Table of Contents

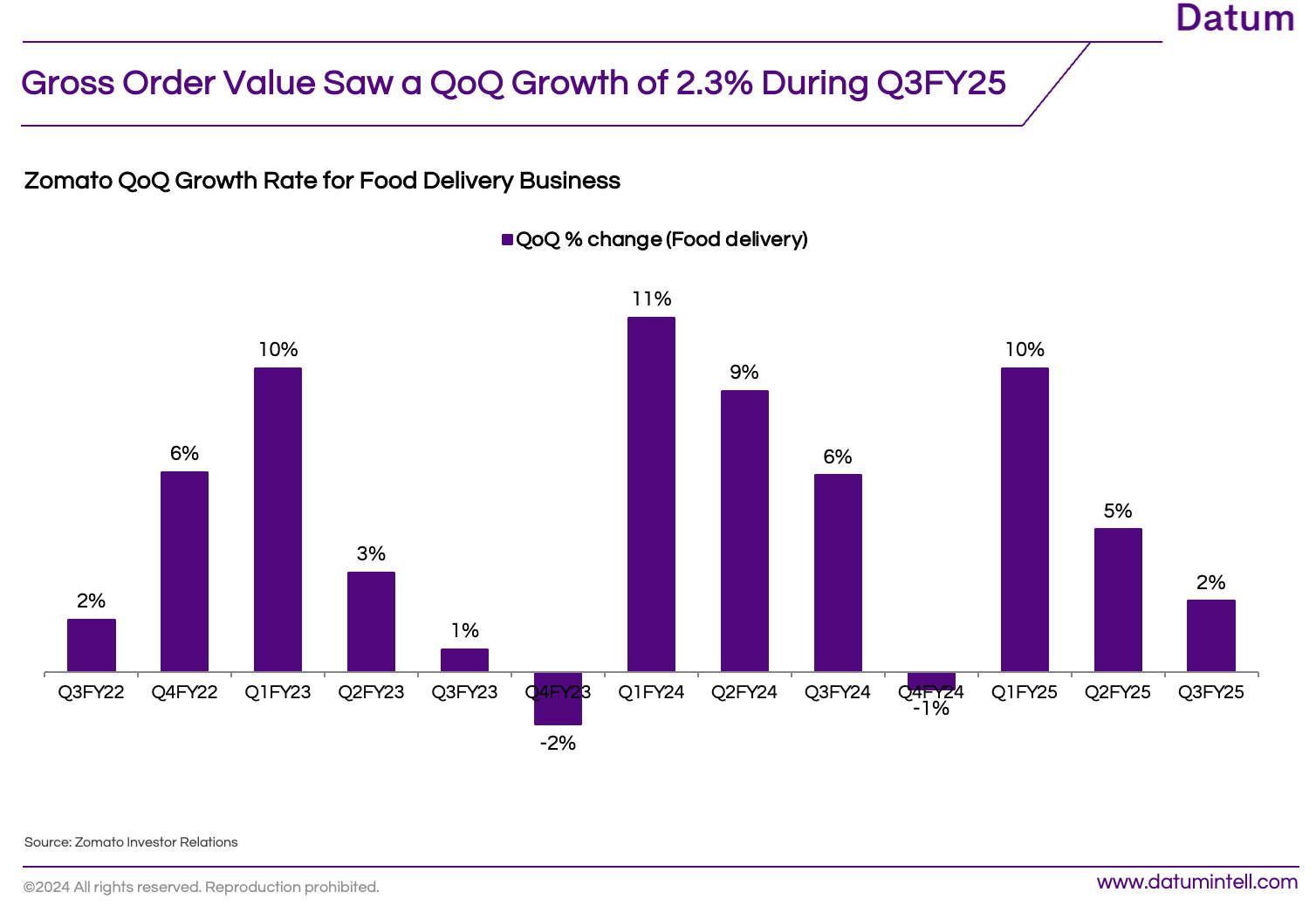

Zomato witnessed a slowdown in its food delivery growth rate, as reflected in its quarterly growth data. Despite an initial rise, the food delivery sector has seen a gradual decline in the quarter-over-quarter (QoQ) percentage change.

In Q2FY23, Zomato’s food delivery business saw a modest 3% quarter-over-quarter (QoQ) growth. This improved to 9% in Q2FY24, but by Q2FY25, the QoQ growth dropped to 5%, signaling a cooling of the earlier growth momentum. Similarly, Q1FY24 had a strong 11% growth, but this too slowed down to 10% in Q1FY25.

