Table of Contents

Zomato Ltd on Friday reported a second straight quarter of profit in the September quarter. Some of the key details are as follows

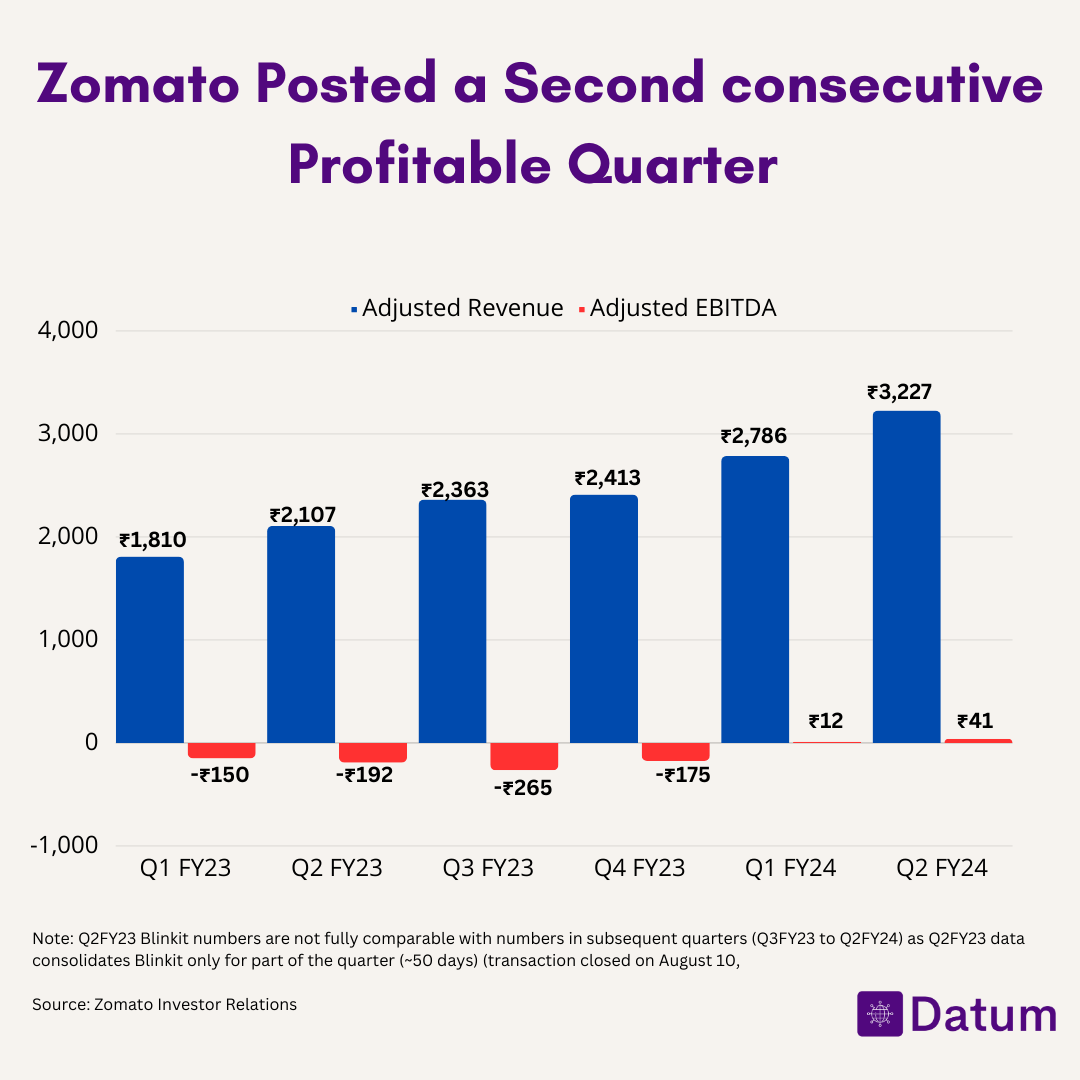

Second Consecutive Profitable Quarter

Posted a second consecutive profitable quarter with Adjusted EBITDA of INR 41 crore as compared to INR 12 crore profit in the previous quarter (Q1FY24) and a loss of INR 192 crore last year same quarter (Q2FY23).

