The rise of quick commerce in India has sparked a seismic shift in the way consumers shop for groceries, as quick commerce platforms mimic the convenience of local kirana stores while offering competitive pricing and rapid delivery options. In our recent report, we delve into the factors contributing to the meteoric rise of quick commerce, its impact on traditional kirana stores, and the changing preferences of Indian consumers.

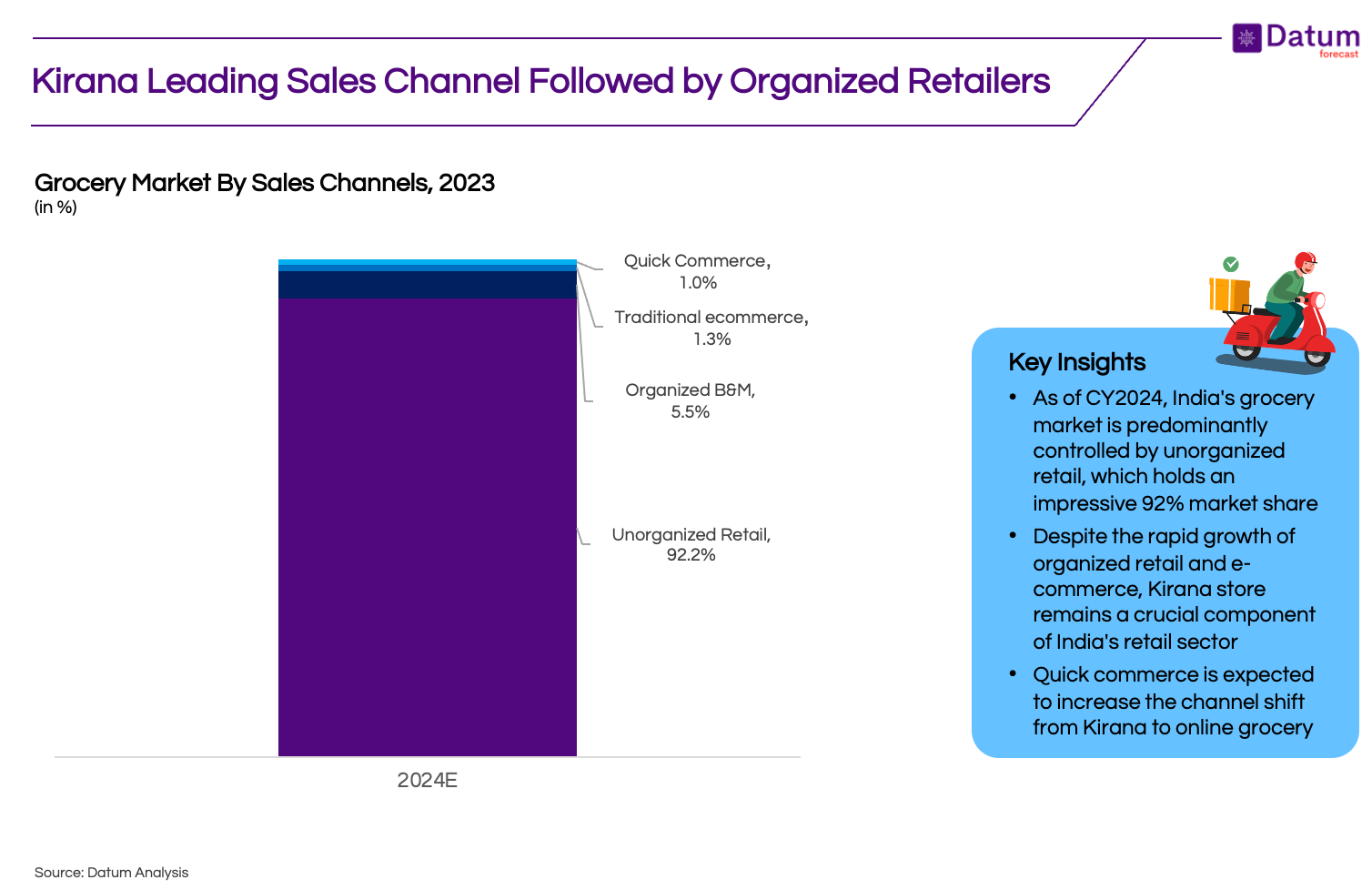

State of Indian Grocery Retail Market - Kirana Leading Sales Channel

Kirana stores have long been a cornerstone of India's retail landscape, serving as the primary sales channel for various goods, including fast-moving consumer goods (FMCG). Despite the growth of organized retail and the advent of e-commerce, kirana stores continue to play a vital role in the Indian retail ecosystem, connecting brands with consumers at the grassroots level.

