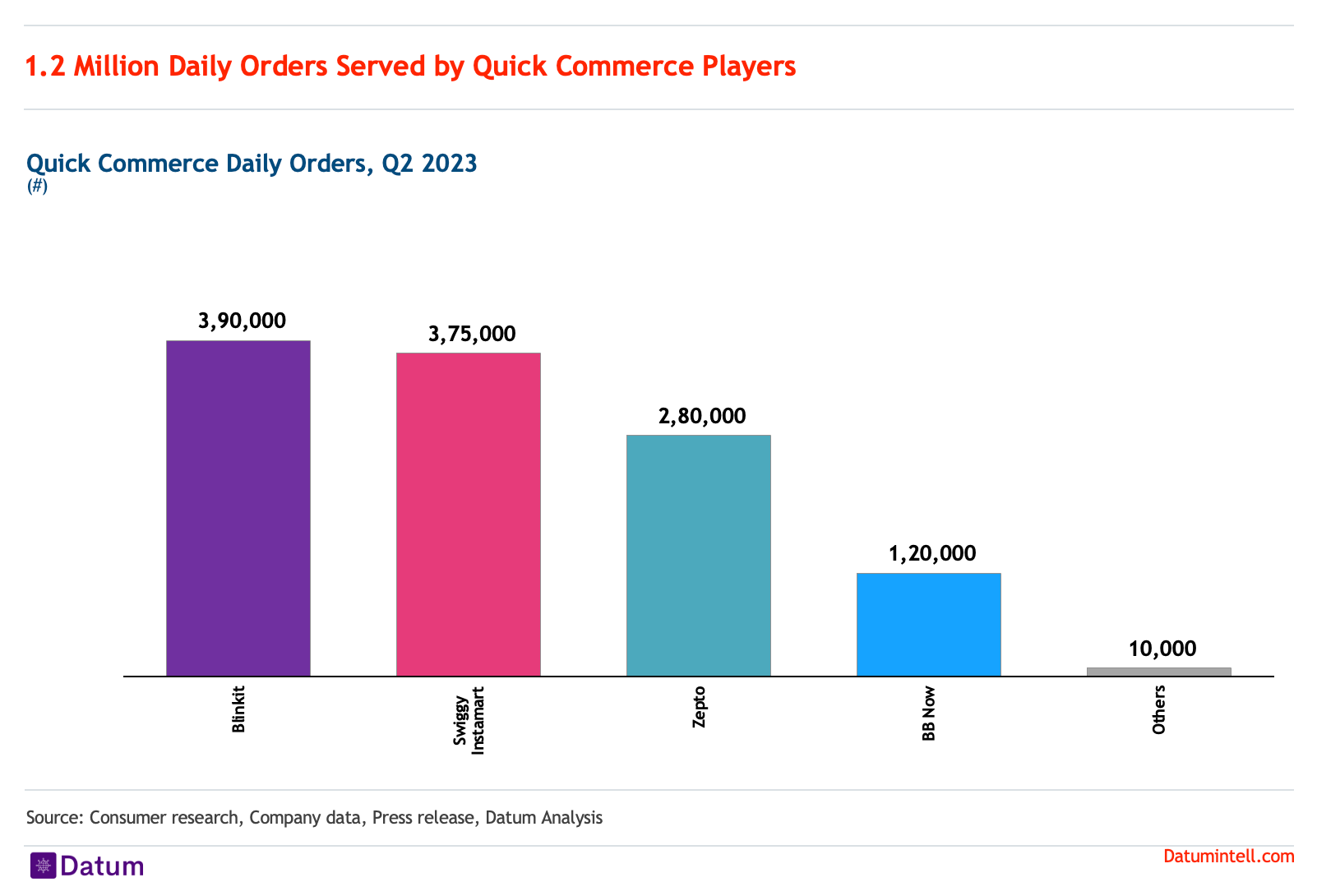

1.2 Million Daily orders served by Quick Commerce Players

Customers ordered roughly 1.2 million deliveries every day through Quick Commerce, with Blinkit topping the list in Q2 2023 with 390,000 daily orders, Swiggy Instamart second with 375,000, and Zepto third with 280,000. With over 120,000 daily orders, BBNow by BigBakset is still the fourth competitor and is unable to fully capitalise on their advantage in the online grocery industry.