We expect our Adjusted Revenue to compound at a 40%+ growth rate over the next couple of years and we remain on track to deliver on that outlook -Zomato

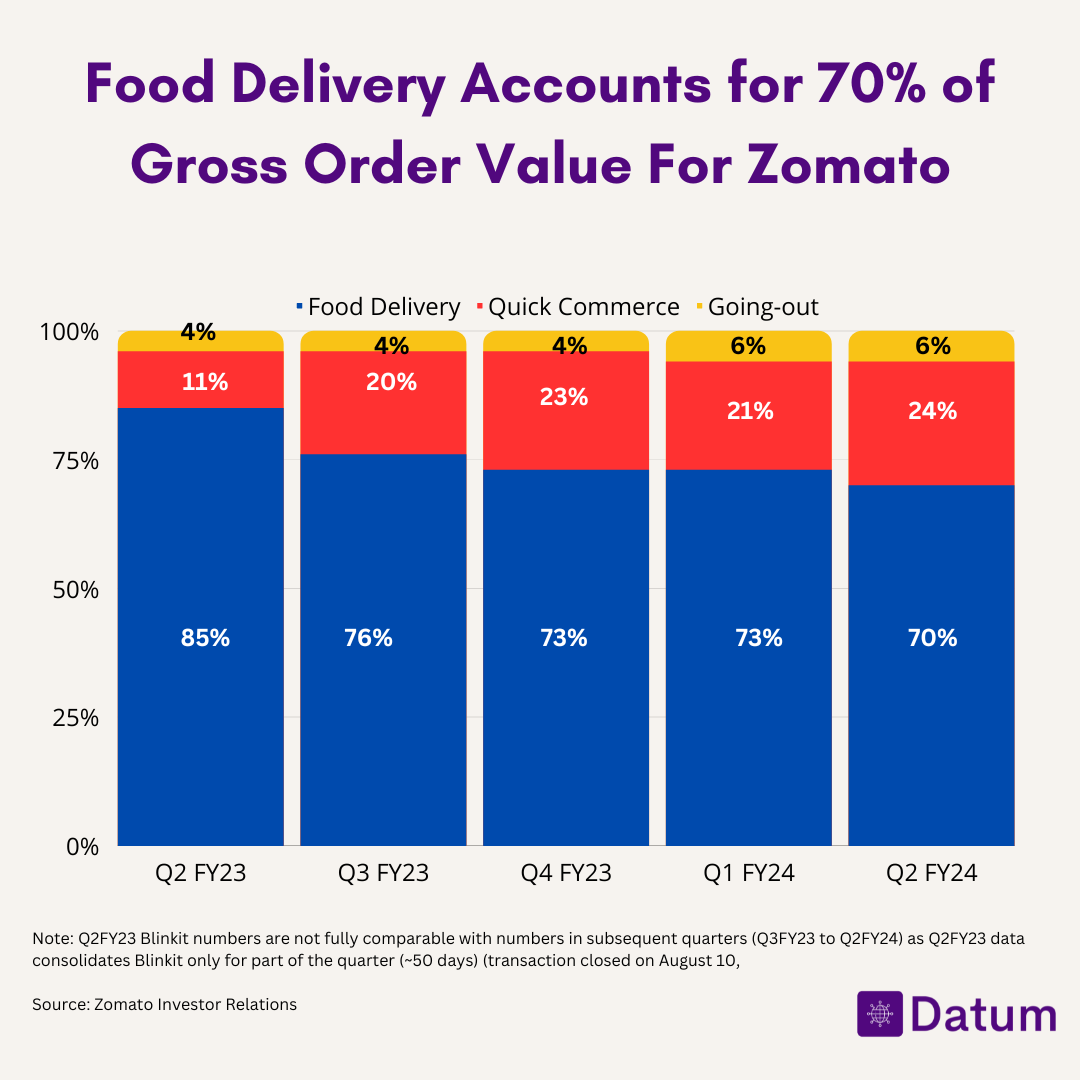

Food Delivery Dominates Gross Order Value, But Quick Commerce Seeing Rapid Growth

Food delivery accounted for 70% of gross order value in Q2 FY24 as compared to 85% in Q2 FY23. After two quarters of slow growth in Q3 FY23 and Q4 FY23 food delivery business gross order value (GOV) is growing at 11% in Q1 Fy24 and 9% in Q2 FY24.

The share of gross order value from quick commerce has nearly doubled year-over-year, jumping from 11% in Q2 FY23 to 24% in Q2 FY24.