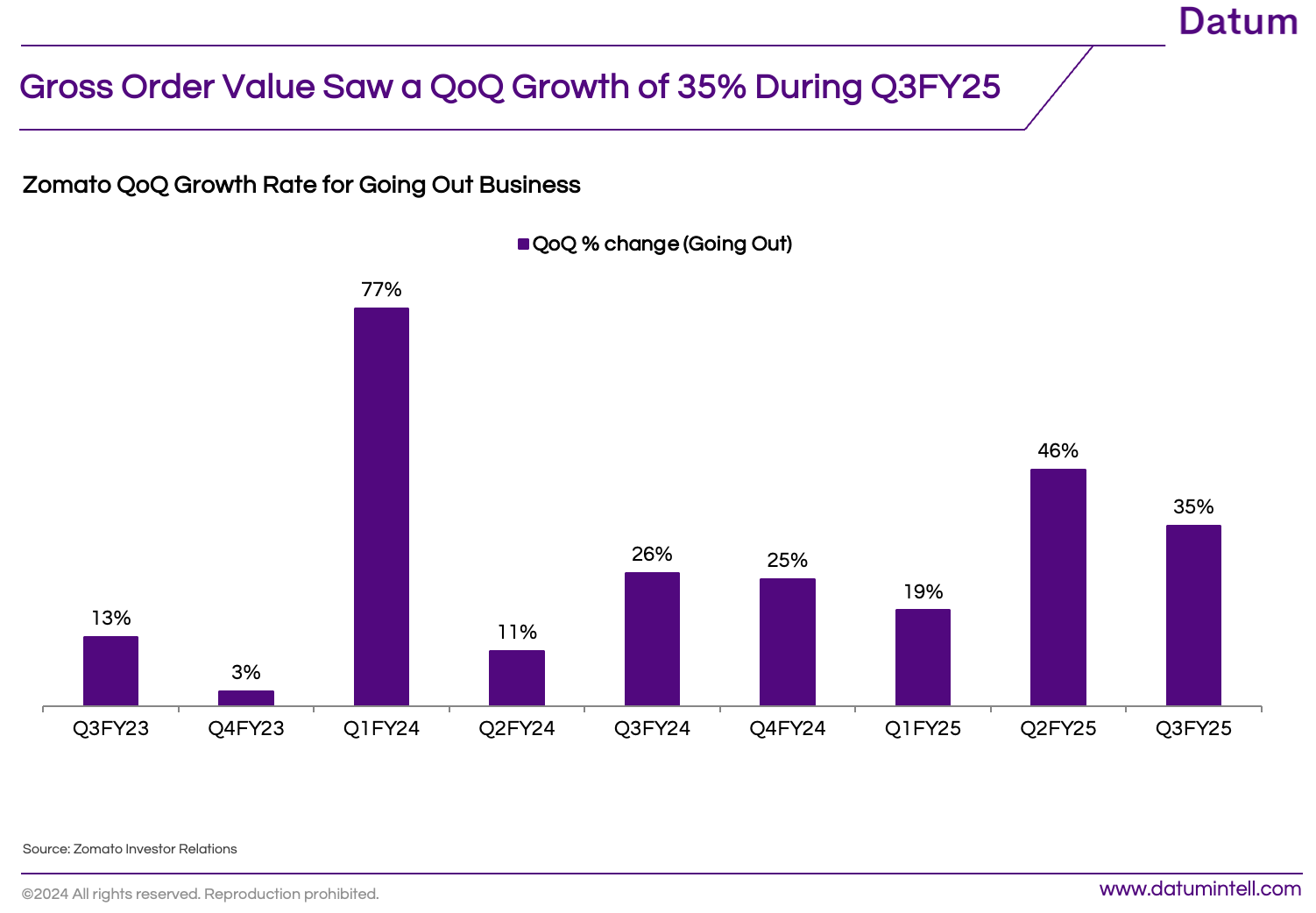

In contrast to the slowdown in food delivery, Zomato’s "going out" segment has shown strong growth.

In Q4FY23, the QoQ growth for eating out was just 3%, but by Q4FY24, it surged to 25%. The trend continued into Q3FY24 and Q3FY25, where the QoQ growth reached 26% and 35%, respectively.

In Q4FY24, Zomato's food delivery segment experienced a negative 1% QOQ growth, indicating a decline in performance. In contrast, the "going out" segment saw a robust 25% QOQ growth during the same period, highlighting a significant shift in consumer behaviour towards dining out.

In November 2024, Zomato announced the launch of District, a separate app catering to live events and ticketing services after acquiring Paytm Insider. The District app has since gained significant traction among users and has now surpassed an impressive 6.5 million downloads.

This divergence in the growth trajectories of food delivery and eating out is an important insight into consumer behavior. The rising popularity of eating out reflects an evolving consumer preference for social dining experiences, which could be contributing to the stagnation in food delivery growth.

- Slowdown in Spending: Rising inflation and living costs have made consumers more budget-conscious, leading to a decline in non-essential purchases like food delivery.

- Changing Consumer Preferences: Consumers are increasingly opting for dining out experiences due to social factors and post-pandemic, many consumers are returning to the enjoyment of eating at restaurants, preferring the experience over home delivery.

- Increasing Competition: Zomato faces tough competition from Swiggy Bolt (80,000 orders/day) and Zepto Café (50,000 orders/day with 60% month-on-month growth), who offer faster deliveries and competitive pricing, challenging Zomato’s market share.

The slowdown in food delivery growth indicates a shift in consumer preferences, with demand stabilizing after an initial surge. This suggests that the market may be maturing, with fewer new users and a focus on retaining existing customers. Economic factors, such as rising living costs, are likely influencing consumer behavior, making food delivery less of a priority for many. As the market matures, players in the food delivery sector may need to innovate in service offerings and pricing strategies to sustain growth.