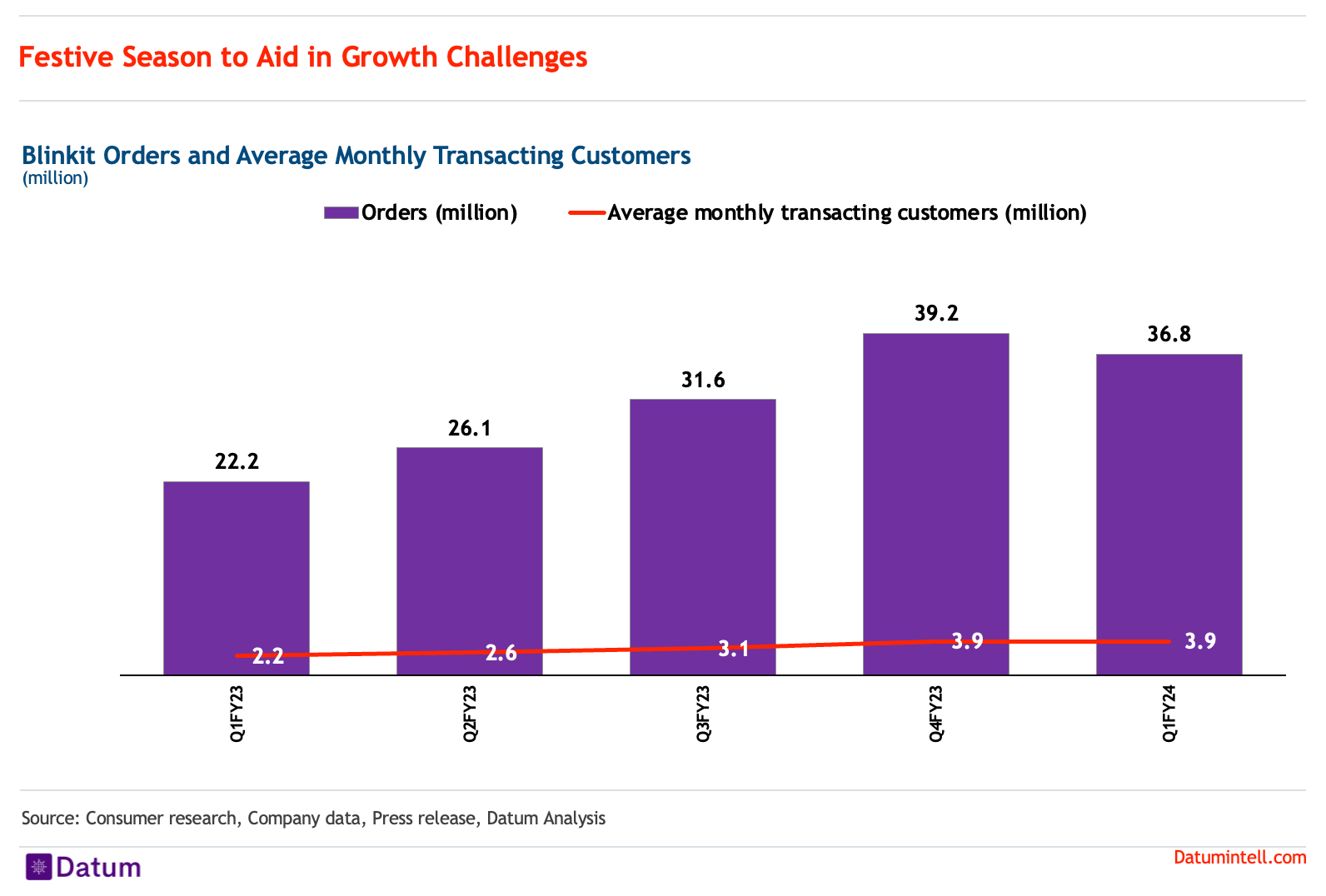

Festive Season to Aid in Growth Challenges

The number of orders and average monthly transactional orders on Blinkit are slowing down, but we anticipate a boost from the holiday season. Still the current size of the market is small for 4 big players to fight out. We expect more competition and discounting to acquire customers during the festive period.