This rapid increase demonstrates how quickly the on-demand delivery of groceries and convenience items is being adopted. Quick commerce saw 29% year-over-year growth in gross order value, making it the fastest growing category.

Going-out revenue accounted for 6% of total GOV in the last two quarters.

Food Delivery GOV Grew 20% QoQ

- Order Volumes Driving GOV Growth. GOV growth was almost entirely led by growth in order volumes, while the average order value remained largely flat.

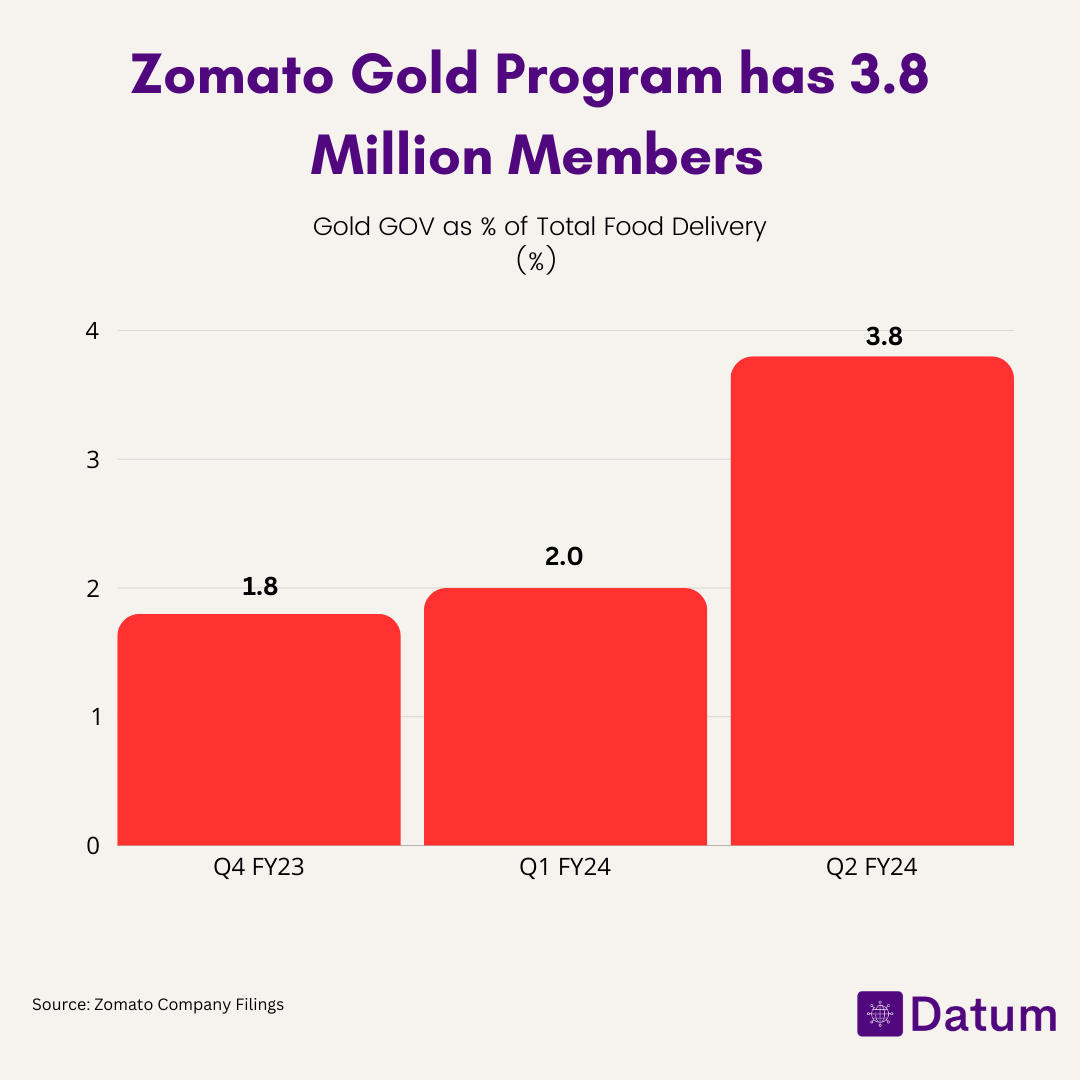

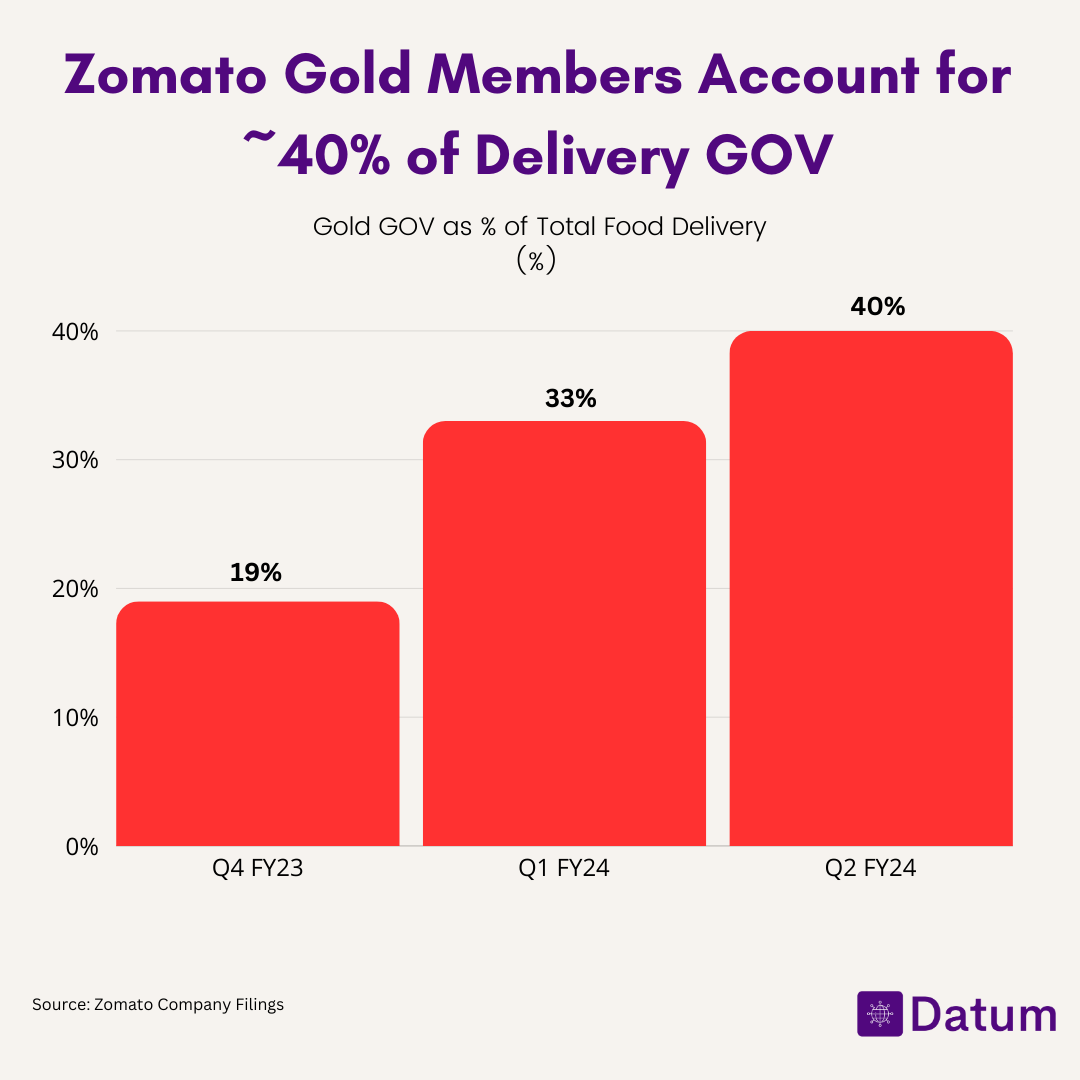

- Gold Program Adoption. Another key driver of GOV growth in the quarter was the growing adoption of Gold program, which is continuing to drive higher ordering frequency amongst members

- Gold Program Accounts for 40% of Food Delivery GOV but Less Profitable. Gold program is driving the GOV growth but the order by Gold member is less profitable.

A Gold order is less profitable than a non-Gold order due to the impact of program benefits. The delivery charges paid by the customer are almost negligible (due to the free delivery benefit for orders above a certain value)

- Addition of Platfrom Fees. Starting Q2FY24, customers are being charged a nominal platform fee (in the range of INR 2-5 per order) on every order, including those of Zomato Gold members.