Kirana stores accounts for 92.2% of estimates $617 billion grocery market in India in 2024

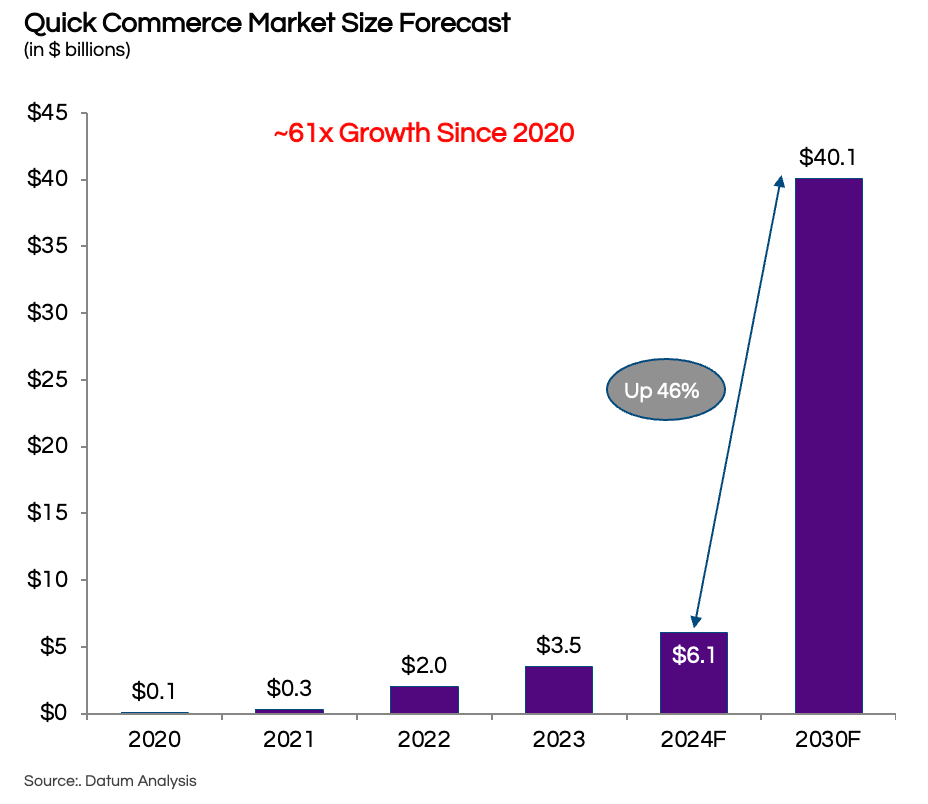

Quick Commerce to Reach ~$40 Billion by 2030

The swift acceptance of quick commerce among consumers demonstrates a clear willingness to pay for the convenience of immediate, on-demand purchases. Rapidly evolving consumer preferences are positioning quick commerce as the primary online retail channel for brands, swiftly replacing traditional e-commerce platforms, kirana stores and modern retail stores.

Quick Commerce Mimics Kirana Store Experience

Quick commerce platforms, such as Blinkit, have successfully replicated the ease and familiarity of shopping at local kirana stores, offering customers a wide array of products and the convenience of doorstep delivery. This user-friendly approach has attracted a growing number of Indian consumers to the quick commerce grocery retail landscape, fueling the rapid growth of these platforms.