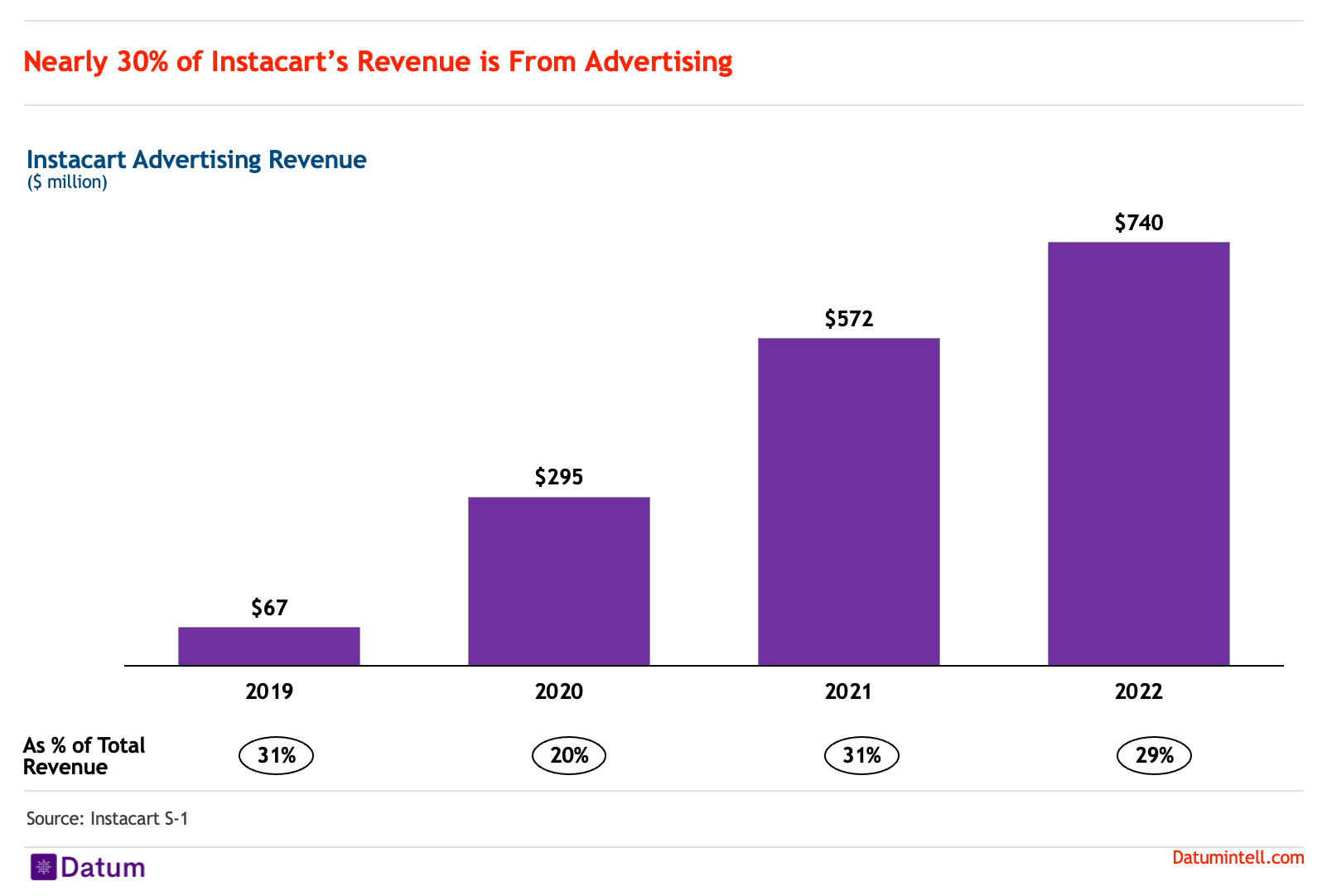

Follow Instacart - Advertising Key to Profitability

Advertising accounted for about 30% ($740 million) of Instacart's 2022 revenue, and Indian quick commerce rivals are attempting to mimic this by working with FMCG brands to improve their visibility to online grocery customers. However apart from the ad revenues Instacart’s growth is slowing down with grocery orders remained flat last year and customer acquisition cost increased rapidly— to $625 million in 2022 from $87 million in 2019. As a result, Instacart offers quick commerce players in India a business model to emulate, but a poor response to its IPO would have a big impact on future fund raising for Indian players.

Gross transaction value (GTV) — the measure of the total value of each sale — increased to $28.8 billion in 2022 from $5.1 billion in 2019. - Instacart

With an effective business strategy and the development of an ad revenue platform, Zepto hopes to become profitable in this model for online grocery delivery in India.

From just Rs 2 crore in July 2022, the company is now generating roughly Rs 10–12 crore in advertising revenue each month. - Moneycontrol

However, growth and scaling up is becoming an issue with business is still heavily reliant on existing stores to drive scale.

Zetpo said about 90-95 percent of its total sales came from existing stores while new ones contributed just 5-10 percent.