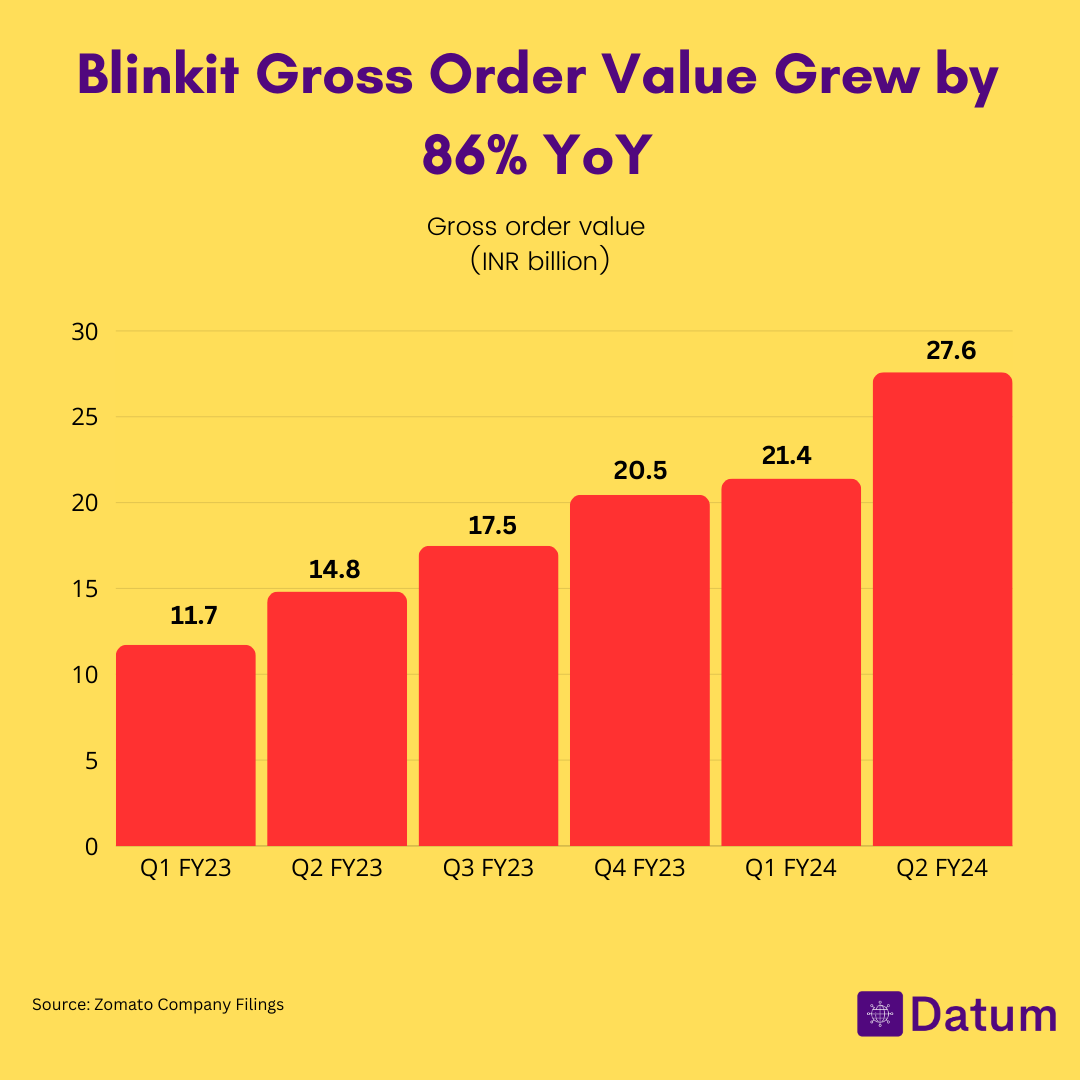

Quick Commerce on Blinkit Grew 29% QoQ

GOV growth was largely driven by same store sales growth as we continue to focus on serving more customer needs and ensuring consistency of service levels.

- Blinkit orders surged 24% due to the impact of festivals

- GOV growth was largely driven by same store sales growth

- Blinkit Saw 21% Growth in Transacting Customers driven by increase in dark stores. Net addition of 28 new stores during Q2 FY24, taking our overall store count to 411 stores as at the end of the quarter

On a YoY basis, the GOV growth was 86%, as expected and in-line with the past.