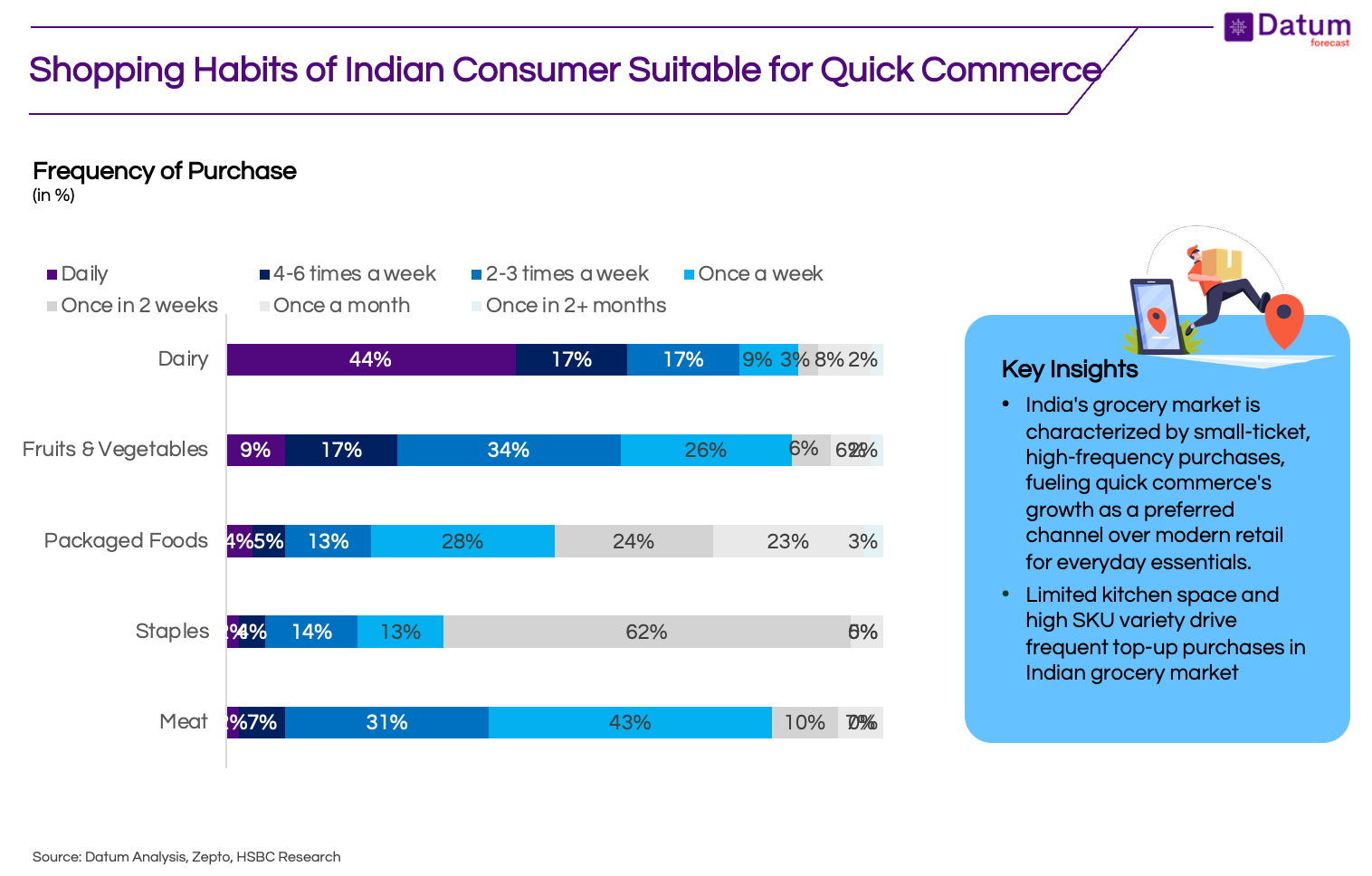

India's grocery market is characterized by small-ticket, high-frequency purchases, fueling quick commerce's growth as a preferred channel over modern retail for everyday essentials. Limited kitchen space and high SKU variety drive frequent top-up purchases in Indian grocery market

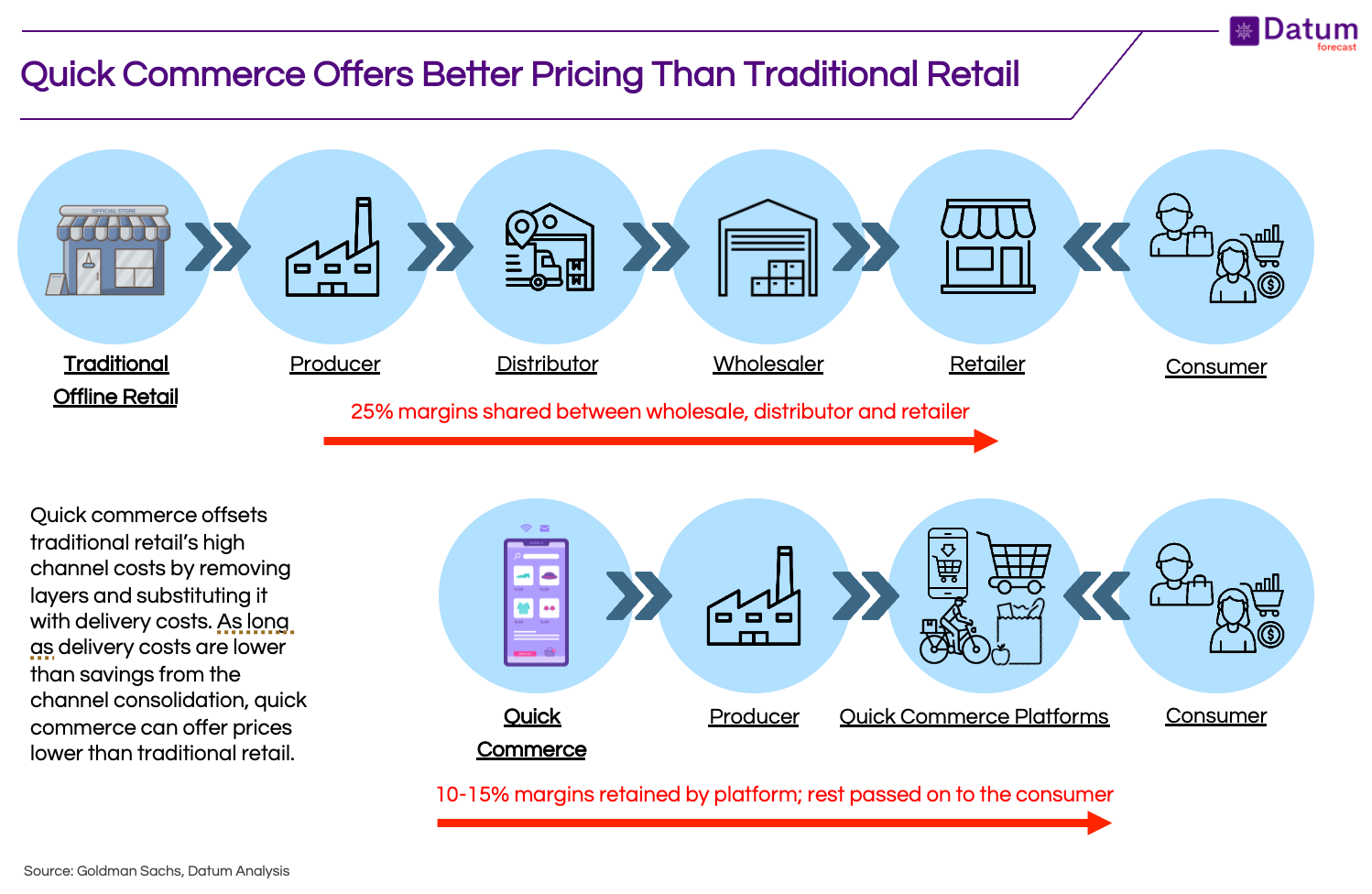

Better Pricing Through Streamlined Supply Chains

One key advantage of quick commerce platforms is the ability to provide competitive pricing by removing multiple intermediaries between FMCG companies and the end consumer. This streamlined supply chain enables these platforms to offer better deals and discounts, attracting price-conscious shoppers who might have previously relied on kirana stores for their grocery needs.