- Steady rise in Blinkit’s GOV as a percentage of Zomato’s GOV in the cities where Blinkit and Zomato has an overlapping presence.In some of these cities, Blinkit’s GOV is already more than Zomato’s GOV.

- Over 60% of stores are now Contribution positive, and many of them are already at 5%+ contribution margin (as a % of GOV).

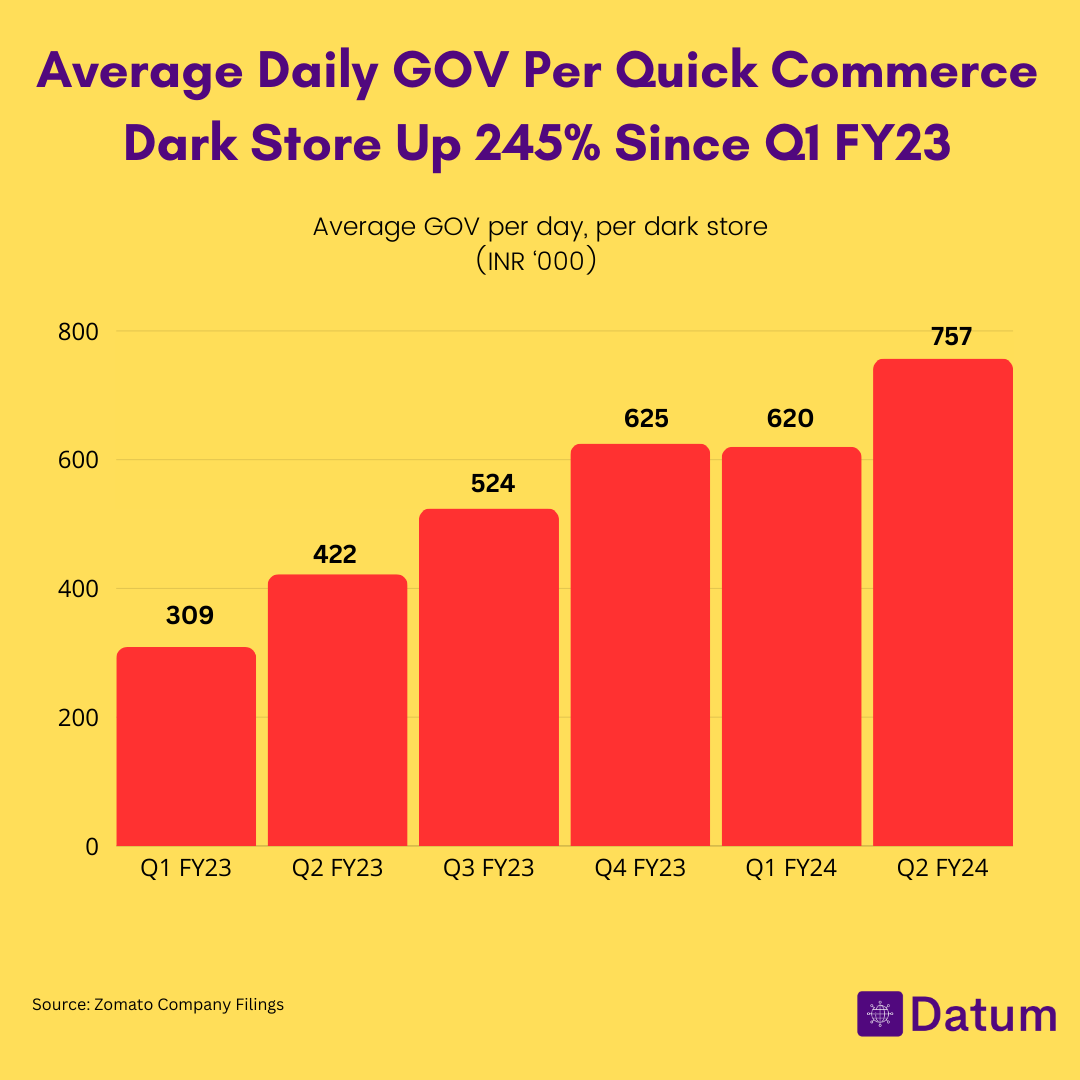

- Gross order value per day per dark store also grew by 22% to reach 757,000 in Q2 FY24. With greater scale and optimization, quick commerce players can offer wider product selection and faster fulfillment, leading to surging order values. The over 100% increase in average daily GOV per dark store underscores the potential as the model matures.