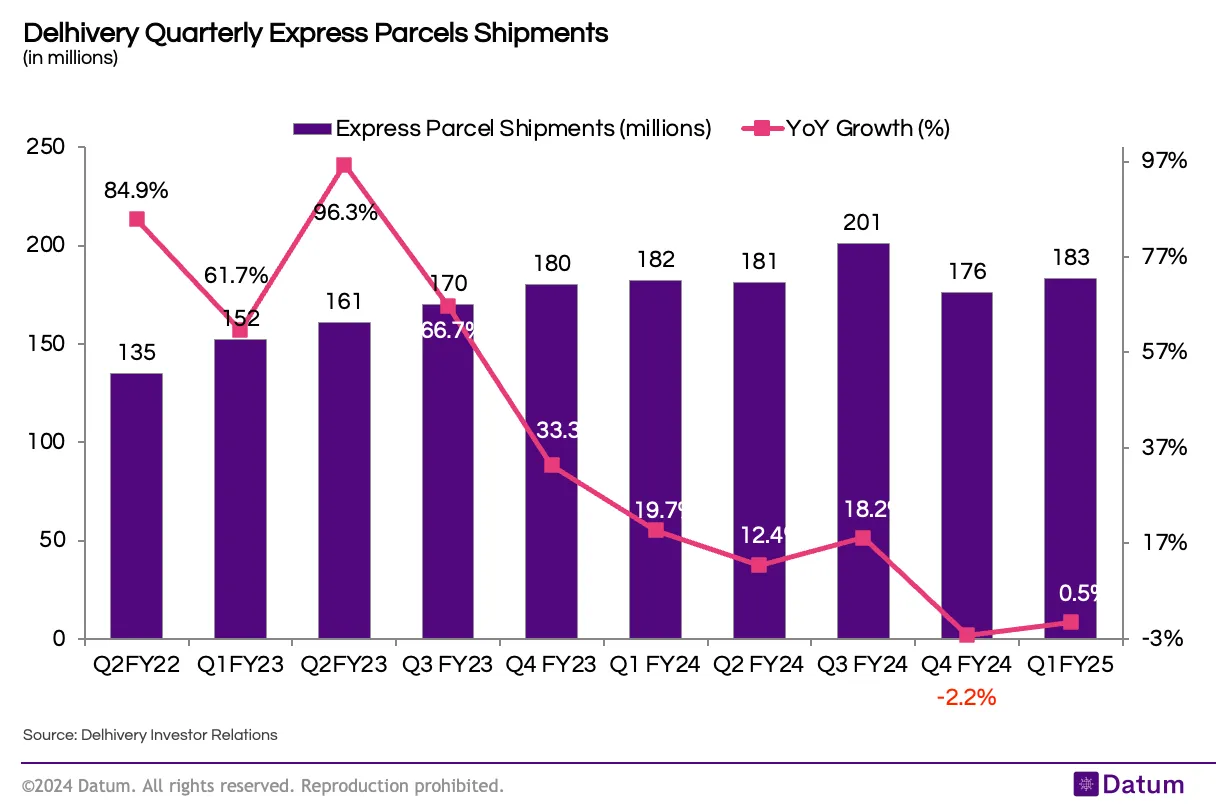

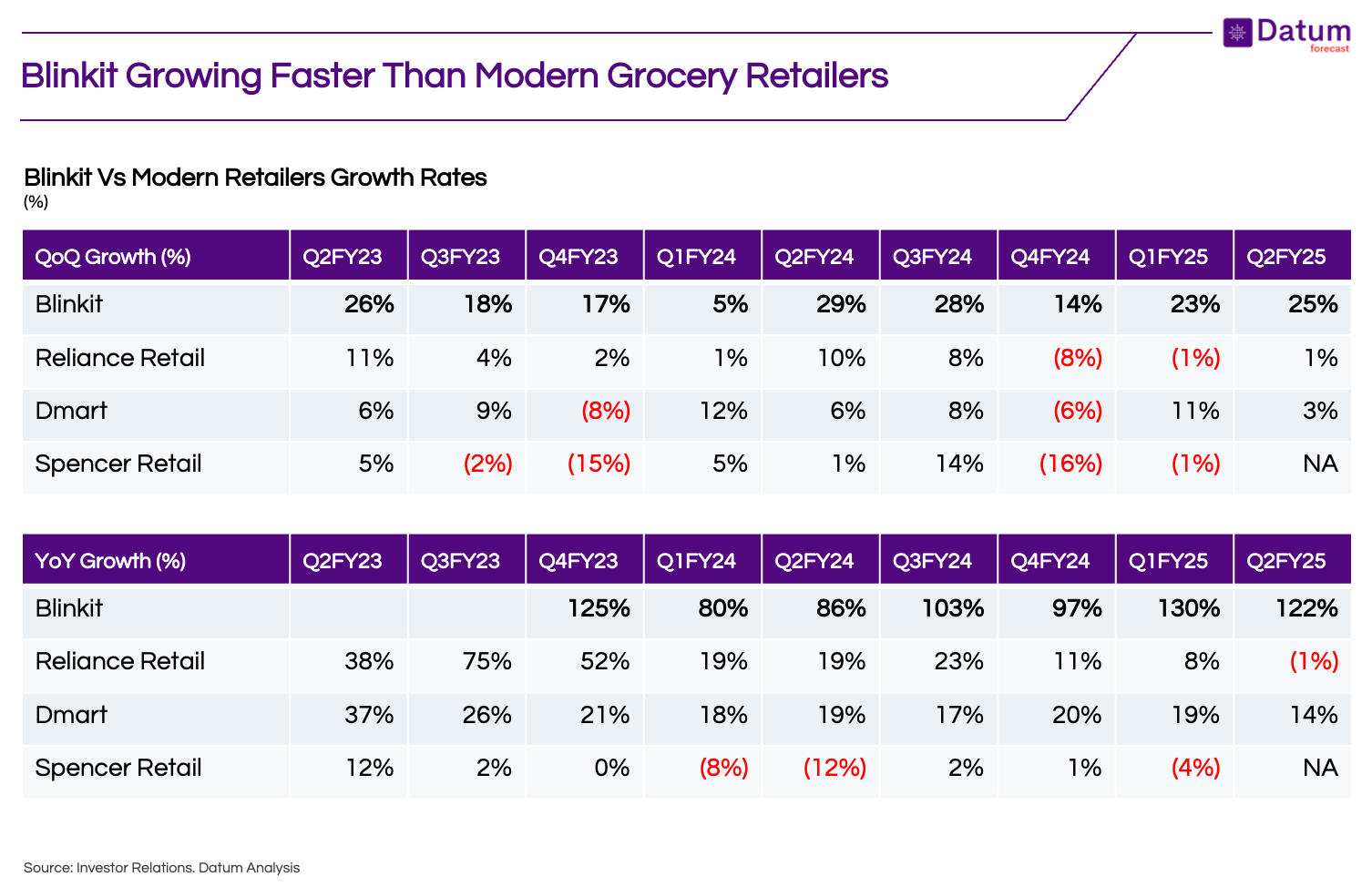

Growth Outpacing Traditional Grocery Retailers

Blinkit and other quick commerce players have experienced remarkable growth, outpacing their brick-and-mortar counterparts in the modern grocery retail sector. This accelerated expansion can be attributed to the widespread adoption of digital technology and shifting consumer preferences for convenience and speed in the purchasing process.