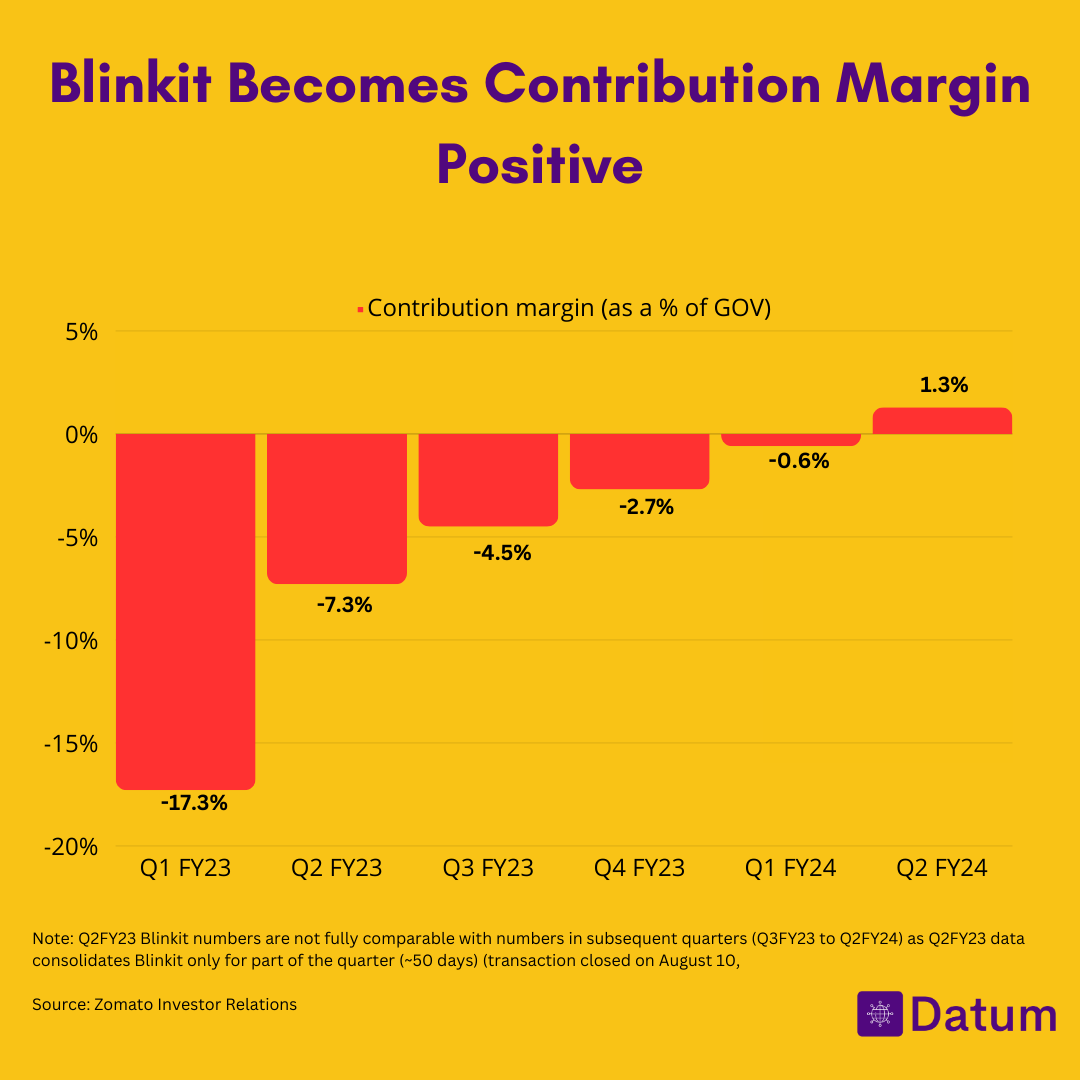

Blinkit Becomes Contribution Margin Positive

In Q2FY24, Blinkit’s contribution margin, as a percentage of Gross Order Value (GOV), improved to 1.3 percent, from -7.3 percent in Q2FY23, when Zomato had acquired the company.

Source: Zomato Investor Relations