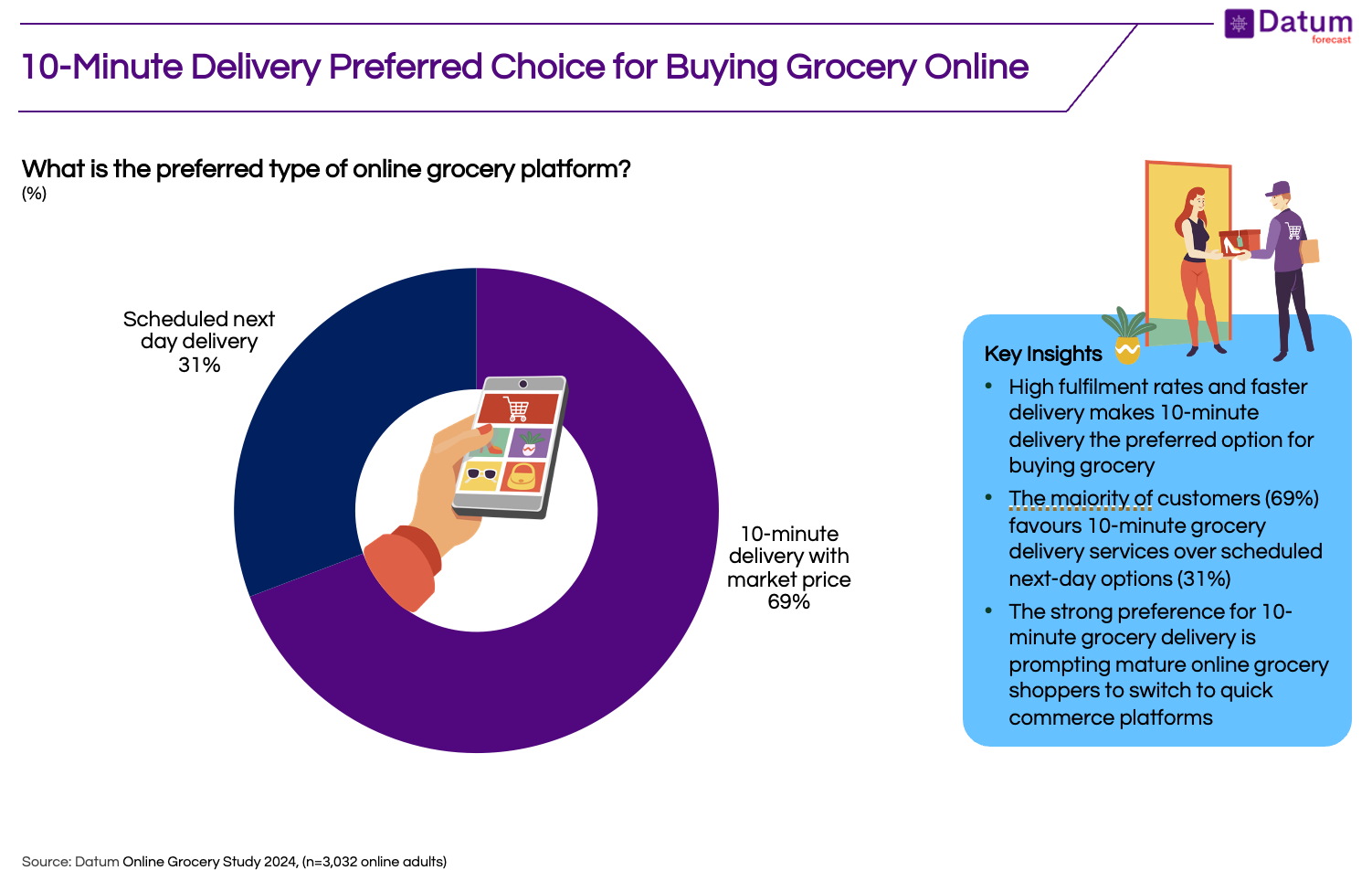

Quick Commerce: The Preferred Online Grocery Shopping Method

The convenience and affordability offered by quick commerce platforms have made them the preferred choice for buying groceries online. Customers are drawn to the ease of browsing and comparing products, as well as the time-saving benefits of 10-minute delivery options, which have proven more popular than scheduled delivery services.

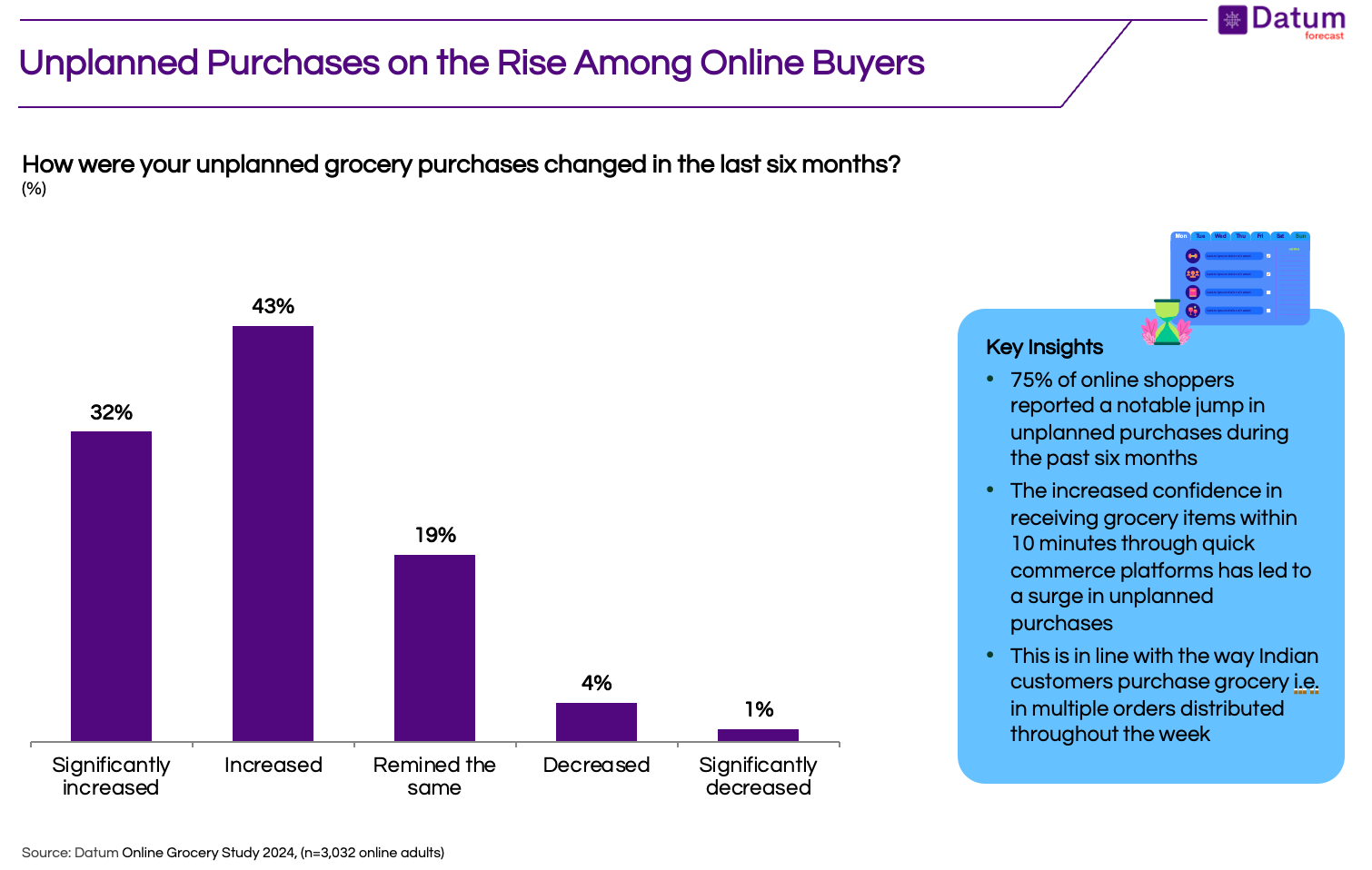

Unplanned Purchases on the Rise

The availability of diverse product offerings and targeted promotions on quick commerce platforms have contributed to a significant increase in unplanned purchases among online grocery shoppers.

A remarkable 75% of buyers reported a jump in impulsive buying within the last six months, highlighting the potential for quick commerce platforms to drive additional sales and revenue.

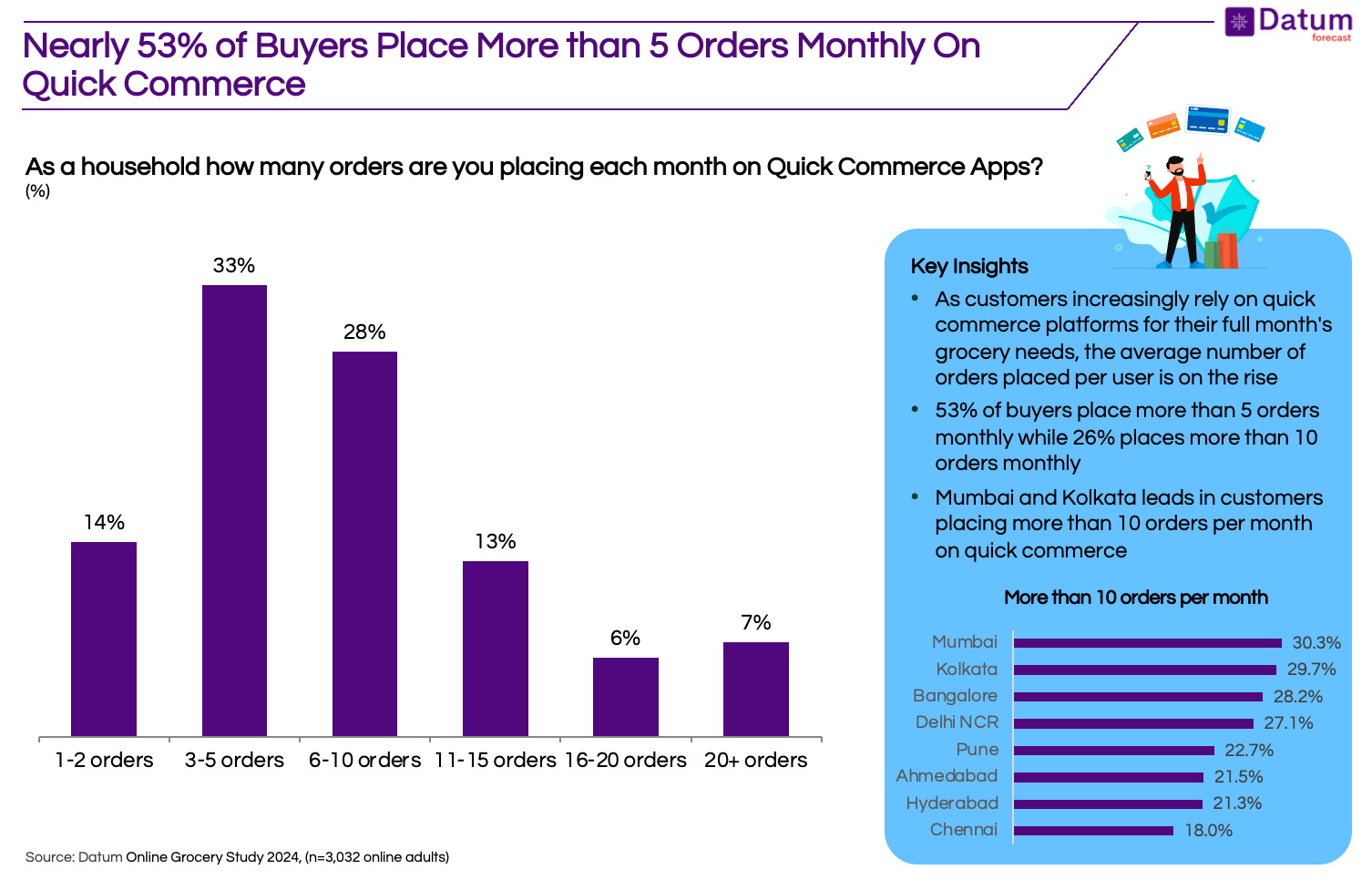

Loyalty and High Order Volumes

Quick commerce platforms have fostered customer loyalty through a combination of convenience, competitive pricing, and attractive promotions.

As a result, nearly 53% of buyers place more than five orders monthly on these platforms, and 67% have an average order value exceeding ₹400.

Impact on Kirana Stores

While quick commerce has brought undeniable benefits to Indian consumers, its rapid growth has had a significant impact on traditional kirana stores.

46% of quick commerce buyers have reduced their purchases from kirana shops, with 82% shifting at least 25% of their kirana spending to digital platforms.